MicroStrategy just announced a huge purchase of Bitcoin, bringing its total stash to 439,000 BTC. This is a pretty next level sats stacking.

15,350 BTC added to cart

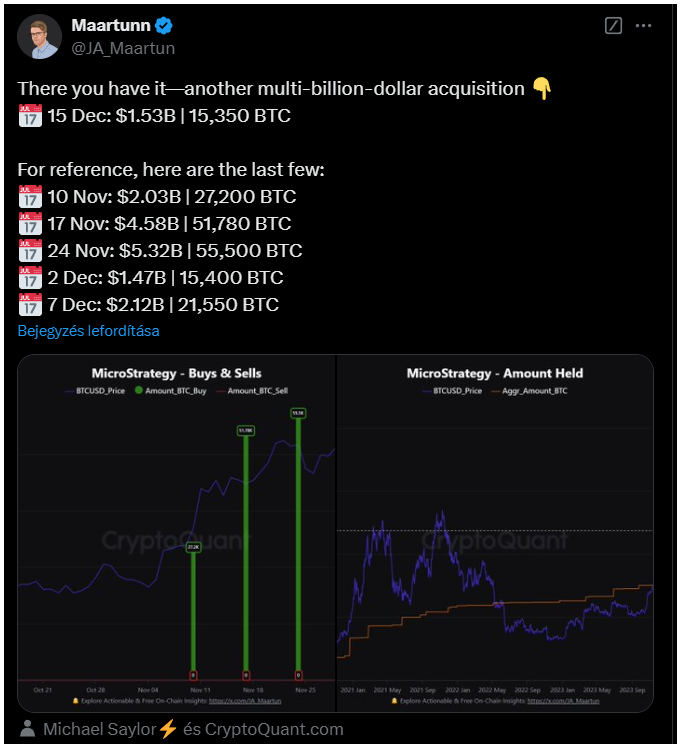

MicroStrategy scooped up 15,350 BTC for around $1.5 billion, which breaks down to an average price of about $100,386 per coin between December 9 and 15.

This company has been a major player during the current Bitcoin bull run, and it doesn’t seem like they’re slowing down anytime soon.

CryptoQuant community analyst Maartunn shared a chart on X showing the various points where MicroStrategy has made its purchases in recent months, and after a quick look, we can see that while this latest buy is the smallest in terms of BTC value, it still holds significant USD value since the price of Bitcoin has been climbing.

New highs in prices, holdings, commitment

MicroStrategy’s aggressive buying strategy this time around has outpaced its efforts during the 2021 rally, making this accumulation spree its largest yet.

Overall, the company has spent $27.1 billion on Bitcoin over the years, averaging about $61,725 per coin, so with current prices soaring, Saylor’s gamble seems to be paying off as his firm is sitting on profits exceeding 72%.

In numbers we trust

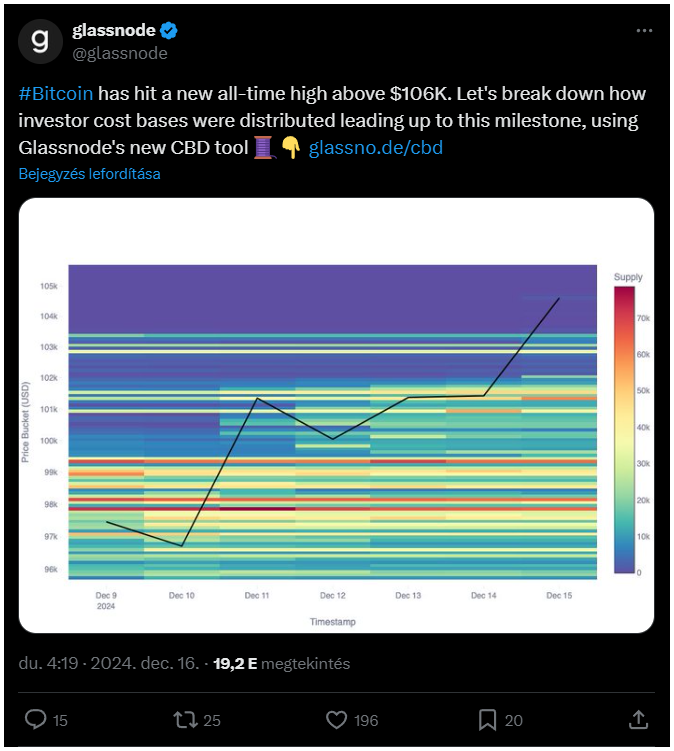

Bitcoin recently set a new ATH beyond $106,00*, and Glassnode has provided some insights into how accumulation has looked leading up to this milestone.

Their new Cost Basis Distribution, or CBD tool shows just how much of Bitcoin’s supply was last purchased at various price levels.

The data reveals that investors were quite active between $96,000 and $100,000, with a notable cluster around $97,000 to $98,000, which accounts for about 500,000 BTC.

Above the $100,000 level, trading activity continues but without any big supply clusters forming yet, especially thin above $103,000.