Microsoft dropped a quantum computing chip called Majorana 1, and the Bitcoin world went crazy.

Are we closer to a future where quantum computers crack Bitcoin’s code? Maybe, or maybe not.

Quantum isn’t that fast, yet

River, a Bitcoin exchange, thinks so. They hopped on X to say this new chip might speed up the timeline to make Bitcoin quantum-resistant.

Now, before you panic-sell your Bitcoin, remember that a truly crypto-busting quantum computer is still years away.

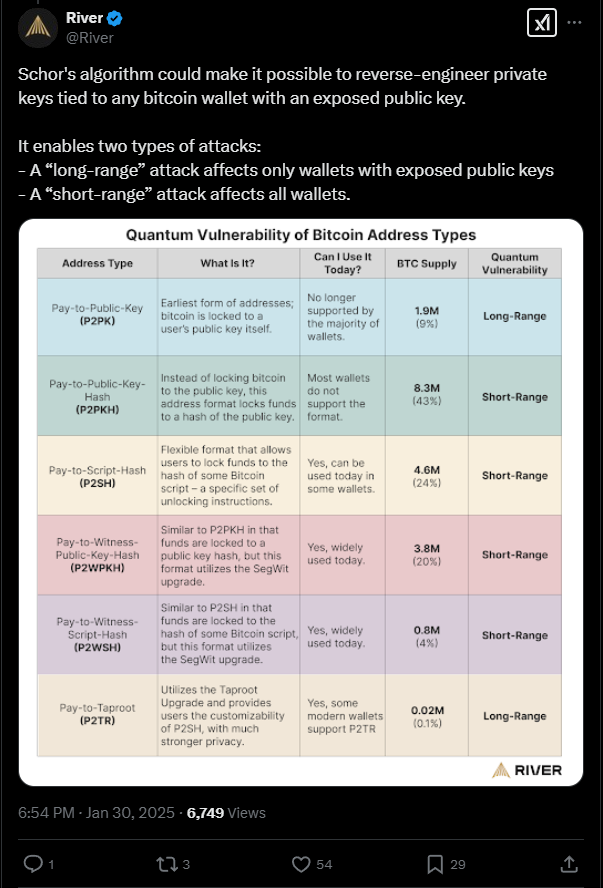

River estimates that a one-million-qubit QC, run for days or weeks, could potentially crack Bitcoin addresses, and that the new chip could reach that level by 2027-2029. But they also noted, it’s pretty important to address vulnerabilities before it.

Is this really a threat?

Not everyone’s convinced, and some critics think the quantum threat is overblown right now.

They argue that if a quantum computer could crack crypto, it’d go after bigger fish first, like the world’s banking giants, who held over $188 trillion in assets in 2023. Bitcoin’s market cap is a mere $3.2 trillion by comparison.

Plus, advancements in quantum computing could actually help Bitcoin, making the network stronger.

Adam Back, a Bitcoin expert thinks post-quantum solutions are still decades away and will likely improve Bitcoin’s security. Some even say we have a century before quantum computing becomes a real worry.

What’s the plan?

Preston Pysh, co-founder of The Investor’s Podcast Network, pointed out that the Bitcoin community is already on it, with BIP-360 leading the charge.

This proposal’s goal is to shift Bitcoin to a quantum-resistant structure by swapping out vulnerable signature methods.

River’s CEO, Alexander Leishman, chimed in, agreeing that a quantum attack isn’t an immediate problem, but also argued that banks have more security layers than just public key cryptography, like passwords and manual checks.

In case of Bitcoin, an attacker would only need a Bitcoin public key to attempt an attack.

So, is it time to freak out? Probably not. But it looks like Microsoft’s new chip has definitely sparked an important conversation about Bitcoin’s future security.

Have you read it yet? Congress should rethink the IRS DeFi rule?

Disclosure:This article does not contain investment advice or recommendations. Every investment and trading move involves risk, and readers should conduct their own research when making a decision.

Kriptoworld.com accepts no liability for any errors in the articles or for any financial loss resulting from incorrect information.