The tech giant is gearing up for a big shareholder meeting on December 10, where one hot topic will be whether the company should officially explore investing in Bitcoin.

This proposal has caught the attention of the corporate world, especially after a recent SEC filing brought it to light. Microhard is coming?

Board not on board with Bitcoin

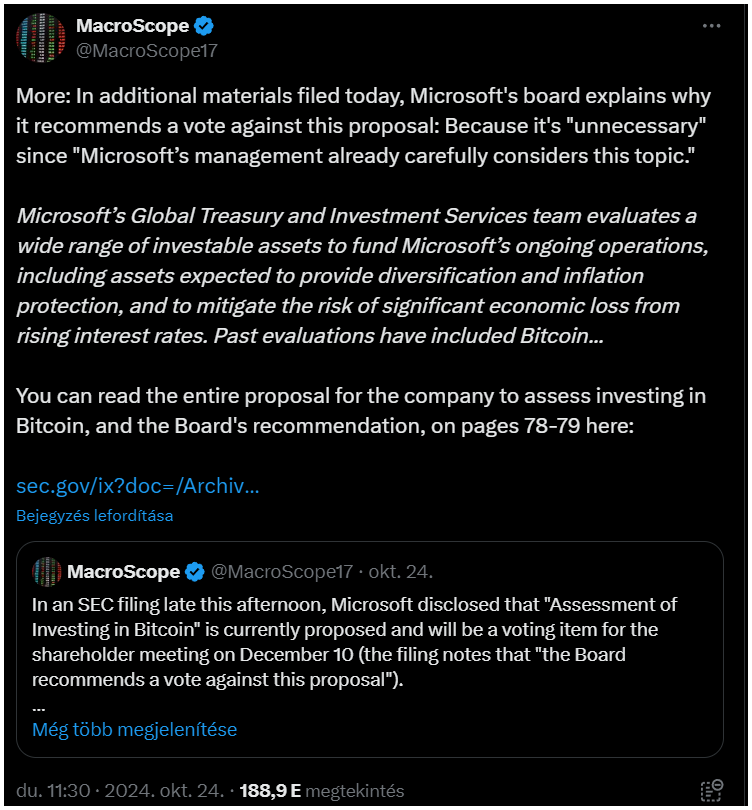

Despite all the chatter, Microsoft’s board is recommending that shareholders vote against the proposal, because they believe that the company’s management is already looking into a wide range of investment options, including Bitcoin.

Microsoft’s Global Treasury and Investment Services team is constantly evaluating assets that can help diversify investments, protect against inflation, and manage risks like rising interest rates.

So, they argue that Bitcoin is already part of the conversation.

Why Microsoft says “no thanks”?

The board feels that an additional public assessment of Bitcoin isn’t really needed.

They point out that Bitcoin’s price can be incredibly volatile, which doesn’t mesh well with Microsoft’s need for steady assets to keep things running smoothly and ensure liquidity.

While they’re keeping an eye on crypto trends, they repeated that they already have solid processes in place for managing their investments.

Solid processes, without the best-performing asset of the decade, yes, tell me more please!

It’s not about the Bitcoin, but in fact it’s about the Bitcoin

The December 10 meeting won’t just focus on Bitcoin, as there are several important issues up for discussion, like governance policies, executive pay, and electing new board members.

But let’s be honest, the Bitcoin proposal is stealing the spotlight as more companies show interest in cryptocurrencies.