Decentraland’s MANA is riding a wave of excitement, with its price shooting up 70% in just a single week.

This jump is part of a wider rally in Metaverse-related tokens that’s got everyone talking.

What’s behind the growth?

While some might be scratching their heads over this spike, others think there are more factors what are driving this movement. Likely the biggest?

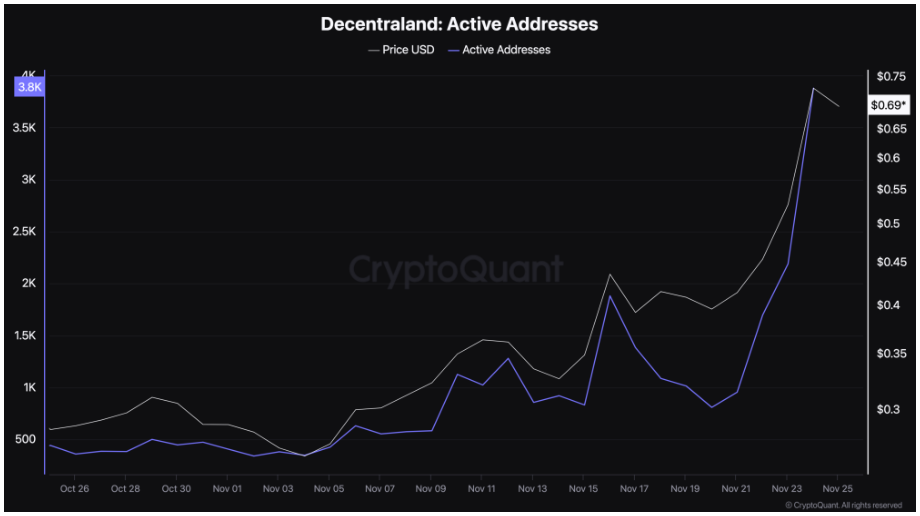

A quite big increase in active addresses for MANA, which means more users are getting involved on the blockchain.

This uptick mirrors what’s happening with The Sandbox, another key player in the Metaverse revival.

Active addresses track the number of unique users successfully completing transactions, so when this number goes up, it usually signals increased engagement, definitely a good sign for any cryptocurrency.

On November 20, MANA had around 810 active addresses, but just a few days later, that number skyrocketed to nearly 4,000.

This is very likely fueled MANA’s price jump from $0.40 to $0.70, to its highest level since March.

Volume hits new heights

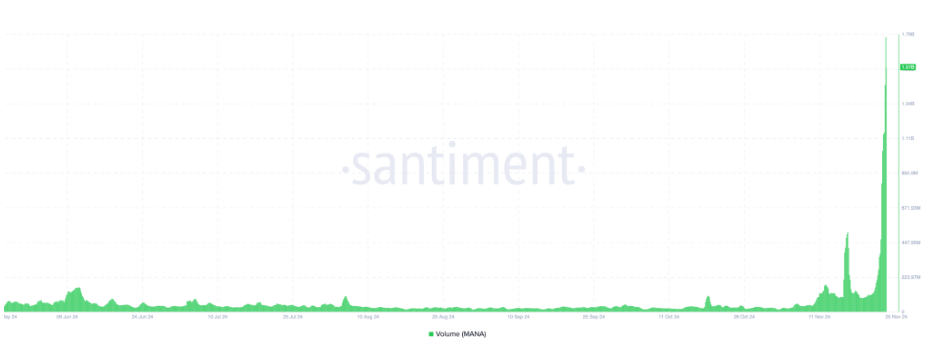

Santiment’s data revealed that MANA’s trading volume hit an impressive $1.57 billion.

Trading volume reflects how much of a cryptocurrency is being bought and sold over a specific period, and high volume generally signals strong market participation, while low volume can suggest fading interest.

The increase in trading volume backs up the rising active addresses, showing that more people are getting into the action.

On the other hand, MANA’s price has dipped from its peak, maintaining this uptrend might be tricky. Analysts are hinting that a pullback could be on the horizon.

Pullback is coming?

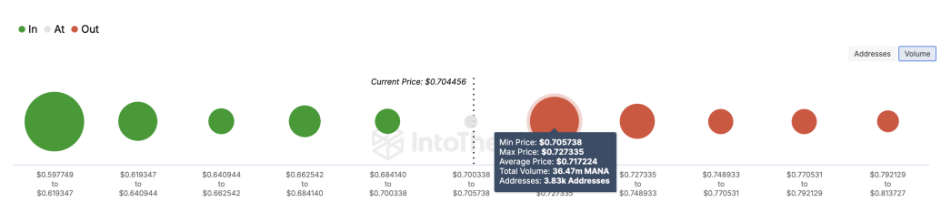

Now it seems like MANA’s price rally might have hit a local top. This prediction is based on data from the In/Out of Money Around Price metric, which analyzes how many holders are in profit or loss based on their purchase prices.

For MANA, about 36.47 million tokens held by addresses that bought near $0.70 are currently “out of the money.”

This means those holders are sitting on losses since the market price has dropped below their buy-in point. These out-of-the-money areas often act as resistance levels, places where selling pressure can kick in.

If MANA indeed does retrace, we could see its price dip back to around $0.61 in the short term.

But if buying pressure ramps up and trading volume exceeds what we saw at $0.70, then we might just see MANA push toward $0.80 instead.

Have you read it yet? Ethereum’s volume is up, but the price is flat

Disclosure:This article does not contain investment advice or recommendations. Every investment and trading move involves risk, and readers should conduct their own research when making a decision.

Kriptoworld.com accepts no liability for any errors in the articles or for any financial loss resulting from incorrect information.