Messari, a top US crypto market intelligence platform announced they will cut ties with the Securities and Exchange Commission, the SEC.

CEO Ryan Selkis shared the decision, criticizing the SEC’s tough stance on the industry.

End the SEC

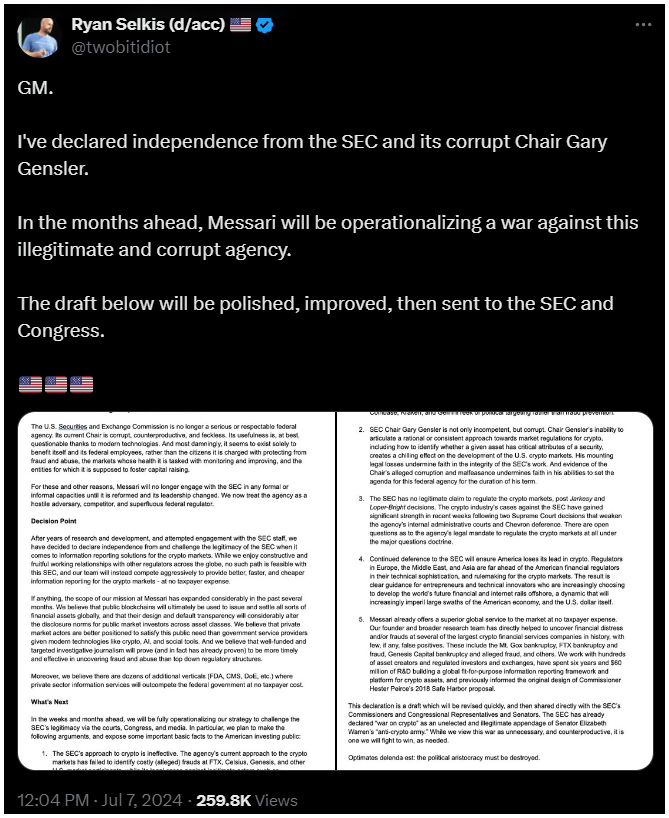

On July 7, Ryan Selkis declared that the company is breaking away from the SEC and its Chair Gary Gensler, and he stated clearly that Messari will be fighting against what he calls an illegitimate and corrupt agency.

I think it’s not a big surprise, but Selkis reeceived extremely strong support, and loud cheering from the crypto community, as his criticism is widely recognized both among industry participants, and among users, investors, taxpayers.

What are they doing?

In a draft letter shared on X, Messari outlined its reasons, revealed that the company has had positive and constructive interactions with regulators in other countries but struggles with the SEC.

They believe the SEC, under Gensler, is highly ineffective and politically motivated, failing to detect frauds at companies like FTX, Celsius, and Genesis before their collapses.

Many echoing this view, as the SEC allegedly ought to protect the investors, and supporting the country, but the most common argument against them it seems they want only protect the traditional finance interest.

The letter mentioned recent court rulings, such as Jarkesy and Loper-Bright, which have seriously weakened the SEC’s authority.

Messari argued that these rulings raise questions about the SEC’s legal right to regulate crypto markets.

Public servants or goons?

Messari believes the SEC’s actions are hurting America’s leadership in the crypto sector, and they now views the SEC as a hostile competitor and an unnecessary regulator.

Based on the declaration, they will stop all formal and informal engagements with the SEC until reforms are made and new leadership is in place.

Messari plans to challenge the SEC’s authority in courts and through Congress in the coming months.

Have you read it yet? Lionel Messi promotes Solana memecoin

Disclosure:This article does not contain investment advice or recommendations. Every investment and trading move involves risk, and readers should conduct their own research when making a decision.

Kriptoworld.com accepts no liability for any errors in the articles or for any financial loss resulting from incorrect information.