Some experts believe altcoin season might not happen as expected. A major reason for this is that traders are jumping too quickly into the most speculative assets, like memecoins.

Bitcoin, then high cap, then low cap, then memecoins

James Check, the lead analyst at Glassnode shared his insights during an episode of the Rough Consensus podcast.

He told that the usual cycle of alt season is being disrupted because traders are rushing straight to the most hyped assets, memecoins, skipping over more stable investments.

Check explained that in past market rallies, the surge in memecoins typically occurred later in the cycle, but this time, traders have been so inpatient to capitalize on quick gains that they’ve bypassed the more traditional alts entirely, traders have gone “straight to the punchline”.

“The joke has been told, everybody knows the punchline, and they’ve just gone straight to the punchline, and it is just not funny anymore.”

Investing, speculation or gambling?

During the 2021 bull run, there was a more orderly, somehow traditional-like progression of investments.

Traders first moved into Bitcoin, then Ethereum, followed by other layer-1 blockchains, DeFi tokens, and finally, the riskier assets like memecoins.

This time around, the strategy changed, with traders immediately jumping into the most volatile options, hoping for huge returns.

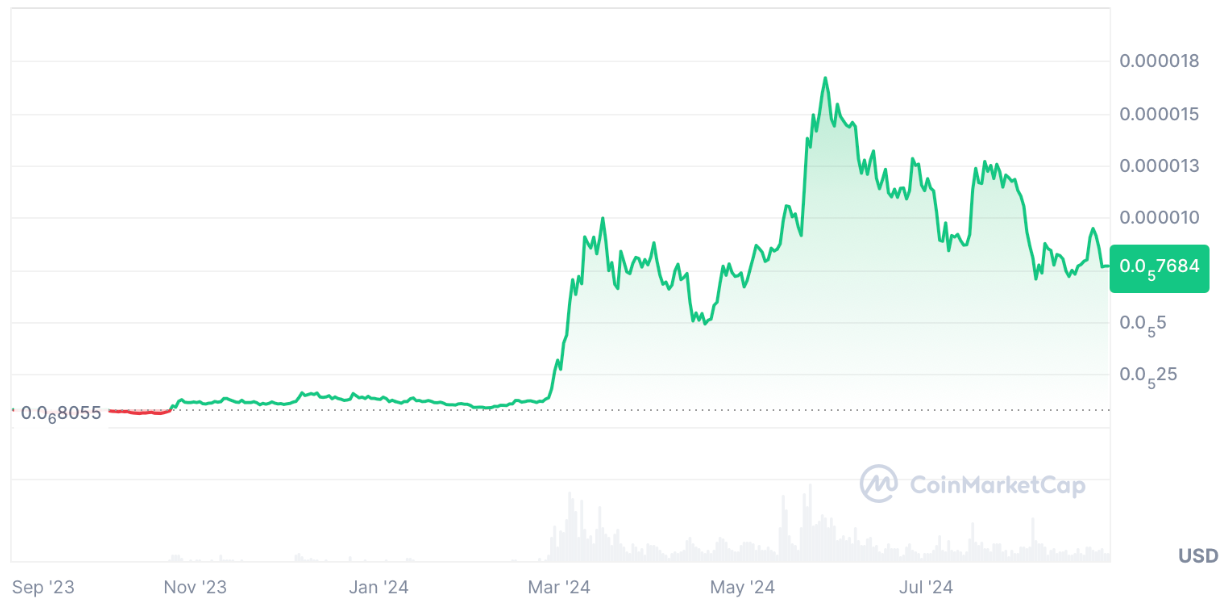

Check pointed out that the rapid rise of memecoins like PEPE, which saw incredible gains earlier in 2024, is a clear example of this trend.

“In 2021, we had the everything bubble, where it was this beautiful capital waterfall, Bitcoin, Ethereum, L1s, DeFi, all the way down to monkey JPEGs. Many crypto natives had now learnt the quickest way to make the most money was to buy the most stupid coin.”

The money pouring in, but projects get only drops

The rush to memecoins also created a gap where many other alts are overlooked. Some traders and analysts see this as a sign of potential growth for altcoins in the future, as they are still in the ’good buying zone’, but others are way more skeptical.

Luke Martin, a well known crypto trader in the social media shared his perspective on X, and told that he is optimist, he believes that the current low prices and trading volumes for alts could be a positive sign for future price movements.

Martin compared the situation to Bitcoin’s performance in 2020, when its price skyrocketed from $10,000 to $60,000 over six months after a period of stagnation.

He suggested that alts might experience a similar surge if conditions align. But this sounds a pretty big if.