The renowned crypto-news site, AMBCrypto’s latest survey shows a surprising picture of the current state of memecoins in the market.

This preference for memecoins, while might looks unbelivable, may not be unexpected for active market participants, given the reasons behind this trend.

Separating money and state? More like meme revolution

Surveying more, than five hundred respondents worldwide, the study revealed that 53.7% of traders, investors, and analysts favor memecoins over BTC, despite many still believing BTC will reach $100,000 by the end of 2024.

BTC’s price has surged 53.32% since Janury 1. this year, yet this growth pales compared to the crazy performance of some memecoins, particularly those on Solana’s blockchain.

For example, WIF price has soared by a giant 1,768% this year, while BONK saw a 123% increase.

PEPE, another prominent memecoin, achieved a nice 945% gain, despite ETH sluggish performance.

It’s GameStop season. Again.

The survey also revealed that 36.8% of respondents have allocated part of their portfolio to memecoins, which means third of the users are speculating on these assets.

Additionally, 25.5% have invested in AI-themed tokens, with DeFi and GameFi sectors each attracting 25.5% and 15.4% of respondents.

The second quarter of the year began more slowly than the first, the recent resurgence of GameStop GME stock helped memecoin prices rebound. This contributed to PEPE repeatedly reaching new all-time highs.

Despite the strong bullish sentiment surrounding memecoins, BTC remains a significant investment, with 65.5% of respondents owning BTC, and many also believe BTC could increase by 80% by December this year, potentially reaching a price of $121,000 by year-end.

Retail degens, unite!

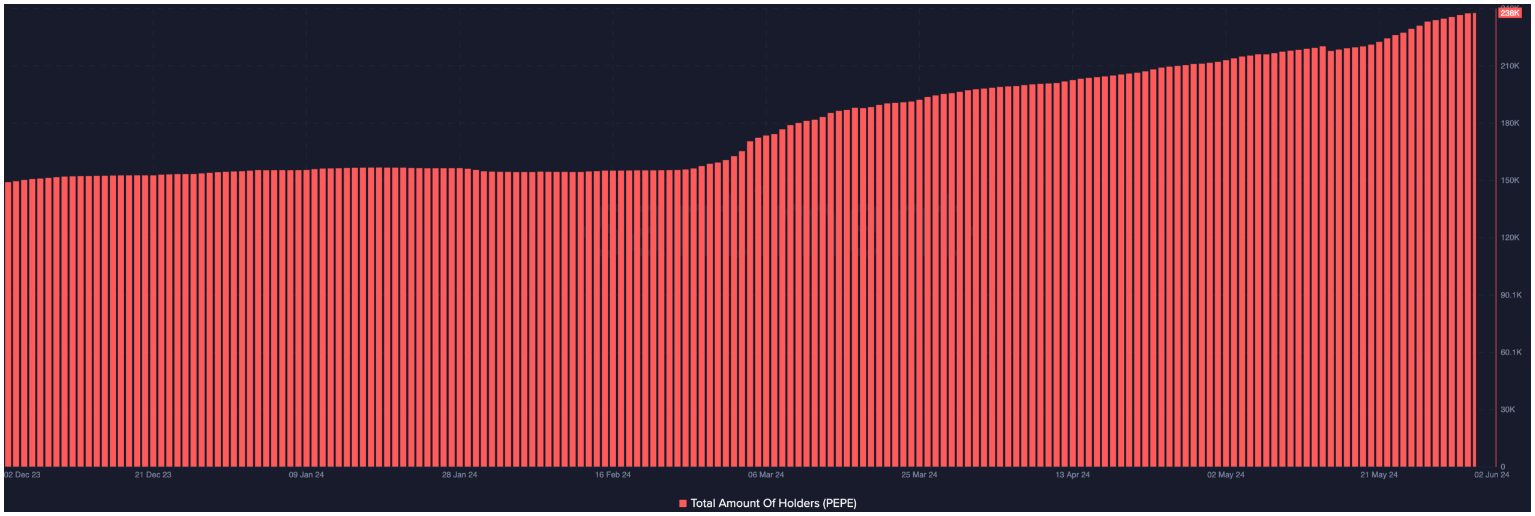

So, where does this leave memecoins? Data from Santiment shows that the number of PEPE holders grew from less, than 160,000 in February to 238,000 at the time of writing, an increase of almost 50% in under three months.

This growth suggests the so called memecoin supercycle might remain here longer, siphoning liquidity away from other altcoins with real-world utility.

The rise of SocialFi platforms like Friend.tech and Fantasy.Top, which have seen millions in trading volume, indicates a stronger trend towards social-based financial products.

Despite the influx of funds into these areas, memecoins are likely to continue attracting sizeable market interest.

Majority of experts still thinks while memecoins benefit from vast community engagement and speculative investment, they remain high-risk assets due to their lack of substantive use cases beyond entertainment.

This “backed by nothing but thin air” scenario is the best example of the speculative nature of these investments.

Have you read it yet? The SEC and CFTC both want to regulate crypto, but they likely can’t

Disclosure:This article does not contain investment advice or recommendations. Every investment and trading move involves risk, and readers should conduct their own research when making a decision.

Kriptoworld.com accepts no liability for any errors in the articles or for any financial loss resulting from incorrect information.