The market just faced a general downturn, but XRP managed to perform visibly better than many other assets.

Analysts say there are more indicators showed that market sentiment was moving contrary to XRP’s price.

XRP is crashing, but slower than others

If we take a look at CoinMarketCap ’s data, it’s clear that XRP experienced a smaller decline over the past week compared to other top ten cryptocurrencies.

XRP’s dip was about 5% over the last seven days, while Bitcoin dropped by over 9% in the same period.

Ethereum also saw a significant decline of over 8%, and Solana faced a sharp decrease of more than 17%. And the smaller alts? Turmoil.

XRP’s support is holding, and there are the whales

An analysis of XRP on a daily time frame revealed a pattern of declines, with the biggest drop occurring on August 2nd, where XRP’s price fell by 6.13% from approximately $0.59 to around $0.56.

Luckily, Ripple’s price support remained strong, the long-moving average provided support around the $0.54 range, preventing the declines and stabilizing XRP’s price, more or less.

So it’s not a big surprise that XRP has shown signs of recovery, rebounding by almost 2% to trade at around $0.57.

The RSI has also returned to the neutral line, signaling a balance in market sentiment and potential stabilization of buying and selling pressures.

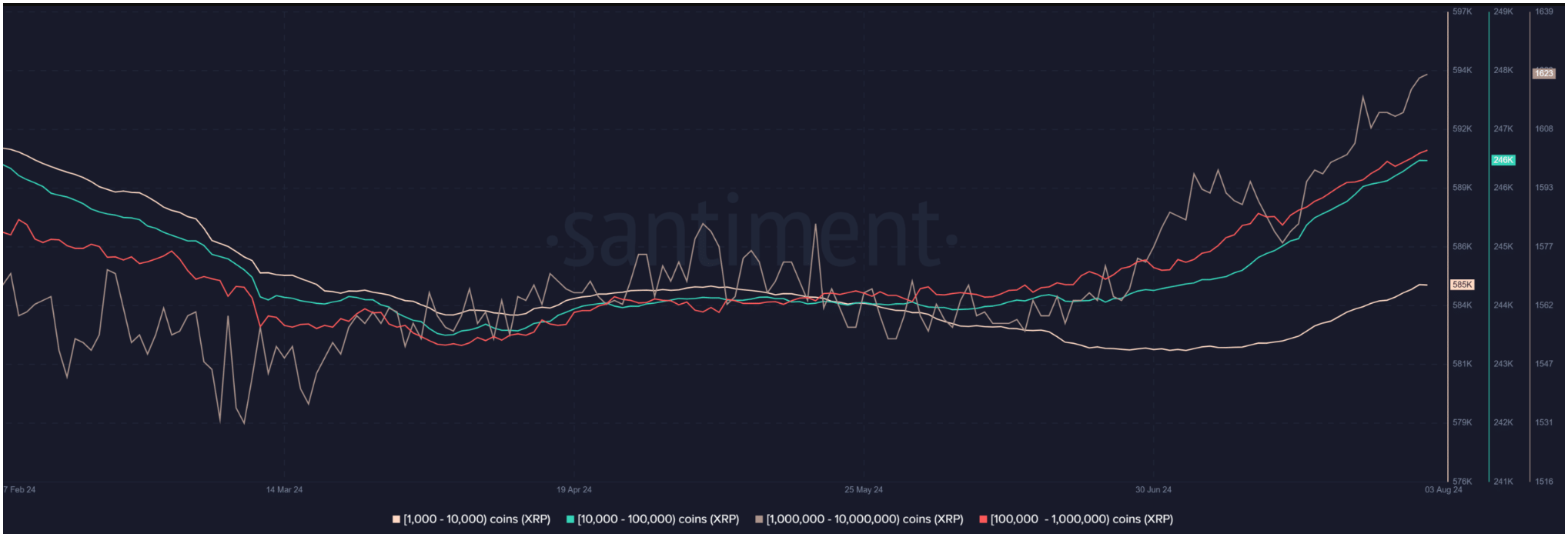

Another promising factor is the amount of whales, and their activity. Ripple’s supply distribution showed that large wallets have continued to accumulate XRP no matter how volatile is the market.

Wallets holding between 1,000 to 10 million XRP indicated a clear uptrend in holdings, suggesting ongoing interest from these investors.

Owner confidence is clear

While the increase in these wallets it’s only temporary, and might not be substantial, the short term trend is clear.

It illustrates that larger holders are choosing to retain their assets rather than sell during price declines.

Wallets holding between 1 million to 10 million XRP increased in the last few days, reflecting cautious but definite confidence among these holders.

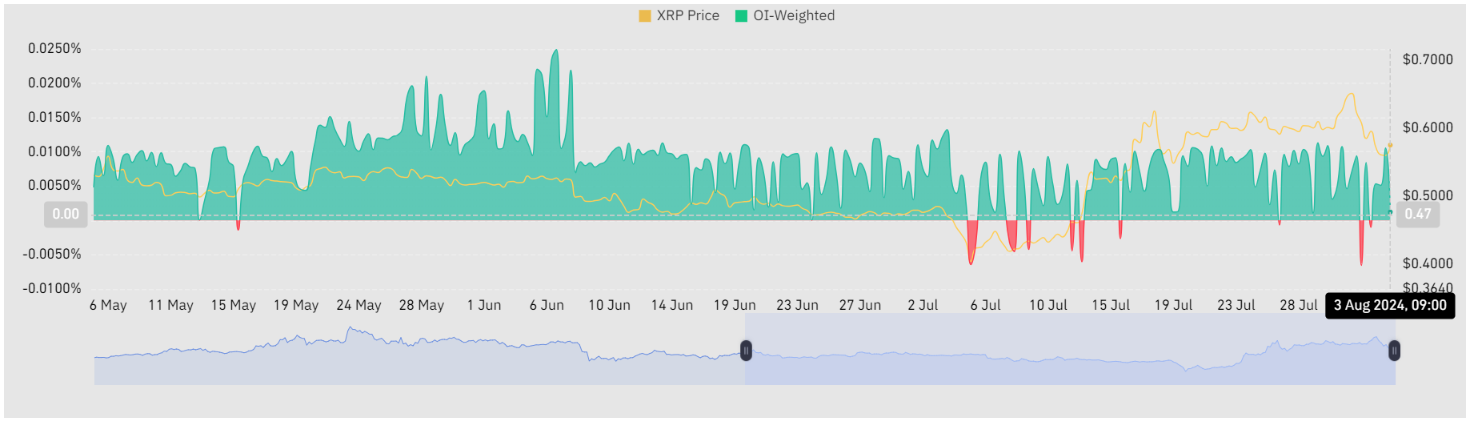

An analysis of Ripple’s funding rate on Coinglass showed a bigger spike, reaching 0.0106%, even though XRP’s price had declined in the previous trading session.

Spikes like this often shows that traders were optimistic or expecting a price recovery, hence their willingness to pay a premium to hold long positions.

Have you read it yet? Bybit exits France

Disclosure:This article does not contain investment advice or recommendations. Every investment and trading move involves risk, and readers should conduct their own research when making a decision.

Kriptoworld.com accepts no liability for any errors in the articles or for any financial loss resulting from incorrect information.