Litecoin has often been in the shadows of more popular cryptocurrencies like Ethereum and Bitcoin, evident from its past performance.

The digital silver narrative also supports this status. But its luck might change soon thanks to Fidelity Digital’s latest actions.

Old asset, new product

On Friday, Litecoin announced that Fidelity Digital added LTC to its digital product offerings, and this is especially significant because it allows Fidelity clients in the U.S., including institutional investors, to gain exposure to Litecoin.

Fidelity currently manages assets worth over $12 trillion, it’s a giant in the crypto industry, and Litecoin in Fidelity Digital’s portfolio it’s a positive sign for many.

Road to the future

The addition of Litecoin to Fidelity Digital’s portfolio sparks speculation about the possibility of a Litecoin ETF in the future.

Bitcoin ETFs have already seen tens of billions in inflows, and ETH ETFs were recently approved as well. Litecoin, similar to Bitcoin in its scarcity and proof-of-work consensus algorithm, fits the criteria for such assets.

The ETF is maybe not a matter of if, but the when. While Fidelity Digital hasn’t suggested a Litecoin ETF is coming soon, its focus on Litecoin makes this the logical next step.

Make Litecoin 100 again

Litecoin briefly surpassed $100 in March 2024, peaking at $112.83 in early April before dropping 49% to a low of $56.62.

At the time of writing, Litecoin was trading around $73. It still has some way to go before reaching the $100 mark again, but now both the RSI and MACD indicators show bullish momentum.

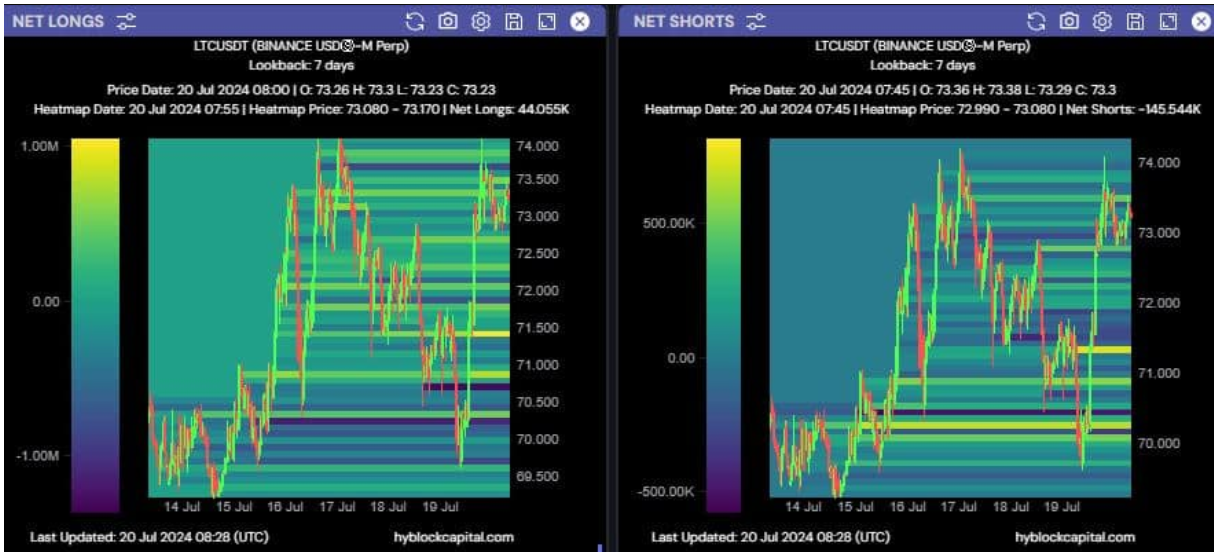

The latest data on longs versus shorts revealed a decrease in shorts by 145,540 while net longs stood at 44,055, indicating a shift in sentiment. Not a big shift, but a shift, no doubt.

It’s unclear if this is related to the news of Fidelity Digital adding LTC to its portfolio, but it is pretty possible explanation, and more than enough for anyone who want to speculate.