Canary Capital submitted an application for a Litecoin ETF, as Litecoin could be a strong contender compared to other alts. Just one week prior we saw a similar application for an XRP ETF.

Litecoin’s chances for an ETF

The application claims that Litecoin is suitable for use as an enterprise-grade payment system.

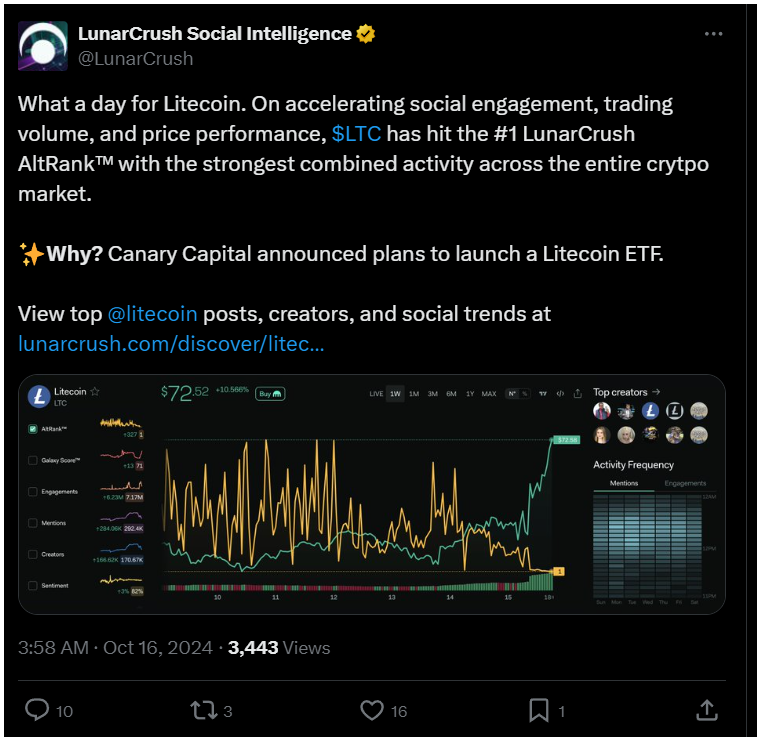

Following this news, Litecoin saw a 10% increase in price, with social media buzzing about the potential ETF.

On Wednesday, both Litecoin and Dogecoin experienced gains of over 8%, driven by Bitcoin’s surge to $67,000 and big inflows into Bitcoin ETFs, which reached a three-month high.

Litecoin also rose above $72, breaking out of a week-long period of relatively stable prices. This increase coincided with Canary Capital’s full submission of documents for the proposed LTC ETF.

The Form S-1 filed with the SEC emphasizes that Litecoin is one of the longest-running blockchains with a perfect uptime record, as LTC celebrated its 13th anniversary on October 13.

Canary Capital argues that like Bitcoin, Litecoin shouldn’t be classified as a security, as it has practical uses through BitPay, which processes one-third of its transactions in LTC.

Factors behind Litecoin’s success

The 8% gain has brought Litecoin to a new monthly high of $72.52 in the middle of the week.

This rise can be attributed to its strong presence on social media and a robust daily trading volume of $669 million, nearly double that of competing altcoins like Cardano and Tron.

Despite being lower in global rankings, Litecoin’s trading activity is still strong.

In addition to its social media success and increased trading volume, Litecoin’s Chaikin Money Flow indicator suggests accumulation among top holders, hovering around 0.10 on one-day charts.

On the other hand, Stochastic Relative Strength Index signals that LTC is in an overbought condition above 82 on the one-day charts.

This overbought status is pretty likely fueled by the excitement surrounding the potential ETF.

The unique position of Litecoin

Unlike Bitcoin’s anonymous creator Satoshi Nakamoto, Charlie Lee, the founder of Litecoin, remains actively involved in the project and contributes to its development.

This ongoing involvement allows Litecoin to adapt more easily to technical upgrades and solve some issues present in Bitcoin, such as lower transaction costs.