The seemingly unstoppable growth of Bitcoin ATMs has hit a stop. For the first time in ten months, May 2024 saw a worldwide decrease in active machines’ numbers, based on the CoinATMRadars’ data.

Reasons for the Decline

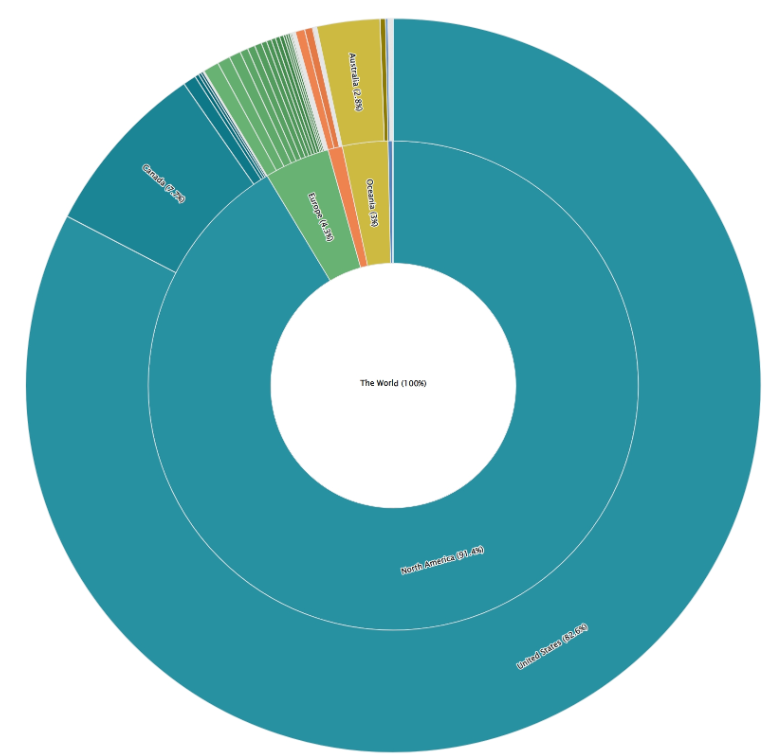

This drop, especially sharp in the US, the global leader in Bitcoin ATMs, has people questioning the future of this popular way to buy Bitcoin.

The exact reasons behind the decline are unclear, but there’s a possibility of US authorities cracking down on ATMs suspected of illegal activity.

Another possibility is a broader shift in regulations for Bitcoin ATMs.

US Market, where to go?

The US, with the most Bitcoin ATMs globally, was hit the hardest, over 300 machines were deactivated in May.

This could be linked to the potential crackdown on ATMs involved in criminal activity.

Impact on Accessibility

A decrease in ATMs could make it more difficult for people, especially those without access to online exchanges, to buy Bitcoin.

This could potentially slow down wider cryptocurrency adoption for those who prefer a more traditional cash-based approach, however, it’s important to note that this is a speculative theory.

Bitcoin Depot Stands Out

Interestingly, Bitcoin Depot, a major US operator, maintained steady earnings despite the decline.

This suggests that smaller operators may struggle to adapt to changing regulations more than established players, and Bitcoin Depot’s performance independent of Bitcoin’s price suggests their ATMs cater to users beyond short-term, speculative trading.

The Future of Bitcoin ATMs

The recent decline in Bitcoin ATMs highlights a period of unknowns, because whether it’s a response to illegal activity or a sign of stricter regulations is unclear.

While concerns about accessibility exist, it’s too early to say if this will significantly impact Bitcoin adoption.

Regardless of this, investors and users should stay informed as regulations develop.