Adam Back, the CEO of Blockstream and a quite well-known figure in the crypto world, has recently chimed in on the latest hype surrounding Bitcoin and financial heavyweight BlackRock.

Node runners, the social layer

So, here’s the deal, some chatter erupted after MicroStrategy’s Michael Saylor shared a seemingly harmless educational clip from BlackRock about Bitcoin.

But eagle-eyed followers spotted a little disclaimer that raised eyebrows, essentially saying there’s no guarantee that Bitcoin’s supply will stick to that 21 million limit. Cue the panic!

Now, let’s be real. The idea of increasing Bitcoin’s maximum supply is like suggesting pineapple belongs on pizza, just a big no-no in the Bitcoin community.

The limited supply is one of the main reasons people value Bitcoin so much, especially when you compare it to fiat currencies and those inflation-prone altcoins, and the Bitcoin community in this case isn’t some rhetorical phrase, or internet phenomen.

This reflects to the node-runners, and every single node has more power over the network as the biggest Bitcoin-whale, and able to enforce the rules to anyone. Including the rule of the 21 million.

Adam Back to the rescue

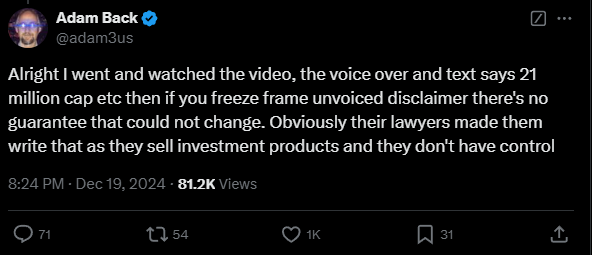

Back isn’t buying into the fear. He brushed off BlackRock’s disclaimer as just some cautious legal coverage.

According to him, it seems pretty clear that BlackRock’s lawyers insisted on adding that fine print to protect themselves since they’re dealing with products they can’t control.

“It’s just their lawyers making sure they don’t get sued if the community changed the number and they’d sold bitcoin ETFs saying it could never be over 21 million.”

In other words, it’s more about covering their bases than a real threat to Bitcoin’s supply.

You dont f*ck with Bitcoin

Back insists that this disclaimer is essentially meaningless because the community isn’t going to budge on increasing Bitcoin’s cap, and honestly, he’s not alone in this thinking.

Charlie Shrem, an early Bitcoin advocate weighed in too, saying that ditching the 21 million cap would completely transform Bitcoin into something unrecognizable.