When we read an article or a social post about a new, promising cryptocurrency or project, we can be almost sure we will encounter the phrase, ‘do your own research!’

It’s a fundamental suggestion, as everyone has responsibility for their own financial decisions, but the main issue here is not everyone is an educated investigator, researcher, or investor.

The following are not advice, I can’t give that, but more like a summary of the main questions and the most common methods in doing your own research in the crypto industry.

How do I do my own research? Where to start, what to check, how to evaluate the data, and how can I use my findings to support my decisions?

In this article, I will show you how I do this. Maybe it’s not comprehensive, as I’m also not a professional researcher, but maybe I can provide a good starting base for anyone to develop their own methods.

After all, the point of doing your own research is the ‘own’ part, one should not neglect it.

The crypto industry is a quite fast-changing scene, but there are main lines that can help guide us through the huge, sometimes overwhelming amount of information, and filter the signal from the noise.

Unfortunately, I’m not an expert, nor a professional investor, or any kind of advisor, just someone who has followed the industry for a few years, so if you think I can provide a done-for-you solution, I’m afraid you will be disappointed.

I can only show you how I do it, and you can adapt it to your specific circumstances and personal preferences.

Step Zero: Where did I find the name?

It may sound stupid, but the place where I find the name of the new, promising project matters a lot. How did I find it?

In a Facebook cooking group chat, where a random stranger mentioned this super-duper investing opportunity?

Or did a programmer friend send a long Medium article to me, to show how elegant their method for this or that use case is? I don’t have many programmer friends, but you know what I mean.

The basic rule is if a project only lives in the shady corners of the internet, I should be careful.

The serious teams, the real companies will collaborate with bigger crypto news sites, and won’t fear the watching eyeballs.

When a project tries to hide in private pages, smaller groups, and mostly peer-to-peer communications, without wider publicity, it could be a sign they don’t want expert opinions about their stuff, which may deter potential buyers.

Maybe this is not the case, but most projects and the companies behind them should be happy with as much hype as possible.

If they don’t, and they try to avoid the mainstream crypto media, I can assume something is off.

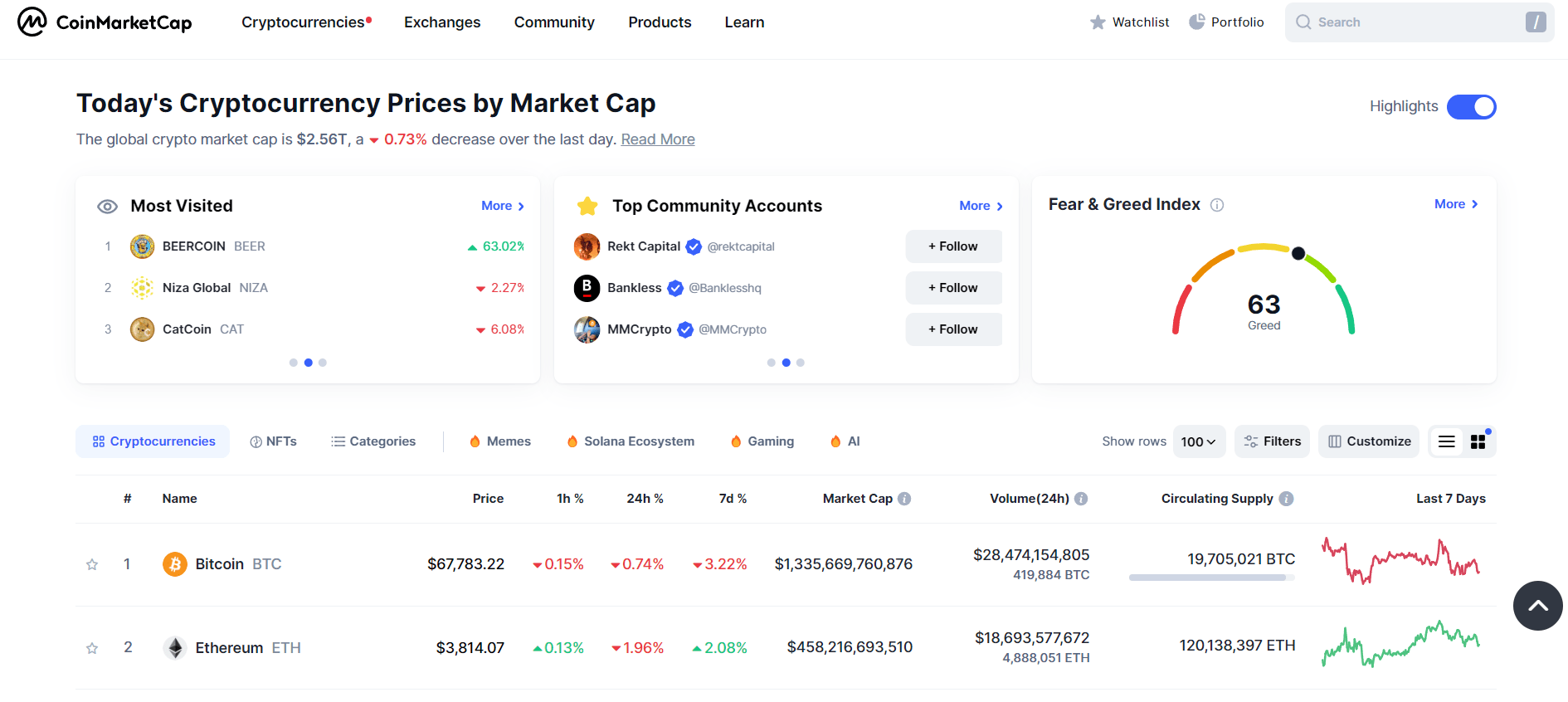

Step One: CoinMarketCap, CoinGecko, and co.

The two main pieces of information I will check are the price and the market capitalization.

The screener sites like CoinMarketCap serve as the so-called starting page for the crypto industry, where I can collect an enormous amount of data.

Charts, news, development and community activity, exchange listings, everything.

There are many projects which aren’t listed on one site but are on another, so usually, I open CoinMarketCap, Dexscreener, CoinGecko (and GeckoTerminal), Coinpaprika, and Messari too, and compare my findings.

These sites indeed serve as a starting point, in most cases, this is where users get their first impressions about a crypto asset.

So if a project is lazy to provide as much information as possible, lazy to build a nice landing page for their venture, giving all the data and information about themselves (we are talking about a 10-minute email from one of the developers, or from the community manager), I don’t know why they would work hard to deliver results for their customers.

I can also see if their marketing and reality match. They may describe themselves as a world-transforming solution, with a huge team and dozens of business partnerships, but then there is only a Uniswap listing?

Come on! Nothing is wrong with a dex listing, but it’s cheap, and if it’s the only trading venue for the project, that’s a red flag for me. Big projects will start on big exchanges too.

In the case of dexes, many sites, including GeckoTerminal, offer a kind of code/project review. Nothing extensive, but I can see if the code is potentially malicious, of poor quality, or if another suspicious factor is in play.

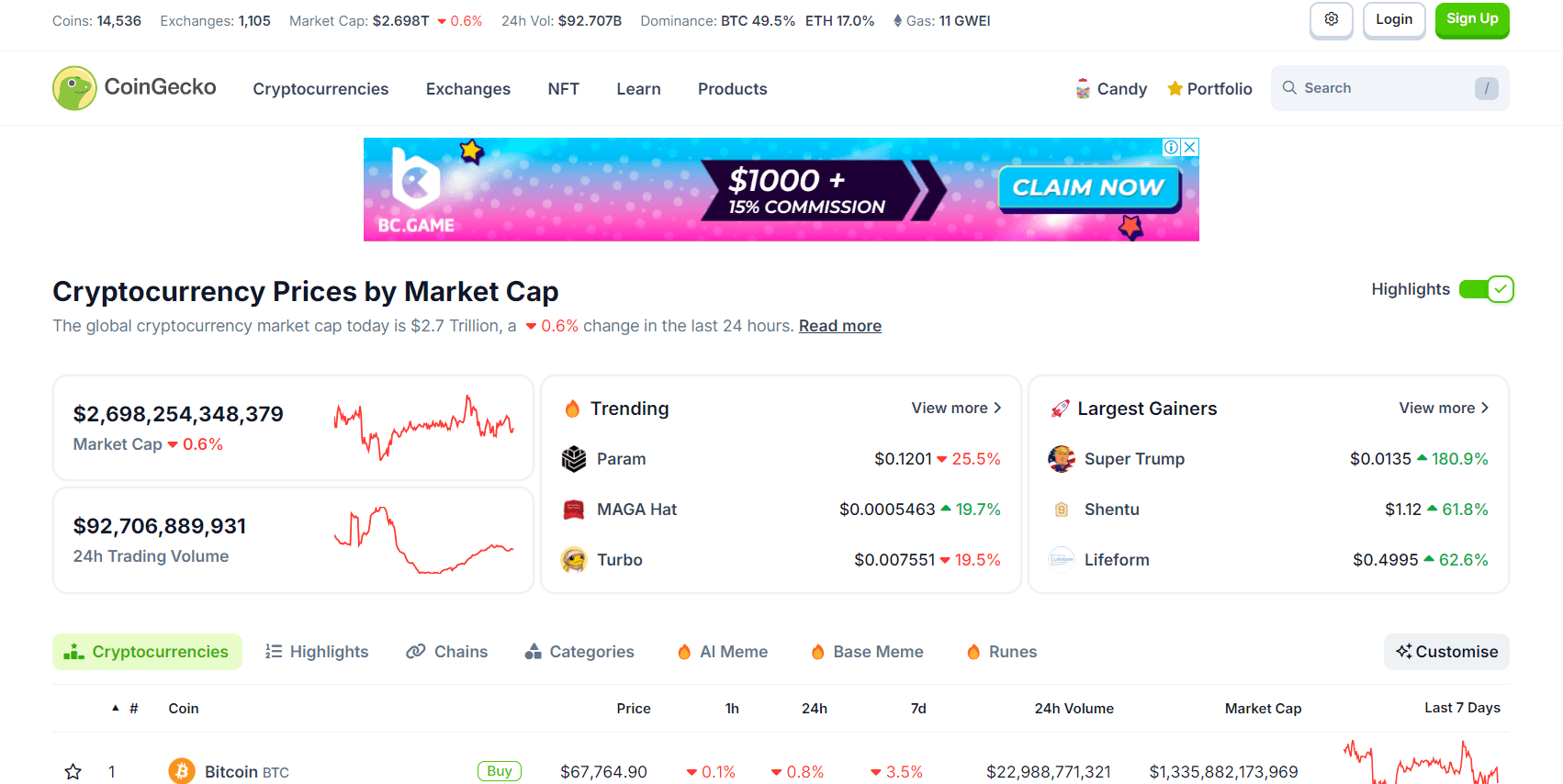

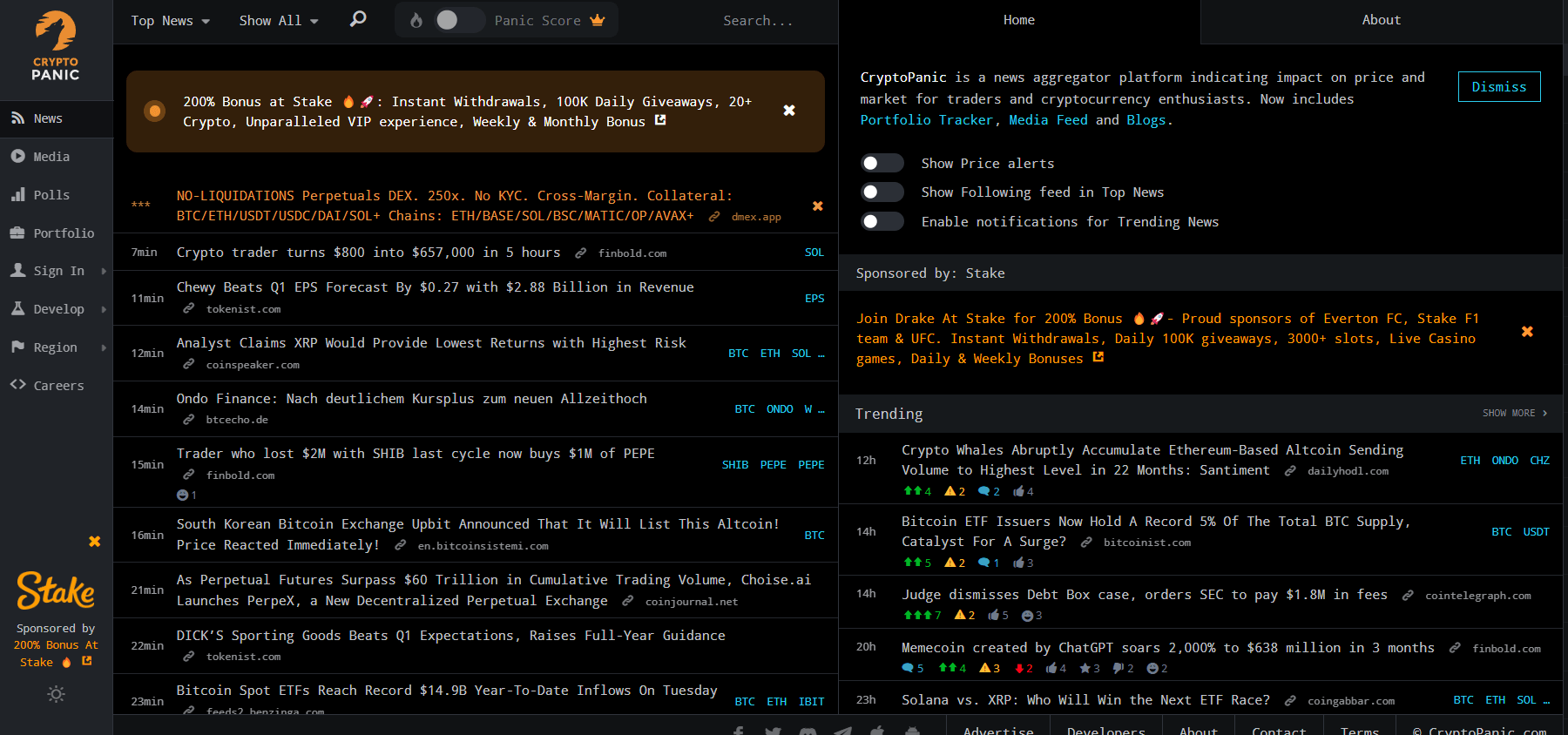

Step Two: Cryptopanic

Maybe the most popular, best news aggregator site. Here I can find almost every piece of information about certain projects and cryptocurrencies by monitoring the major crypto news sites, blogs, and Reddit subforums.

The only thing I have to do is filter for the target crypto or keyword, and my feed will be flooded.

Pretty useful when I want to get as much info as I can from a diverse set of sources, and also useful when I don’t want to spend much time on news sites but want to see what the industry says about the chosen project.

Step Three: The website

It may sound counterintuitive for me to list the project’s webpage only in the third step, but here is the catch! Anyone can lie about anything on a webpage.

They may build the most professional-looking site in the world, and it basically makes me beg for a buying opportunity, but simultaneously all the public information screams scam or a dead project.

If the project is real, the company is real, it’s time to dig deep on their webpage and find all the technical information.

This is the place where I will search for the white paper, tokenomics, the developers’ profiles (LinkedIn or Github), roadmap, things like this.

The white paper is the blueprint of the project, it must exist, and it must be open to the public. Unavoidable. If there is no such thing, run!

The developers are another question, as cryptocurrencies tout themselves as trustless, decentralized projects.

This is only true in very few cases. But many work with open-source code, with smart contracts without human interference, and in a transparent way. The code doesn’t lie, so in this case, it may be forgivable if the developers are anonymous.

But the majority of the projects disclose their developer team, with relevant profiles too, LinkedIn and Github, as I said already, not Facebook.

If a project is highly centralized, and the team is anon? I would keep my distance. A big distance, just in case.

On the website, I often check if there is any additional info about partnerships, or places where I can use the cryptocurrency, for payment, or for anything.

Step Four: The social media

Social media has become stronger than legacy media, and it shows. I can find basically any company, entrepreneur, or their spokespersons on social media, and get relevant information about the projects firsthand, without delay, and without biased editing.

Twitter (okay, X), Telegram, Discord, YouTube, blogs, newsletters, you know it.

We are living in an era where multimillionaire founders will share everything in a podcast, or in their own social media posts, mostly because they may like the fame, or if they don’t, it’s still good for the business.

This step is not so important if I want a quick trade, a speculation. That’s where technical analysis comes into play for the believers, supports and resistances are more important than a random guy’s thoughts about tokenization.

But if I want to play the long-term game? Better listen to the guy and to the overall activity of the project.

Step Five: News sites

Veteran Cryptopanic users can skip this step, but it’s worth mentioning that news sites are good sources of information.

Next to the fact that the information itself is sometimes not so good, because many sites publish promotional articles and guest posts, which are practically ads.

They have to disclose this fact, but sometimes they don’t, and in the case of social media influencers? The situation is way worse.

As a rule of thumb, when I want to collect data or information about a project, I also take a look at the news sites, and the Reddit/Medium duo too, where I have a bigger chance to find hopefully unbiased reviews and information.

Step Six: The decision

There is only one rule in this step: you have to make your decisions, as you are the one who bears the consequences of them. No one can do it for you.

Doing your own research is important, but we are humans, and we are fallible. We don’t know everything. We can’t.

And the crypto industry is a brand new, immature sector, with huge risks, even the biggest players are in the danger zone, as there is no guarantee about future performance.

I can see many seed rounds for new companies with tens or hundreds of millions of dollars from venture capital, but this doesn’t mean I can be confident.

This only means the big guys also see the possibilities, and they decided to chip in, despite the risks. But these are just possibilities, not certain outcomes.

When it comes to research, I think the more the better, because when I want to buy something, I want to make sure I won’t burn myself.

Sometimes it happens anyway, but the best practice is to minimize the blind spots with extensive research. And everyone should do this on their own.

It’s not worth neglecting it.