It’s still unlikely. but many thinks the price of Ethereum will rise with the introduction of new U.S.-based spot Ether ETFs, while Bitcoin might struggle due to repayments from Mt. Gox creditors, and German government selling. This is the theory.

ETFs are good for business

Analysts from K33 Research suggest that the upcoming launch of spot Ether exchange-traded funds in the U.S., possibly as early as July 8, could lift Ethereum’s price, at least for compared to Bitcoin.

These ETFs are seen as a major positive factor for Ethereum’s price. In contrast, Bitcoin will face selling pressure as $8.5 billion worth is repaid to creditors of the collapsed exchange Mt. Gox, started this week.

Flippening

For more than a few years, Ethereum lagged behind Bitcoin, which has seen nice gains with over $14 billion flowing into its spot ETFs in 2024.

K33 analysts Vetle Lunde and David Zimmerman noted that Ethereum’s price can initially dip following the ETF launch, but they expect inflows to the spot funds to eventually support the price, similar to what happened with Bitcoin.

Lunde expressed optimism, saying that ETFs are a strong catalyst for Ethereum’s relative strength as the summer progresses and investment flows increase.

He believes that current ETH/BTC prices present a good buying opportunity for patient traders.

K33 Research maintains a positive outlook for ETH, anticipating net inflows equivalent to 0.75-1% of ETH’s circulating supply in the first five months after the ETFs launch.

Don’t do too big leverage kids

Despite the optimistic view from K33 Research, the market seems more skeptical.

Ethereum futures are trading at a discount compared to Bitcoin futures, and right now, the price ratio of ETH to BTC stands at 1 ETH to 0.055 BTC.

Over the past years, ETH’s value has steadily declined against Bitcoin, hitting a low of 0.045 on May 24.

The approval of Ether ETFs by the SEC led to a smaller reversal in Ethereum’s relative value to Bitcoin, pushing the ETH/BTC ratio up to 0.055.

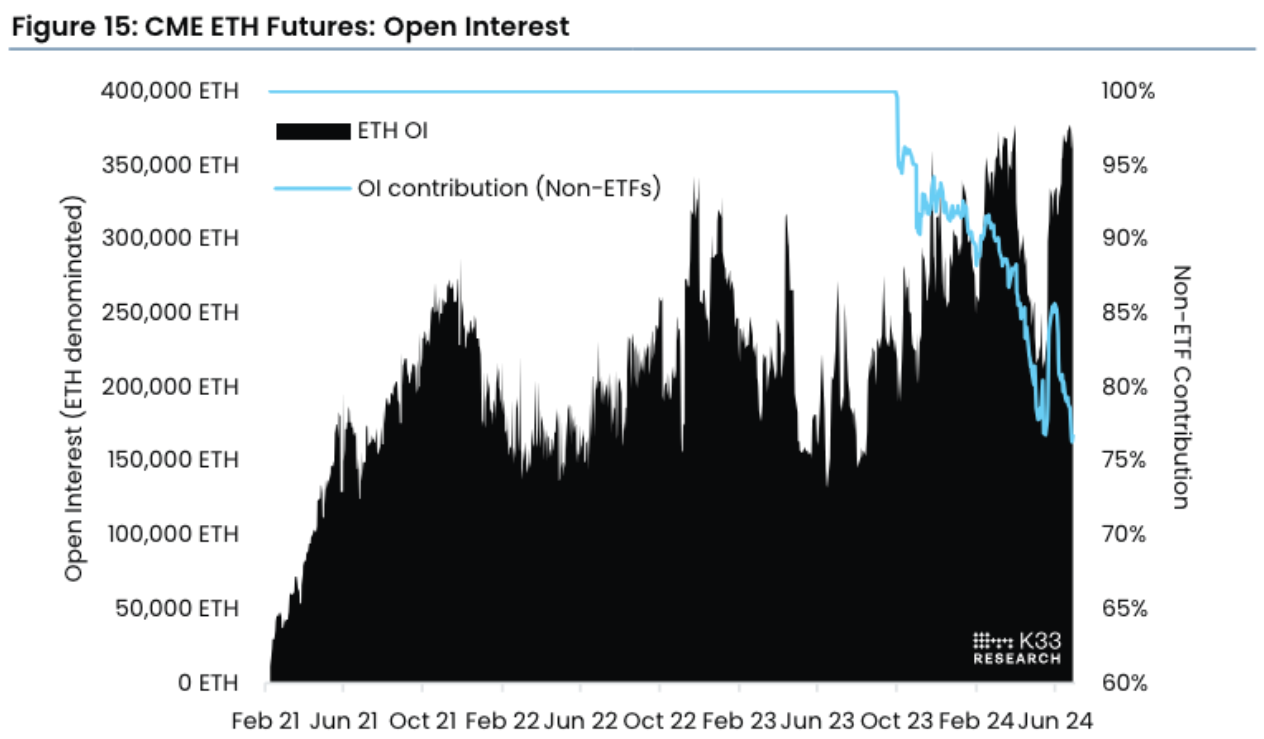

But Lunde and Zimmerman noted that Ether futures open interest is really high, signaling that many traders are leveraging heavily, way too heavy, as we experienced this after the liquidation wave, betting on ETH’s price movement as the ETF launch approaches.