Economist Peter Schiff just restarted the debate on the purpose and value of owning Bitcoin directly, or through exchange-traded funds.

He told owning ETFs undermines the fundamental principles of the cryptocurrency. And he’s right.

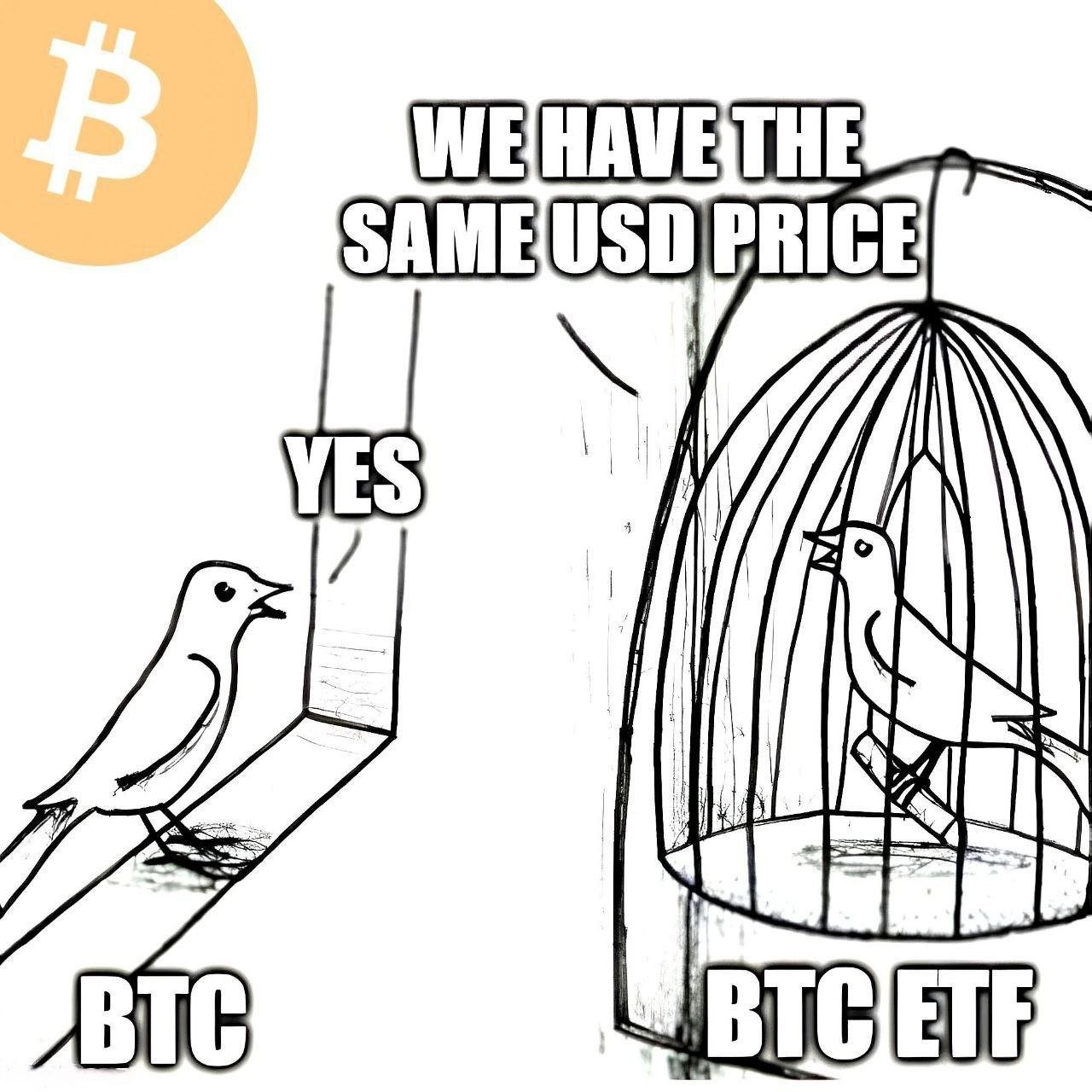

Paper Bitcoin it’s not permissonless

On Tuesday, Schiff took to X to argue that holding Bitcoin in ETFs contradicts the cryptocurrency’s main values, such as decentralization and peer-to-peer transactions.

“Owning Bitcoin in ETFs defeats the entire purpose of owning it in the first place. It’s not your keys, not your coins.”

Schiff is right. He added that Bitcoin in ETFs loses its decentralized nature, becomes vulnerable to seizure by authorities, and cannot function as a currency for payments or be transferred across borders. ETF-held Bitcoin is easily controllable by others.

Source: X, unknown meme maker

Bitcoin is investment for many, but what price?

Schiff continued that the primary demand for Bitcoin ETFs comes from people who do not value Bitcoin’s fundamentals but see it merely as a profit-making medium, like any other investment.

“This shows the pyramid scheme will soon collapse.”

Schiff’s critique points to the 2022 seizure of approximately 50,000 Bitcoin by authorities, linked to the Silk Road marketplace, as evidence of Bitcoin’s vulnerability.

Of course, he did not mention that the paper Bitcoin is which could collapse, and seizures by authorities is a vulnerability by the users, not by the system.

Authorities can seize unsecured keys, not breaking the cryptography.

Schiff is right about Bitcoin ETFs, but the community smells hypocrisy

Bloomberg ETF analyst Eric Balchunas responded to Schiff’s comments, acknowledging their fairness but countering with a question about gold ETFs, which Schiff supports.

“Should the motto be ‘Not sitting in your own safe, not your gold’?”

Balchunas quipped, challenging Schiff’s stance on gold versus Bitcoin ETFs. ETFs are no doubt very popular, U.S.-based Bitcoin ETFs recorded net outflows of $148.56 million as of August 6.

The Grayscale Bitcoin Trust experienced redemptions of $32.18 million, while the Fidelity Wise Origin Bitcoin Fund saw capital exits amounting to $64.48 million.

Schiff’s criticism comes during a volatile period for Bitcoin, which recently fell below $50,000, causing concern among investors.

He has warned of a potential crypto graveyard and predicted massive sell-offs in Bitcoin ETFs if Bitcoin dips below its July low, but just remember, he says this for more than ten years.