The Nasdaq-listed Bitcoin mining company, CleanSpark has ramped up its Bitcoin stash to 9,952 BTC, and they’re likely not stopping there.

Thanks to some efficiency improvements and a major boost in deployed hashrate, CleanSpark is positioning itself as one of the biggest corporate holders of Bitcoin.

Arm’s race

In December alone, CleanSpark mined 668 BTC, bringing their total for the year to 7,024 BTC, and their hashrate skyrocketed by 287.9% year-over-year.

By the end of 2024, their operating hashrate hit 39.1 EH/s, reflecting a 33.3% improvement compared to the previous year.

In December, CleanSpark sold 12.65 BTC, which was just 58% of their average daily production for that month. They managed to sell at an average price of about $101,246, raking in around $1.28 million from those sales.

The company also expanded its mining capacity big time in 2024 by acquiring seven facilities in Knoxville, Tennessee, which they claimed would boost their hashrate by another 22%.

Climbing

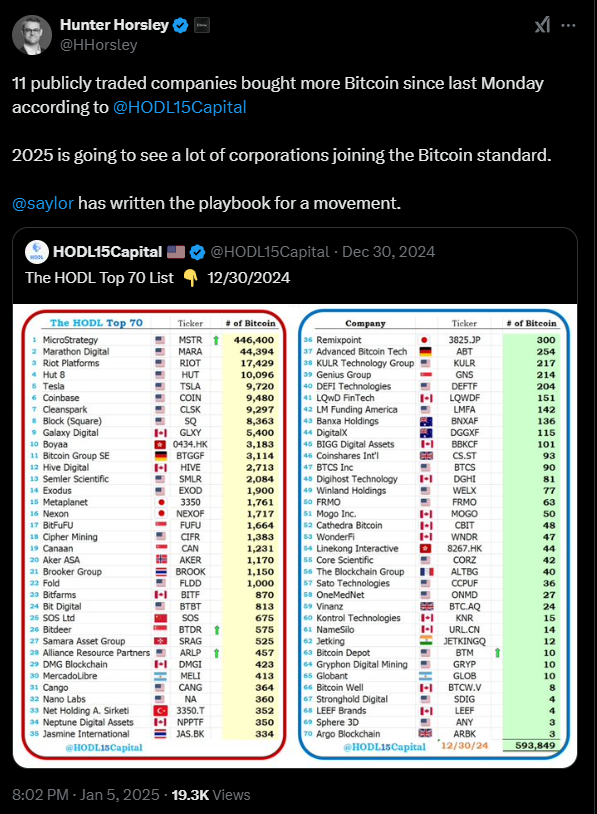

By the end of 2024, CleanSpark had accumulated a total Bitcoin value of about $1.01 billion, making it the fifth-largest corporate holder of Bitcoin, just ahead of Tesla. Only MicroStrategy and three other mining companies hold more Bitcoin than CleanSpark.

Speaking of MicroStrategy, they’ve been busy too, adding another 1,070 BTC to their holdings in early January.

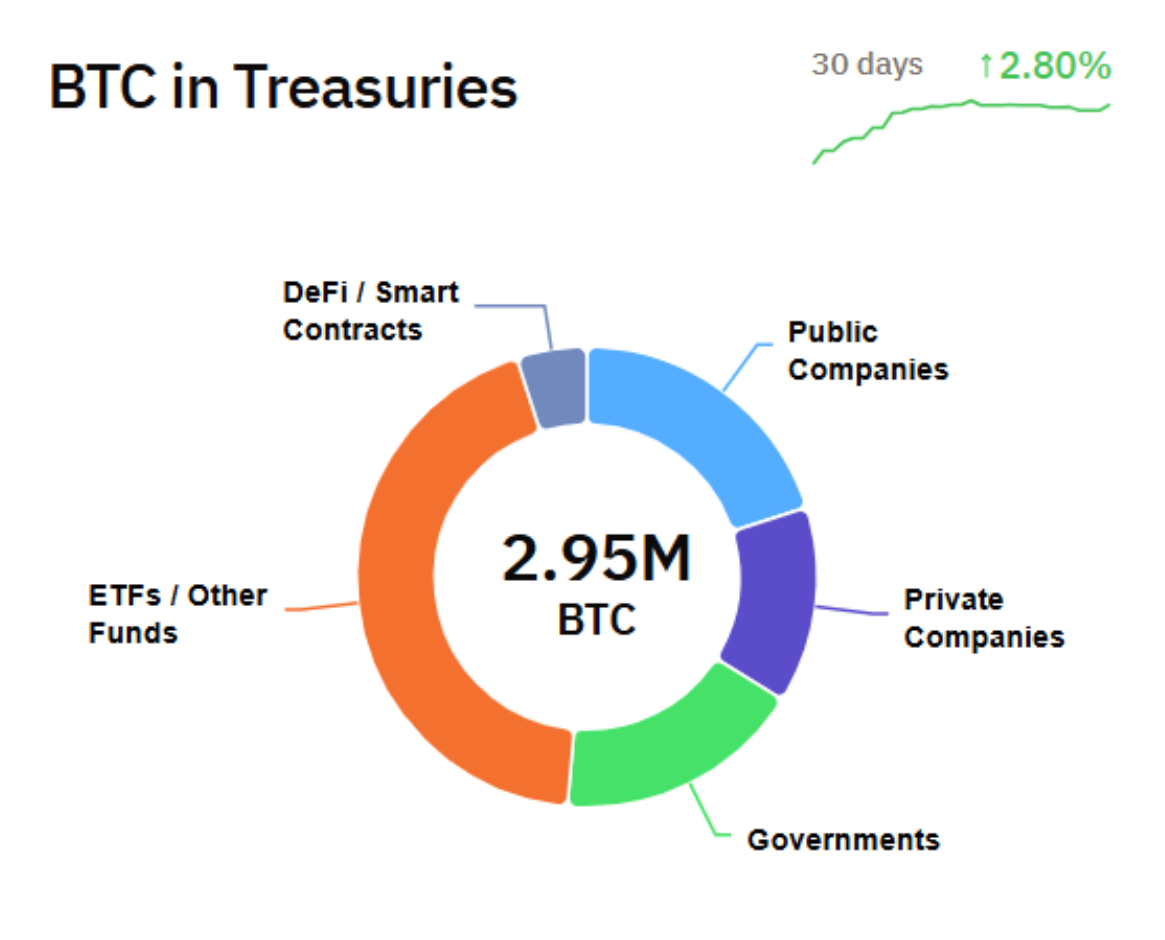

Publicly listed companies now hold a combined 593,152 BTC as reserve asset, which accounts for roughly 20% of all institutional Bitcoin holdings, and don’t forget that this number even includes government confiscated Bitcoin.

There’s a growing trend among corporations looking to add Bitcoin to their balance sheets.

Last month, space tech company KULR converted $21 million in cash into Bitcoin.

Canadian firms Matador Technologies and Quantum BioPharma have also jumped on the bandwagon by purchasing Bitcoin as part of their corporate treasury strategies.

Trendsetters

Hunter Horsley from Bitwise believes that 2025 could be the year when “Bitcoin Standard” corporations start popping up as more companies adopt BTC.

With its growth and strategic moves, CleanSpark is clearly on this way.

As they continue to expand their operations and increase their Bitcoin holdings, all eyes will be on them to see how they navigate the collision zone of traditional finance and Bitcoin.

Stay ahead in the crypto world – follow us on X for the latest updates, insights, and trends!🚀

Have you read it yet? Dogecoin jumped 21% as whales cashing in

Disclosure:This article does not contain investment advice or recommendations. Every investment and trading move involves risk, and readers should conduct their own research when making a decision.

Kriptoworld.com accepts no liability for any errors in the articles or for any financial loss resulting from incorrect information.