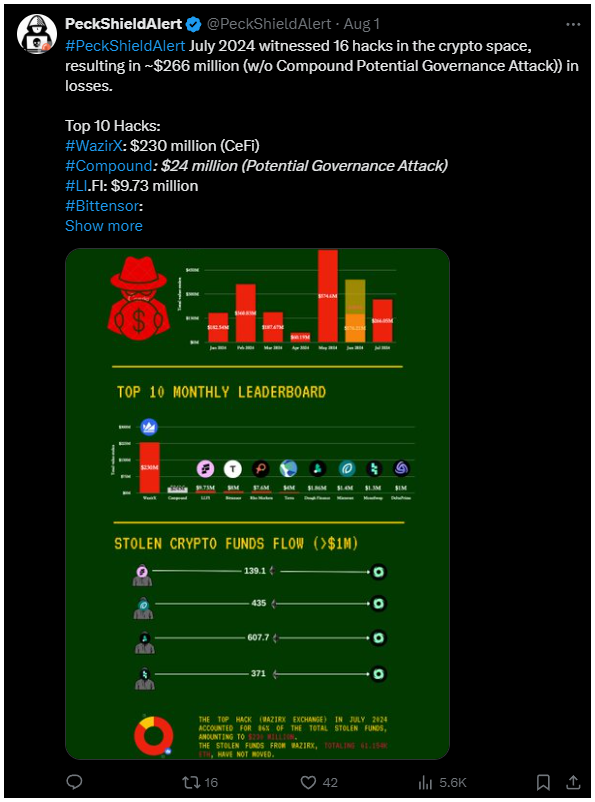

A new report from on-chain security platform PeckShieldAlert shared that July saw 16 crypto hacks, resulting in over $266 million in losses.

The biggest incident was the India-based crypto exchange WazirX, which lost $230 million.

Hunt for the WazirX hacker

PeckShieldAlert’s data shows that the WazirX hack accounted for 86% of the total funds stolen in July, and the report also noted that the 61,154 ETH stolen from WazirX hasn’t been moved.

Following this massive loss, WazirX and its co-founder, Nischal Shetty, have been actively seeking a solution to address the issue. Shetty even announced a $23 million bounty to help recover the lost assets.

Other bigger hacks in July affected platforms like LI.Fi, Bittensor, Rho Markets, Terra, Dough Finance, Minterest, MonoSwap, and DeltaPrime. These firms experienced losses ranging from $1 million to more than $9 million.

Hacker’s spring

In a separate report, bug bounty platform Immunefi detailed the extent of crypto hacks in Q2 2024.

If we take a look to the numbers, the report shows crypto protocols lost over $572 million in the second quarter alone, with $564 million lost to hacks and $8.4 million to fraud and scams. Immunefi listed 53 hacks and 19 fraud incidents during this six-months period.

DMM Bitcoin and BtcTurk were among the hardest hit, with DMM Bitcoin losing $305 million and BtcTurk losing $55 million.

Compared to Q2 2023, there was a 112% increase in total losses in Q2 this year.

Centralized Finance platforms were the primary targets, accounting for 70% of the exploits.

As almost always, Ethereum was the most targeted blockchain in Q2 2024, experiencing 34 incidents. BNB Chain was the second most targeted, with 18 reported cases.

A new hacking each week

The surge in crypto hacks aren’t surprising, and this is an unfortunate situation.

Also these are the clear signs of the growing need for robust security measures in the industry, as hackers continue to target prominent crypto exchanges and protocols, the industry must prioritize strenghtening security infrastructure to protect digital assets.