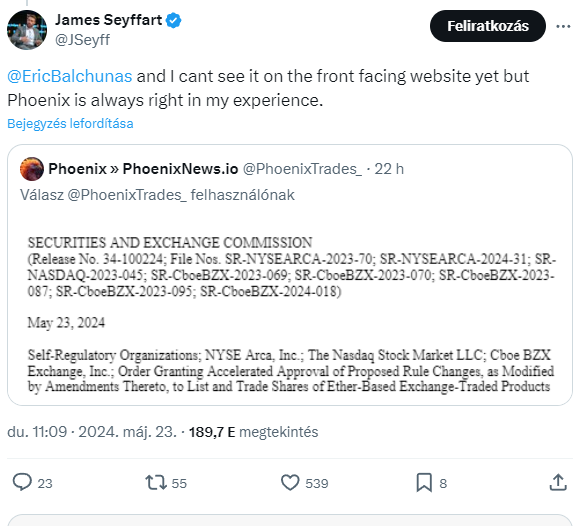

Cryptocurrency investors are celebrating after the US Securities and Exchange Commission, the SEC approved the launch of several spot Ethereum ETFs.

This long-awaited decision could have a significant impact on the future of Ethereum and the broader cryptocurrency market.

Unlocking Billions: Institutional Investors Eye Ethereum

The SEC’s approval paves the way for the listing of eight spot Ethereum ETFs proposed by major financial institutions.

These ETFs will allow investors to gain exposure to Ethereum’s price movement without directly owning the cryptocurrency itself.

This is expected to unlock billions, or tens of billions of dollars in potential investment from institutional players who were previously hesitant to enter the cryptocurrency market due to regulatory uncertainty.

Slow Shift

While the initial approval is a positive step, it’s important to note that the final launch of these ETFs requires additional work, as issuers still need to complete SEC filings and establish exchange agreements.

This process could take several weeks, so a clear launch timeline remains uncertain. To address some regulatory concerns, ETF issuers have agreed not to offer staking options for the underlying Ethereum holdings within these funds.

The SEC’s decision to approve these Ethereum ETFs is seen by many as a potential shift in the Biden administration’s stance on cryptocurrency regulation.

While the specific reasons behind this potential shift remain speculative, it could signal a more crypto-friendly regulatory environment in the US, and this could have far-reaching consequences for the entire cryptocurrency industry.

A Double-Edged Sword

The influx of institutional investment brought on by Ethereum ETFs could have both positive and negative consequences. On one hand, it could lead to a significant

increase in the mainstream adoption of Ethereum, potentially boosting its value. A more regulated environment could attract new investors hesitant about the Wild West reputation of cryptocurrencies.

But this surge in institutional investment could also lead to increased market volatility for Ethereum, because large investments can have a significant impact on the price, causing sharper fluctuations.

Investors should be aware of this potential risk before jumping into the Ethereum ETF market.

A Brighter Future for Ethereum and Crypto?

The approval of Ethereum ETFs is a significant milestone for the cryptocurrency industry. It highlight growing mainstream acceptance of Ethereum and could pave the way for further development and innovation on the Ethereum platform.

While some volatility will occur for sure, the long-term benefits of increased adoption and a more regulated environment could outweigh the risks. Time will tell how this going.