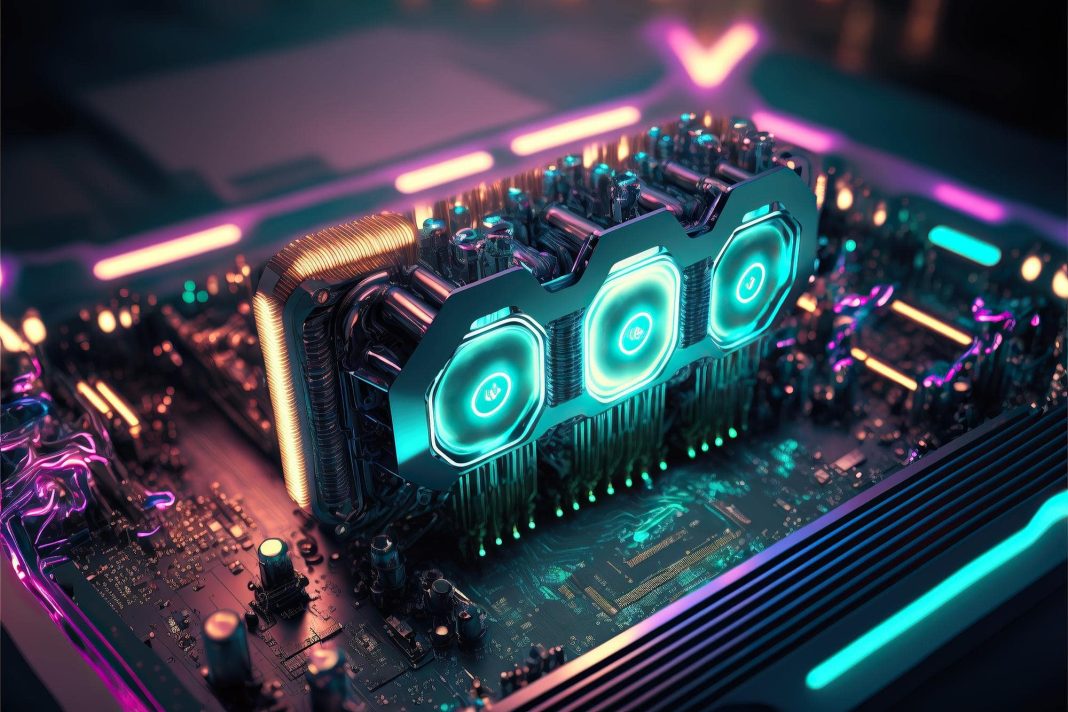

Hidden cryptocurrency mining is making a comeback, focusing on rented GPU power.

Previously, these operations were known to hijack websites or networks, using their computational resources to mine lesser-known cryptocurrencies.

Now, with the rise of GPU rentals from mainstream companies, crypto startups, and former mining farms, hackers are finding new ways to exploit these resources for illegal crypto mining.

Enemy at the gates

The growing popularity of GPU rental services opened up new avenues for hidden miners.

One service, Vast AI, offers cloud-based GPU power at friendly prices depending on the host, so they gained popularity due to the flexible pricing and fewer restrictions.

But this business method also made it a potential target for hidden mining activities. A good example of this activity is linked to a cryptocurrency called Xelis, which has seen increased mining activity.

Xelis, a relatively new coin that began trading on mid-August, operates on a network with a hashrate of 5.23 GH/s, more than twice that of Monero.

pretty funny I was mining Xelis and holding it over the past 2 weeks when it wasn't profitable but I was gaining 3-4 more Xelis than I am now with the same hashrate. So because Xelis' price has increased like 100% it became "profitable" and the difficulty jumped but the Xelis I… pic.twitter.com/hAVQEoJapE

— Red Panda Mining (@RedPandaMining) August 25, 2024

Xelis also mimics Monero’s privacy-focused model. The network is still in its early stages of solo mining, but it’s already attracted attention due to its fast growth.

GPU mining is still a thing

The number of cryptocurrencies that can be mined with GPUs has dwindled in the past years, with many being replaced by speculative tokens.

Monero remains a popular choice for distributed GPU mining, though it faces challenges due to stricter KYC requirements from exchanges and other crypto services, making it harder to trade.

Other GPU-compatible tokens like ZCash and Ravencoin continue to operate, though they are considered older assets.

If there is a market, there is an opportunity

The decline in profitable mining opportunities is obvious, but Monero’s network maintained impressive hashrate levels, staying near its all-time high at 2.5 GH/s.

This low competition environment could present a favorable opportunity for bot miners to enter the market, even with stolen capacities.

A handful of smaller mining projects still exist, although they offer pretty thin profit margins.

Even top-tier GPUs may yield less than $1 in profit over 24 hours, but for hackers, bad actors who can gain access to multiple GPU pools to drain the resources, the cumulative profits can still be worthwhile.