Listen up, the crypto community is abuzz once again, and this time it’s all about the U.S. government making some big moves with Bitcoin.

They’ve just transferred $8.46 million worth of BTC from confiscated funds into two different wallets, and everyone losing their sh*t.

Overreaction

Historically, when governments make high-value Bitcoin transactions, it can cause some short-term price jitters.

ARKHAM ALERT: US GOVERNMENT MOVING $8M $BTC

The US Government just moved $8.46M BTC from Sae-Heng Confiscated Funds.

$10 of BTC was sent to:

bc1qs0qhmlzh2wvs0n70vn7s6jj37zvek2e7t73kfgThe remaining $8.46M moved to a change wallet:

bc1q7qf075up5nkd6hejgkmr9ms0fal97w35asrs55 pic.twitter.com/oTBWxTD2pz— Arkham (@arkham) March 27, 2025

Think of it like a big splash in a small pond, everyone gets a little nervous. But here’s the thing, we haven’t seen any clear signs of the government selling off their BTC stash just yet.

And the second thing is $8 million isn’t that big bag of money, to be honest. Still, the market is as volatile as a teenager’s mood swings, reacting to every little move.

Volatility in the price, volatility in the ETFs

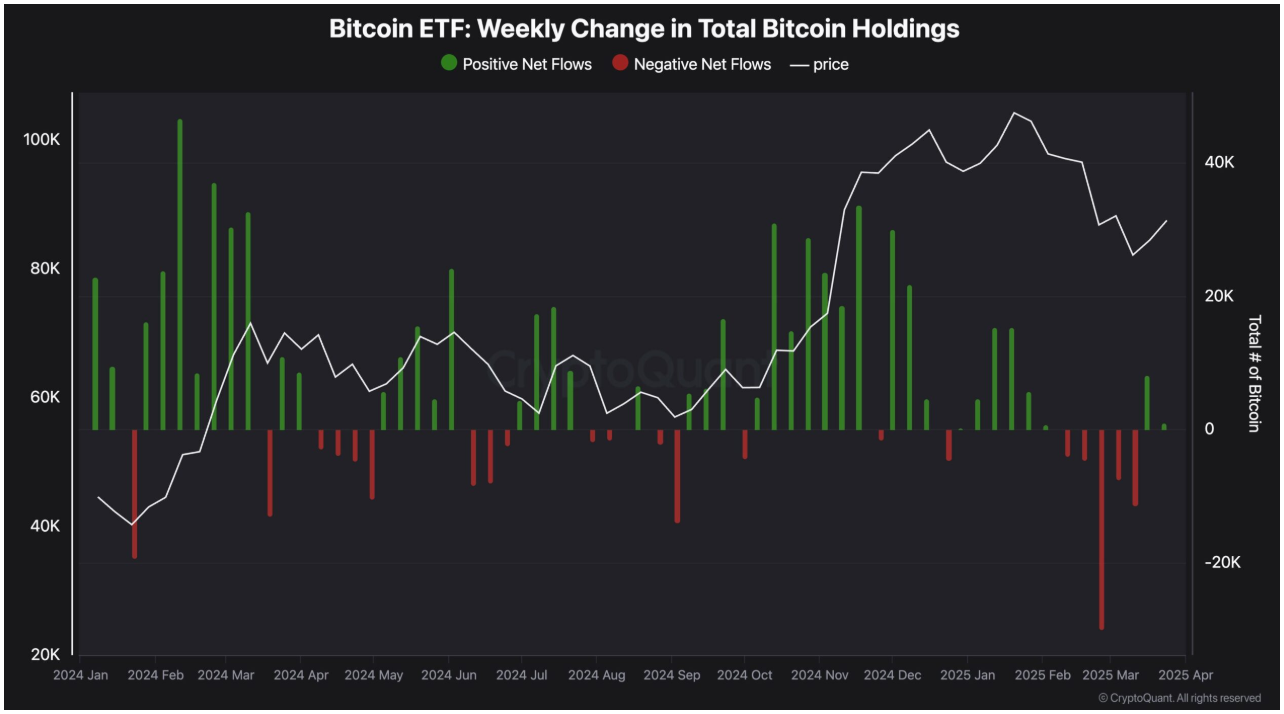

Now, let’s talk about Bitcoin ETFs, and the ETF investors. They aren’t too happy with this volatility, probably.

These ETFs are essentially investment vehicles that track Bitcoin’s performance, allowing institutions to get in on the action. And there’s been a record outflow from these funds.

Institutions are getting cautious, adjusting their portfolios to hedge against broader economic risks.

It’s like they’re trying to balance on a tightrope, reduce risk without missing out on potential gains.

This shift has led to a decline in Bitcoin ETF holdings, which could mean more short-term volatility for BTC.

Over the past 24 hours, Bitcoin prices have taken a hit, dropping by over 2%. This isn’t surprising, given the government transfer and those ETF outflows.

It’s like the whole market is playing a game of musical chairs, everyone’s trying to find their place before the music stops.

The long game

Despite this short-term dip, Bitcoin’s overall trend remains bullish, fundamentals and increasing adoption are keeping it chugging along. Sure, there’s some short-term volatility, but the long-term outlook is promising.

As institutions adjust their strategies, Bitcoin’s price will likely stay influenced by macroeconomic factors.

So, keep an eye on those institutional flows and government actions, they’re the keys to understanding where Bitcoin is headed next.

Have you read it yet? Custodia + Vantage = a new USD stablecoin

Disclosure:This article does not contain investment advice or recommendations. Every investment and trading move involves risk, and readers should conduct their own research when making a decision.

Kriptoworld.com accepts no liability for any errors in the articles or for any financial loss resulting from incorrect information.