After a strong start to 2024, Bitcoin’s price performance has been mostly disappointing, some even say it’s failing to take advantage of the momentum from spot ETFs.

Now searches for Bitcoin on Google have dropped to a new low for the year, leaving investors questioning whether this trend is good or bad for Bitcoin’s price.

Declining interest, what Uptober?

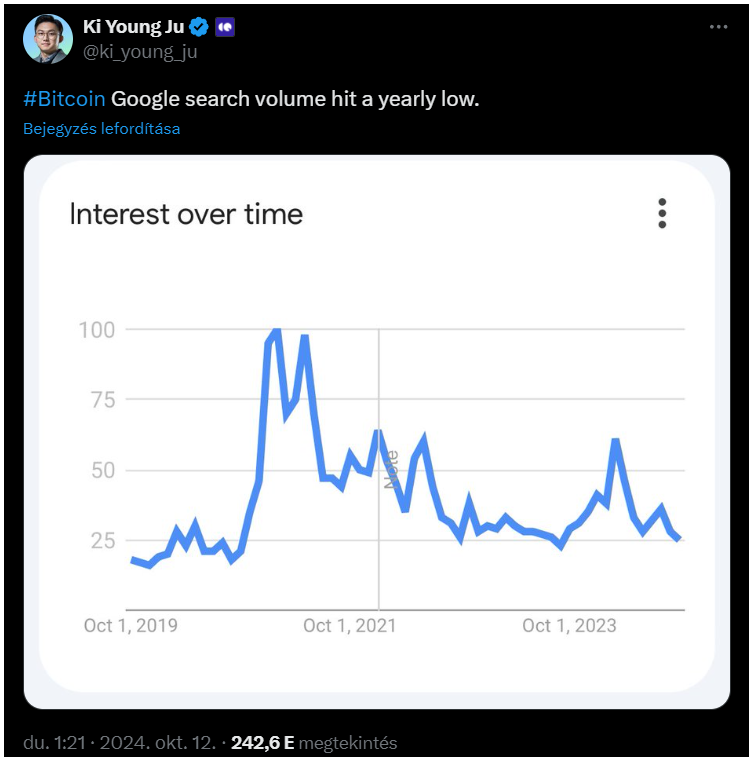

CryptoQuant CEO Ki Young shared in social media that searches for the term ’Bitcoin’ on Google have reached their lowest point in this year.

Typically, when more people search for Bitcoin, it signals strong interest from retail investors, and now, it seems they aren’t here.

The current decline in searches suggests that retail investors may be leaving the market or haven’t yet entered it during this cycle.

Less interest, bigger upside?

A drop in Google searches could actually be a positive sign for Bitcoin. It suggests that there is still potential for the price to rise if retail investors return.

Historically, the crypto market often moves against the crowd, and this means that when most people are feeling negative about Bitcoin, its price tends to increase.

With fewer searches indicating low interest and expectations among crypto fans, it is likely that Bitcoin could see upside price movements.

As of now, Bitcoin’s price is around $64,000, showing a few percent increase over the last 24 hours.

Growing interest in memecoins

On the other hand, memecoins are currently capturing much of the community’s attention.

Young Ju from CryptoQuant has noted that search volume for memecoins is expected to reach an all-time high in October 2024.

Memecoin Google search volume is expected to reach an all-time high this month. pic.twitter.com/ZOfsLFwGmH

— Ki Young Ju (@ki_young_ju) October 12, 2024

This suggests that interest in these tokens is growing, and they have been some of the biggest winners this year.

Nine memecoins already made it into the top 100 cryptocurrencies by market capitalization.

These include popular tokens like DOGE, SHIB, PEPE, WIF, BONK, POPCAT, FLOKI, BRETT, and NEIRO.