CryptoQuant just shared that Bitcoin could be gearing up for an epic bull rally if a key metric, the Puell Multiple, breaks out in a way that mirrors past performance.

What’s the Puell Multiple?

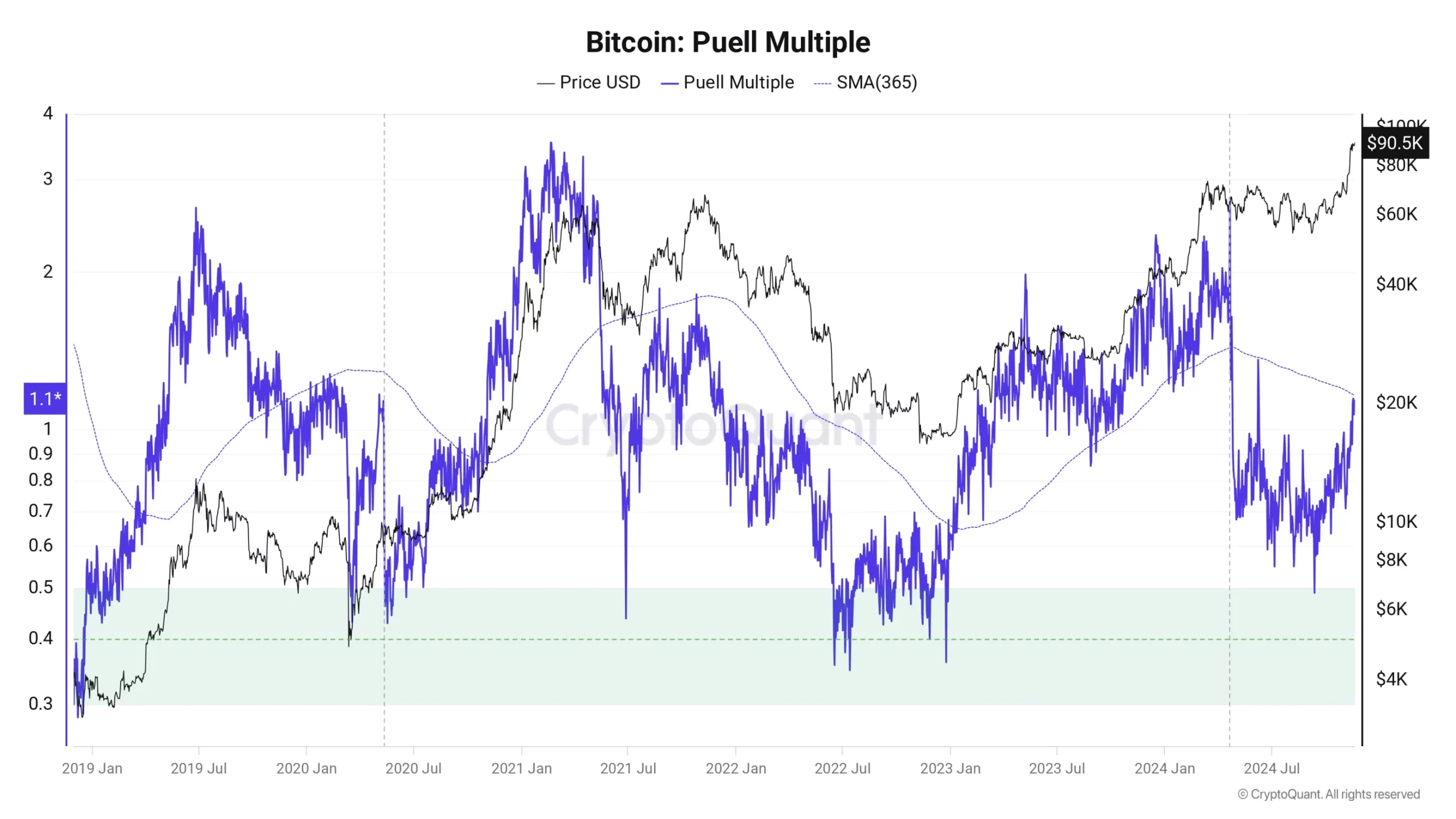

So, what’s all the fuss about the Puell Multiple, is this a big thing? This metric measures the daily value of mined Bitcoin against its 365-day moving average.

CryptoQuant flagged a rare “golden cross” for this indicator on November 18, which historically has been associated with huge price increases for Bitcoin.

When the Puell Multiple crosses above its moving average, it usually signals that miners are doing well, and that tends to coincide with bigger price gains.

In fact, over the past five years, this has only happened three times, and each time, Bitcoin saw price jumps of 76% to 113%. Uh-oh, this sounds quite promising!

“The Puell Multiple helps us understand market cycles from a mining perspective. It’s crucial for evaluating mining profitability.”

Historical performance is promising

Back in March 2019, a similar golden cross led to an 83% price rally. Fast forward to January 2020, and we saw 113% increase.

The most recent breakout in January 2024 resulted in a solid 76% return. This data suggests that when the Puell Multiple settles above its 365-day moving average, Bitcoin historically enjoys an average price increase of around 90%.

With favorable macroeconomic conditions also in play, CryptoQuant believes that a strong rally might be on the horizon.

Analysts are also keeping an eye on Bitcoin’s RSI, which is currently sitting at 74.4. This indicator often remains above the overbought level of 70 during bull runs, suggesting that there’s still plenty of room for growth.

Uncharted waters

Despite Bitcoin’s impressive gains of over 40% in Q4 so far, many experts believe we’re just scratching the surface of what’s possible.

Some predict that Bitcoin could reach six figures for the first time ever, but there are concerns about retail investors’ FOMO potentially leading to a significant correction.

Preston Pysh, co-founder of The Investor’s Podcast, humorously noted on X that many people are about to become very familiar with FOMO during this Bitcoin cycle.

Pseudonymous analyst PlanB, known for his Stock-to-Flow models, anticipates that the main wave of FOMO will hit in early 2025.

He emphasizes that during bull runs, the RSI tends to stay elevated, which could mean even more upward momentum for Bitcoin.