A recent survey reveals a mixed response among Germans regarding the digital euro, with many even unaware of its existence or confused about its nature.

ECB already delivered fantastic results…

The digital euro, which is the European Central Bank’s own digital currency, a CBDC, is being considered as an additional payment option, next to the physical cash.

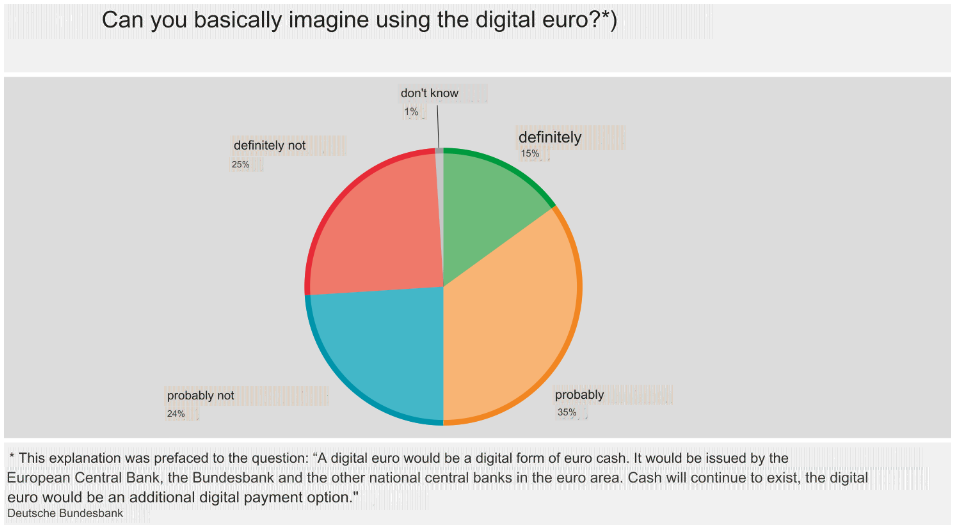

The Deutsche Bundesbank surveyed 2,012 Germans, and the results were published on June 4, as they found that half of the respondents would use the digital euro, despite the general lack of awareness about the currency itself.

While 50% of participants expressed a willingness to use the digital euro, 25% said they definitely wouldn’t use it, and another 25% said they probably won’t use it, and only a small fraction, 1%, were unsure.

Surprisingly, 60% of the respondents admitted they’d never heard of the digital euro.

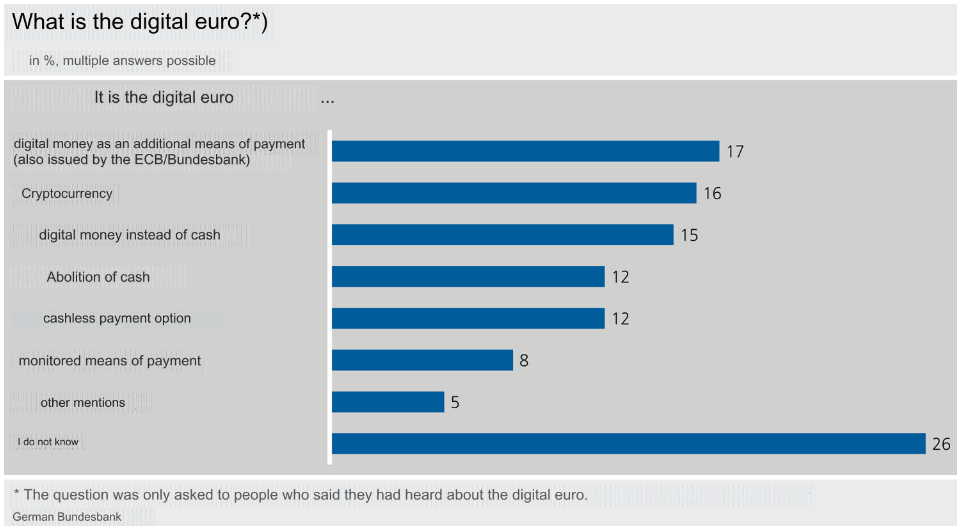

Among those who were aware, the confusion was the number one attitude, because about a quarter didn’t know what it was, 16% mistakenly thought it was a normal cryptocurrency, and nearly 30% either believed it was intended to replace cash or feared cash would be abolished with its introduction.

Only 17% correctly identified it as a form of digital money issued by the Eurosystem to complement existing payment methods.

Bundesbank President Joachim Nagel emphasized the need for more public education on the digital euro, stating, “A great deal of information still needs to be provided.”

They won’t use it for spying on you. They promised.

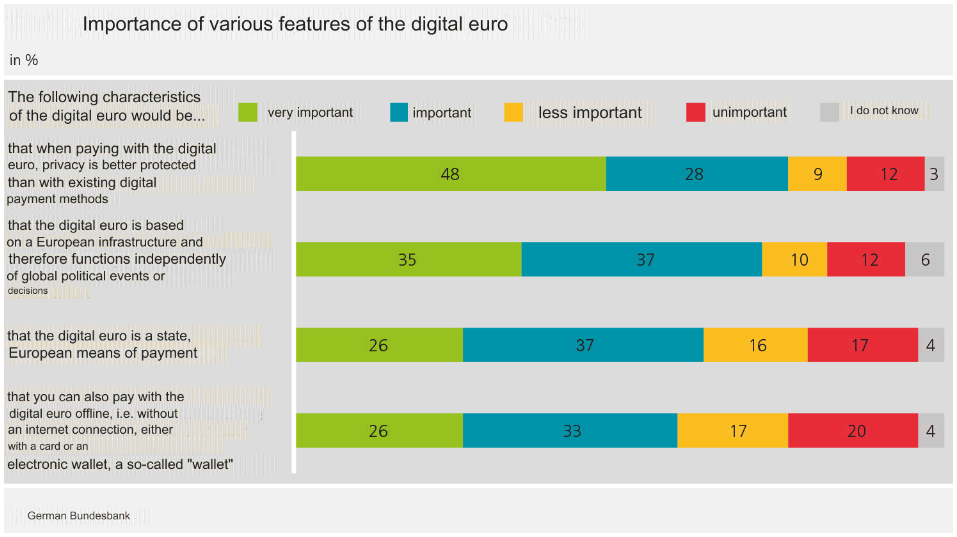

Privacy emerged as the top concern among respondents regarding the digital euro. Over 75% rated better privacy protection compared to existing

digital payment methods as very important or important. Next to this, more than 70% mentioned the importance of the CBDC being based on European infrastructure, and over 60% valued the digital euro being government-issued and having offline payment capabilities.

Nagel reassured the public about privacy, asserting that Eurosystem central banks have no interest in user data, and the digital euro would offer better privacy protections than current commercial payment solutions.

The ECB also claims the digital euro can be used offline with transaction details known only to the payer and the payee. Many experts think this is for our safety.

Gaining steam

The digital euro is currently in its preparation phase, set to be completed by October 2025, if everything going as planned.

This phase focuses on establishing rules and identifying potential issuers, after last June, the European Commission proposed a legal framework for the digital euro and measures to safeguard the use of cash.

Burkhard Balz, the Bundesbank board member overseeing the digital euro project, indicated that the earliest possible implementation for public use would be around 2028.

This timeline suggests that significant work remains in both regulatory and public education efforts before the digital euro becomes a common part of the European financial operations.