A newly published report from Galaxy Research questions the long-term viability of Bitcoin L2 rollups, citing key challenges for these scaling solutions.

Bitcoin rollups are meant to be cheaper, but they aren’t

In the report released on last week, Galaxy analyst Gabe Parker pointed out that Bitcoin rollups, despite their promise to make Bitcoin transactions faster and cheaper, have to face big hurdles.

The biggest issue is the high cost of posting data to the Bitcoin base layer, and rollups, which bundle numerous transactions and then post a summary to the main blockchain, must generate enough revenue from transaction fees to be viable.

For enough revenue, they need a large user base willing to pay for transactions on these L2 networks.

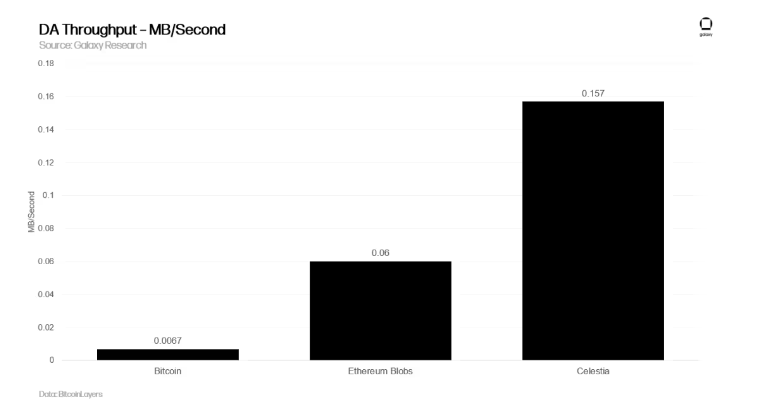

Bitcoin rollups use the blockchain as a data availability layer, posting enough data to allow any ordinary Bitcoin node to reconstruct the latest state of the rollup network.

But Bitcoin blocks have a 4 megabyte (MB) storage limit, and each data posting can consume up to 400 kilobytes (0.4MB), which is 10% of an entire block.

This lead to high fees, and smaller transactions has no chance. They’re priced out.

Competition between Bitcoin solutions

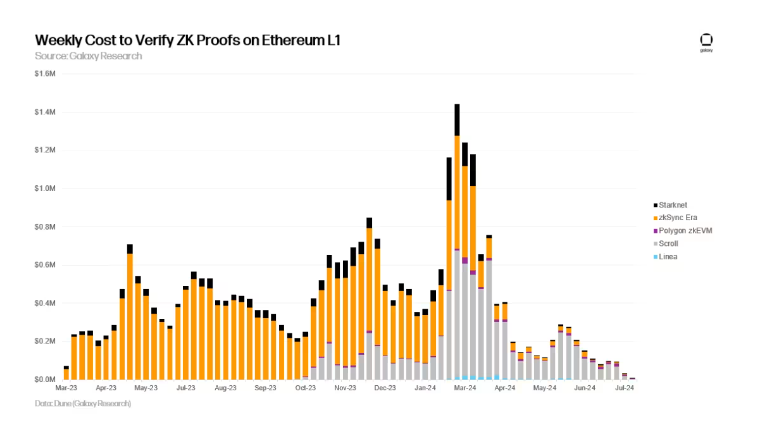

As more rollups compete to post their data, like now, they must generate enough fee revenue to ensure their transactions are prioritized in the blocks.

Galaxy Research estimated that in a low-fee environment, where ordinary transactions cost ten satoshis per vByte, rollups would face monthly expenses of $460,000 to maintain Bitcoin’s security.

In higher-fee environments of 50 sat/VB, these costs could rise to $2.3 million monthly.

The problem is as many arguing that almost no way they can make a budget for this. It’s not a walk in the park.

It’s either Bitcoin, or not

Alexei Zamayatin, co-founder of the Build on Bitcoin, the BOB hybrid rollup, believes that Bitcoin rollups can be as cost-effective as Ethereum rollups, but he also argues against using Bitcoin’s main chain for data availability.

Instead, he suggests using alternatives like Celestia or a merge-mined Bitcoin sidechain.

Yes, these are cheaper, but they may sacrifice some of Bitcoin’s decentralization and security. Then what’s the point?

“No one will use Bitcoin L2s if they are 100x more expensive than Ethereum L2s, just because it is on Bitcoin. Good news: They won’t be more expensive.”