FTX is finally ready to kick off its creditor repayments on February 18, and they’re throwing in a sweet 9% interest on top.

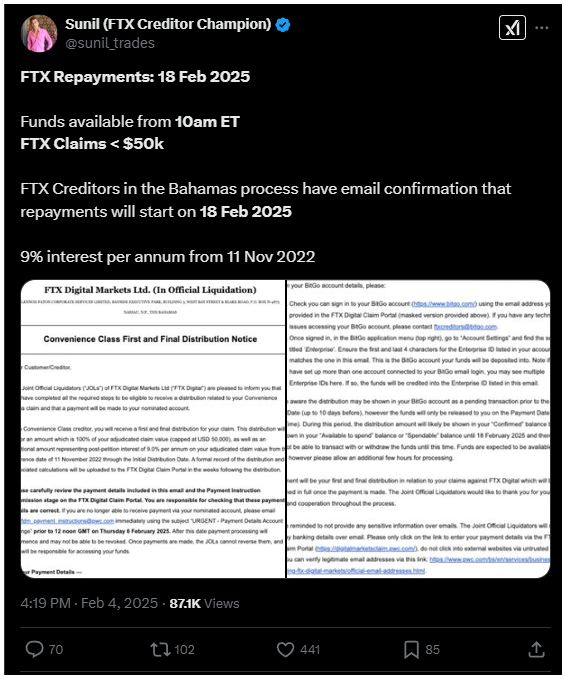

A representative for the creditors, Sunil, spilled the beans that if your claim is under $50,000, you can expect to see your cash that day.

Just about time

Once those payments hit your account, all related claims will be officially wiped clean, but how do you get your repayment in the first place?

The payments will be funneled through a BitGo account, and you can access everything via the FTX Digital Claim Portal.

If you’re in the Bahamas and part of this process, keep an eye on your inbox, emails confirming the repayment schedule are already flying out.

And let’s not forget about the interest, because eligible creditors will see their principal amount plus 9% annual interest added on from November 11, 2022, the day FTX filed for bankruptcy.

This little bonus is meant to make up for all the nail-biting waiting. But it’s a little bittersweet, as Bitcoin prices did a much nicer 5x since then.

Years of pain and waiting

This repayment plan comes after a wild ride of over two years filled with legal wrangling and asset recovery efforts following FTX’s collapse in November 2022.

Thousands of creditors have been left hanging in uncertainty about their finances, so this payout is a major milestone in the ongoing bankruptcy process.

While this is great news for smaller creditors, there’s still a cloud of mystery hanging over larger claims, those over $50,000. When will they see their money?

That’s still up in the air as the FTX bankruptcy estate scrambles to maximize recoveries.

Back to the market?

Now here’s where it gets interesting, as these repayments could pump some serious cash back into the crypto market.

Some experts are even speculating that Bitcoin could jump past $200,000 thanks to all the market hype surrounding these payouts and clearer regulations in the U.S.

Have you read it yet? Crypto facing months-long recovery?

Disclosure:This article does not contain investment advice or recommendations. Every investment and trading move involves risk, and readers should conduct their own research when making a decision.

Kriptoworld.com accepts no liability for any errors in the articles or for any financial loss resulting from incorrect information.