FTX’s chief restructuring officer and CEO, John Ray III announced that the bankrupt crypto exchange’s amended reorganization plan received overwhelming support from its creditors, with a promise of full repayment plus interest for non-governmental creditors.

Good plan

FTX reported that its updated reorganization plan has garnered strong backing from its creditors.

According to FTX and its associated debtors, the plan, which was submitted to the United States Bankruptcy Court for the District of Delaware, has been endorsed by the majority of creditors eligible to vote, including those from FTX US and FTX.com.

Preliminary voting results indicate that over 95% of participating creditors have voted in favor of the plan.

Voted by creditors, but allowed by law?

The high level of creditor participation, with more than two-thirds of all solicited claims by value casting votes, suggests that the reorganization plan is pretty likely to meet the necessary thresholds for approval under U.S. bankruptcy law.

FTX plans to submit the final voting results to the bankruptcy court ahead of a confirmation hearing scheduled for October.

John Ray III shared that the strong voter turnout reflects widespread support for the plan, and the plan’s unique structure wants to return 100% of the bankruptcy claims plus interest to non-governmental creditors.

The plan also seeks to resolve other disputes involving numerous governmental and private stakeholders.

Not everyone

Not all stakeholders are pleased with the reorganization plan, because when FTX filed the amended plan, shortly after that, by mid-August, some concerns surfaced.

Sunil Kavuri, an activist representing FTX customers told that many customers were dissatisfied with the proposed valuation of their crypto holdings.

Kavuri and a group of creditors have formally objected to the plan, arguing that reimbursing creditors in cash would create a taxable event, imposing additional financial burdens.

Kavuri argued that the bankruptcy plan infringes on creditors’ property rights, insisting that FTX is obligated to return the original coins to their owners.

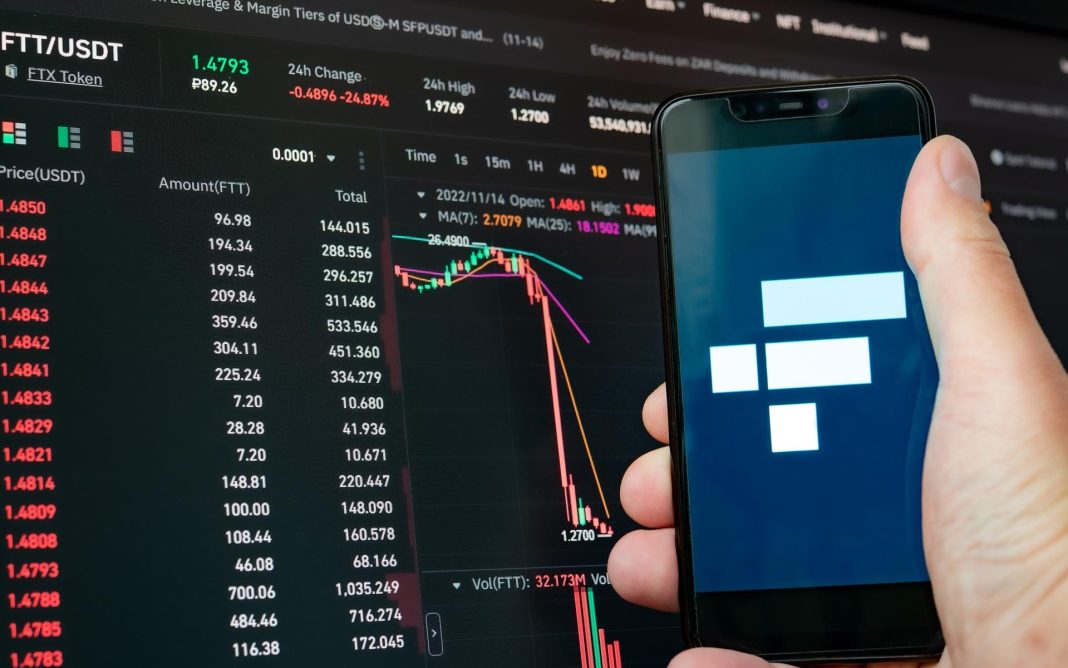

When FTX declared bankruptcy on November, 2022, the global crypto market capitalization was $840 billion, but today, it’s around $2.1 trillion.

This reflects a 161% increase, further complicating the situation for creditors.