The FTX meltdown was a wild ride that left customers nursing losses of about $8 billion.

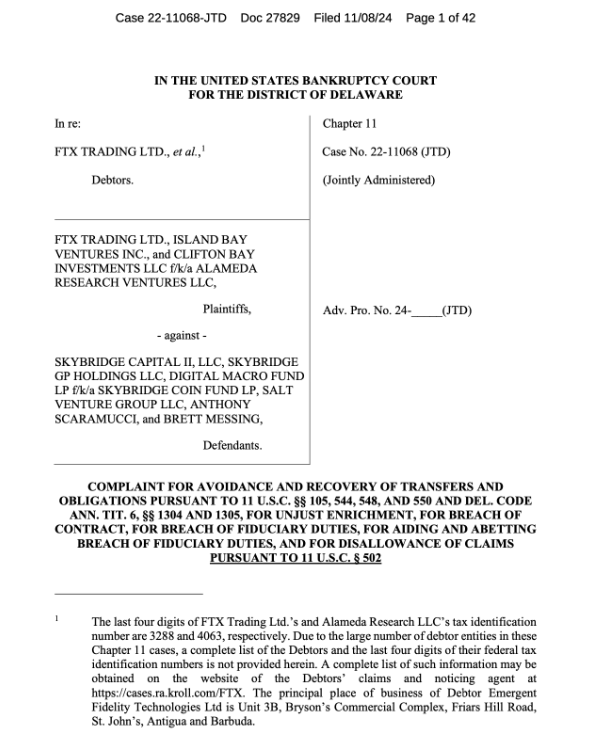

Now, the FTX bankruptcy estate is stepping up to the plate, wanting to recover over $100 million from none other than Anthony Scaramucci and his firm, SkyBridge Capital.

The Sky is the limit?

So what’s the deal? The estate is looking to recoup funds that former FTX CEO Sam Bankman-Fried splashed out on sponsorships and investment deals with Scaramucci and SkyBridge back in 2022.

SBF kicked things off with $12 million sponsorship for Scaramucci’s SALT conference in January 2022. Not long after that, in March, he directed Alameda Research to drop another $10 million into the SkyBridge Coin Fund.

And if that wasn’t enough, by September 2022, FTX went ahead and bought a 30% stake in the companies managing SkyBridge’s investment vehicles for a cool $45 million.

Real investment, or a financial sorcery?

But here’s where it gets juicy, because FTX’s lawyers are claiming that this investment was a total head-scratcher.

They argue that the FTX Group could have easily bought those cryptocurrencies directly for much less than what they paid SkyBridge.

“Employees at the FTX Group noted internally at the time that it made no economic sense for Alameda Research Ventures, which was itself in the business of trading in cryptocurrency assets, to place so much money with a third-party manager that was less experienced than it was in the same business.”

Law and order

The lawsuit also accuses SkyBridge of breaking their agreement by selling off some of those digital assets in 2023 without getting FTX’s blessing first, something FTX lawyers say was a big deal in their contract.

They pointed out that the Bitcoin and Solana holdings bought as part of this deal would be worth around $120 million at today’s prices, while they were valued at about $60 million when SkyBridge allegedly sold them off last year.

On the other hand, the FTX bankruptcy estate has been busy launching lawsuits left and right, SkyBridge is just the one in the line.

Just on October 28, they filed against KuCoin to recover over $50 million in assets that have been frozen since 2022.

And more recently, on November 7, they took aim at Crypto.com, seeking to reclaim more than $11 million in assets held by the exchange since 2022.