Immunefi’s latest report reveals that in the first half of the year, there were over a hundred hacker attacks resulting in nearly half a billion dollars in losses.

While this shows a decline in hacking activity compared to 2022 and 2023, it offers little consolation to the victims affected by these breaches.

Less fraud, more hacks

The report highlights that 96.7% of incidents were direct attacks, primarily through bug exploits or unauthorized access, with fraud constituting only a small percentage of overall activity.

Over $473 million worth of cryptocurrency has been lost to hacks and rug pulls in total 108 incidents in 2024.

$52 million was stolen in May alone, with significant breaches including Gala Games and SonneFinance, which lost $21 million and $20 million, respectively.

This represents a 12% decrease compared to May 2023.

Billion dollar targets

The DeFi market continues to be the primary target for hackers, while centralized finance companies didn’t experience any attacks in 2024, according to the report.

Last year, the crypto industry lost over $2 billion to hacks and exploits, which was about half of the total losses from the previous year.

The North Korean hacking group Lazarus has been particularly productive, responsible for $3 billion worth of crypto losses over the past six years.

Not your keys…

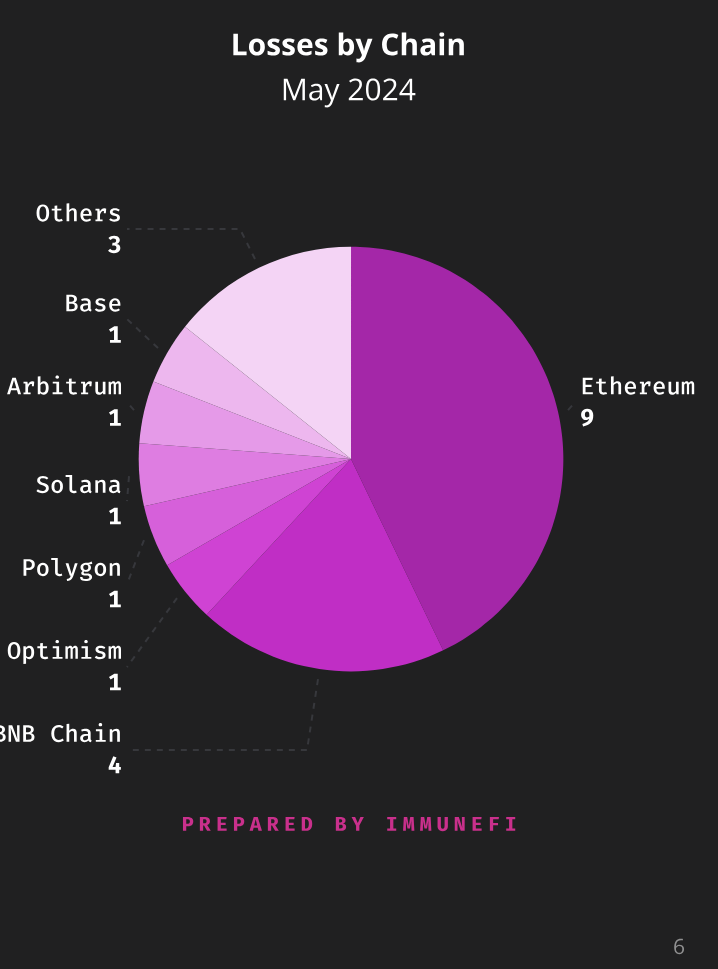

Not surprisingly, Ethereum was the most targeted platform, with nine incidents accounting for 43% of total losses, followed by the BNB Chain with 19% of the total.

Protocols managing large amounts of user assets are especially attractive to hackers due to often exploitable security measures or errors in their underlying code.

For users considering the risks associated with trading venues or decentralized applications, it’s important to remember that the tokens are typically pooled in a single wallet, making them prime targets for attackers.

This highlights the need for strong security measures and careful risk assessment.

Have you read it yet? ADA price in red, but the DEX’s activity is rising

Disclosure:This article does not contain investment advice or recommendations. Every investment and trading move involves risk, and readers should conduct their own research when making a decision.

Kriptoworld.com accepts no liability for any errors in the articles or for any financial loss resulting from incorrect information.