Experienced trader Peter Brandt made headlines about Ethereum.

In an X post, Brandt suggested that Ethereum’s price could fall to $1,651, which dip would represent a 36% decrease from its current price.

Ethereum’s downtrend

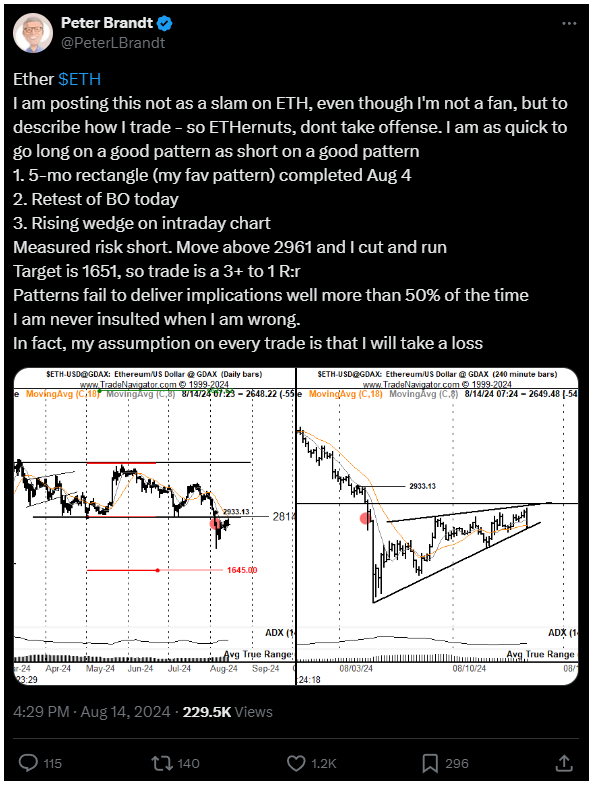

Brandt’s technical analysis shows that Ethereum has been trading within a rectangle pattern since April.

This pattern, often referred to as a horizontal channel, occurs when an asset’s price consolidates within a specific range for an extended period.

The upper boundary of this channel acts as resistance, while the lower boundary serves as support. For Ethereum, resistance was found around $4,000, with support established near $2,814.

The consolidation phase ended on August 4 when Ethereum’s price fell below the rectangle pattern’s lower boundary.

In the textbooks, when an asset breaks out of such a pattern, it retests the breakout level to determine whether it will act as a new support or continue to serve as resistance.

Brandt told that Ethereum is in this retesting phase now, and its future price direction will hinge on whether this level holds or fails.

Bearish signals

Brandt also pointed out the formation of a rising wedge pattern on Ethereum’s intraday chart.

This pattern is characterized by the price making higher highs and higher lows, but the gap between them narrows, creating a wedge shape.

The rising wedge is typically seen as a bearish signal, predicting a potential reversal to the downside.

Risky trade, but with nice rewards

If Ethereum fails to hold above its breakout level, Brandt believes that its price could continue to decline, way lower. Based on this analysis, he has taken a short position, targeting a price of $1,651.

But Brandt also emphasizes the importance of caution. He has set a stop loss at $2,961, meaning that if Ethereum’s price rises above this level, he would exit the trade to limit potential losses.

This strategy reflects a balanced method, acknowledging the real risks in such a bearish outlook.