Santiment shared that whale wallets are now holding 57% of all Ether in existence, and they think this could be a quite bullish sign for the future.

Wealth concentration

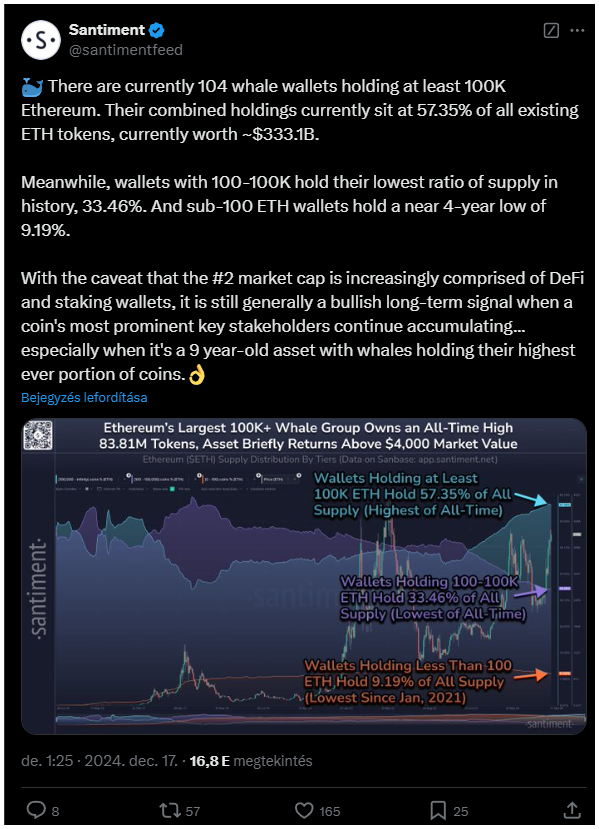

In a post Santiment revealed that 104 whale wallets, each containing more than 100,000 Ether, collectively hold around $333 billion.

On the other hand, wallets with between 10,000 and 100,000 Ether are at a historic low of 33.5%, and those with less than 100 Ether have dropped to just 9.19%, hitting their lowest levels in nearly four years.

If these whales keep accumulating, it could spell good news for the long-term health of Ether.

“While the market cap is increasingly made up of DeFi and staking wallets, it’s still generally a bullish long-term signal when the major stakeholders continue to accumulate.”

The analysts emphasized that it’s particularly important for a nine-year-old asset like Ether to have whales holding their largest share ever.

Optimism about Ether’s future

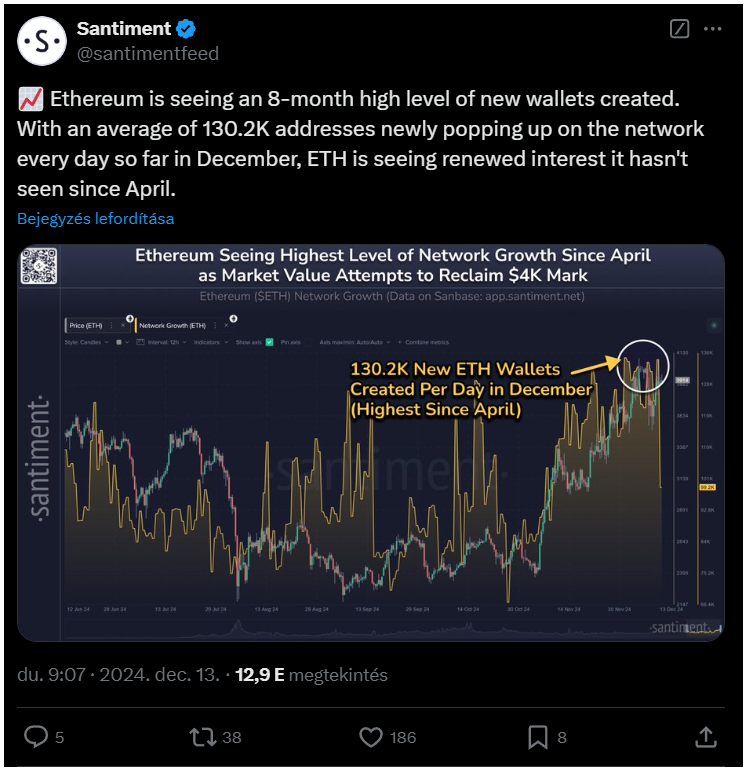

Adding to the optimism, the average number of new Ethereum addresses has also jumped to over 130,200 per day this December, and this is an eight-month high.

Ether’s price also made a comeback, reclaiming the $4,000 level for the first time since March.

Currently, it’s trading at about $4,010, although it’s still down from its all-time high of $4,891, which was reached on November 16, 2021.

Some analysts are predicting that Ether could surpass its all-time high during the first quarter of 2025.

They believe last month’s crypto market deleveraging has set the stage for this potential rise.

Bitcoin and altcoins

In another update from Santiment, they pointed out that Bitcoin’s climb to a new record of $107,800 and Ether’s resurgence above $4,000 are generating more bullish narratives in the whole market.

Their social sentiment tracker shows that Bitcoin is currently a hot topic, along with small, niche altcoins like Vanachains and Moca Networks.

Bitcoin is clearly stealing the spotlight after breaking through the $100,000 barrier on December 6 for the first time in crypto history, and Santiment also noted that conversations are shifting back to Bitcoin’s dominance.

Have you read it yet? SOL and SUI in 2025

Disclosure:This article does not contain investment advice or recommendations. Every investment and trading move involves risk, and readers should conduct their own research when making a decision.

Kriptoworld.com accepts no liability for any errors in the articles or for any financial loss resulting from incorrect information.