Ethereum’s potential as an investment goes beyond just cryptocurrency, positioning itself as a key player in the future of Web3, claims a crypto analyst.

The road which connects

A crypto analyst has highlighted Ethereum’s role, suggesting it can be marketed as an investment in Web3 growth, as it works like the infrastructure for it, like the road network in a city.

The analyst compares Ethereum to a call option on the Web3 industry, contrasting it with Bitcoin’s digital gold narrative.

Michael Nadeau, an analyst for The DeFi Report, stated in a May 28. that ETH is a tech play on the growth of Web3, which he describes as a high-growth index for Web3 adoption.

According to Grand View Research, the Web3 sector is projected to generate $33.5 billion in annual revenue by 2030.

Nadeau argues that Ethereum, with its wide range of applications, has a much larger addressable market than Bitcoin.

This could drive Ethereum to surpass its all-time high of $4,870 from November 2021 since spot ETFs are introduced, as these ETFs would likely increase demand, similar to what was observed with Bitcoin ETFs.

Bitcoin and Ethereum are not the same

One of the key difference between Ethereum and Bitcoin is in their operational structures, as Ethereum validators do not face the high operating expenses that Bitcoin miners do, which means they are not under pressure to sell ETH to cover costs.

They don’t have to sell their stacks to cover the electricity bill. This lack of unavoidable selling pressure can further support the demand for Ethereum.

Nadeau also explains that price increases can lead to more on-chain activity, which results in more ETH being burned, and this cycle can drive further price action and narrative momentum, creating a self-excitative cycle of growth.

Staking good, lack of pitch bad

In Nadeau’s view, Ethereum’s network effects are superior to Bitcoin’s, offering opportunities for investors to stake ETH and earn yields, while this option is not available with Bitcoin.

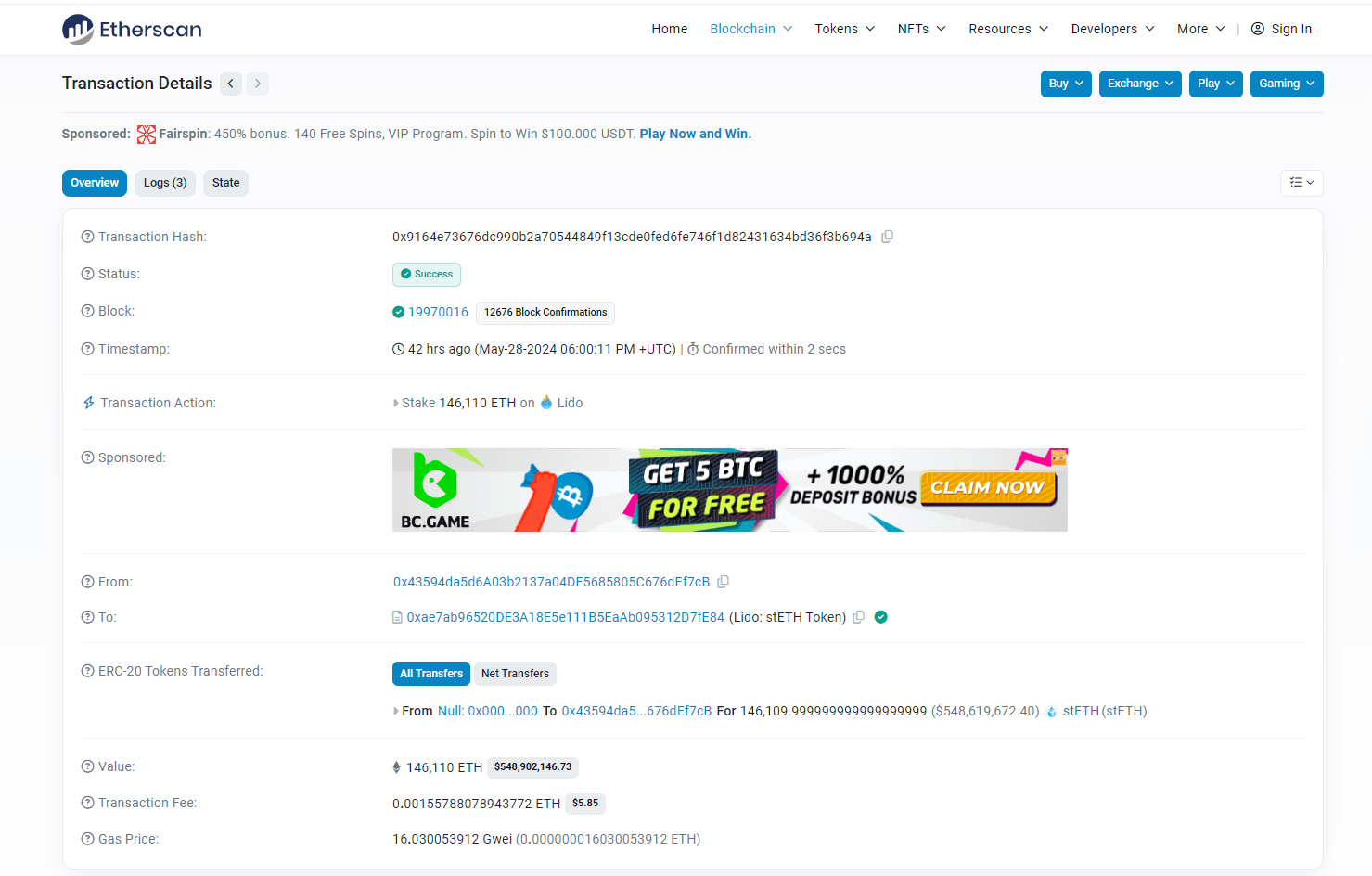

This staking capability „got” a big promo on May 28 when $500 million worth of Ether was staked on Lido in a single transaction, and chances are high the user with this move setting a record.

Ethereum has faced criticism for lacking a clear selling point, because while Bitcoin is often referred to as digital gold, Ethereum’s narrative is not as straightforward.

Glassnode lead analyst James Check mentioned that Ethereum still lacks a definitive elevator pitch.

He’s not alone by the way, Bloomberg ETF analyst Eric Balchunas also questioned whether Ethereum has a simple, memorable tagline like Bitcoin’s.