The price of Ethereum has fallen nearly 15% since the first trading day of its ETFs on July 23.

Grayscale’s Trust, the ETHE has seen over $2 billion in outflows, contributing to the selling pressure, but as outflows slowing down, the decline could be over soon.

Grayscale’s Ethereum ETFs face major outflows

Grayscale, the prominent cryptocurrency asset manager, offers two Ethereum spot ETFs, the ETHE and the Mini Trust.

ETHE has faced pretty big selling due to its higher fees compared to new competitors.

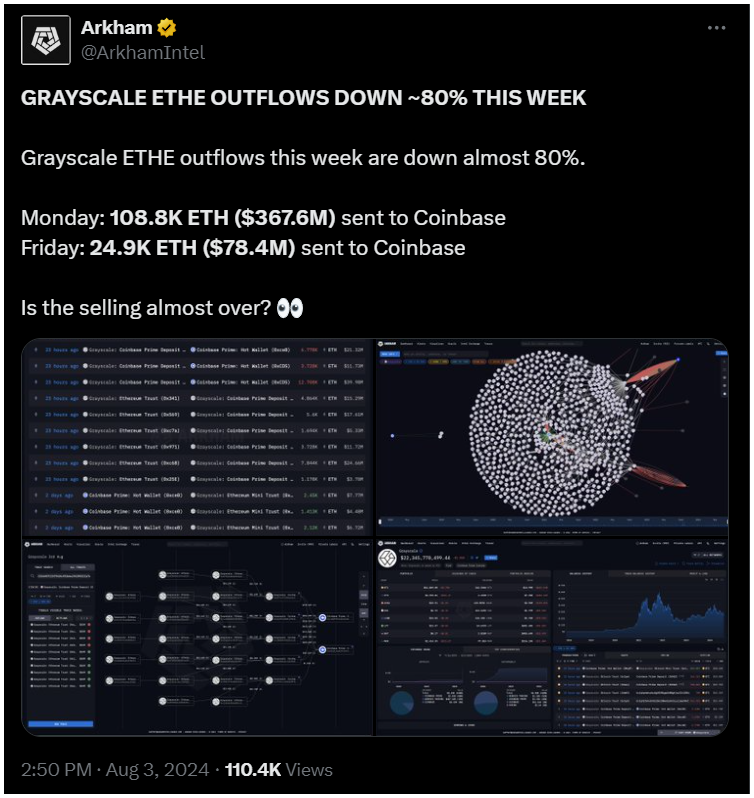

Arkham Intelligence’s new report shows an 80% drop in ETHE outflows over the past week, suggesting the selling pressure may be weakenin.

There was a 108,800 ETH outflow on Monday compared to just 24,900 ETH on Friday.

Ethereum spot ETF net flow, where the magic lies

Data from CoinGlass telling us Grayscale’s ETHE registered $2.12 billion in outflows, while the other eight Ethereum ETFs saw a combined $1.60 billion in inflows.

BlackRock’s iShare Ethereum Trust led with over $700 million in net inflows, followed by Fidelity’s FETH with $297.10 million and Bitwise’s ETHW with $287.90 million.

This is heavy buying by other funds, but Grayscale’s massive outflows resulted in an overall negative net inflow of $511.20 million.

What will do the price of Ethereum?

In the time of writing, ETH is trading around $2,867, testing strong yearly support and showing a 31% increase year-to-date.

The $3000 support is broken, but worth to mention the longer term performance has attracted both institutional and retail investors to the Ethereum ecosystem, who are now anticipating an upward breakout.

Analysts think the future movement of ETH will depend on both micro and macroeconomic factors affecting cryptocurrencies.

Winning Ethereum traders have shown optimism by accumulating millions of dollars worth of the token.