New reports signals that the Chinese government started transferring thousands of ETH seized from a $4 billion Ponzi scheme, causing concern among Ethereum investors about a potential sell-off.

Potential ETH sell-off, should we worry?

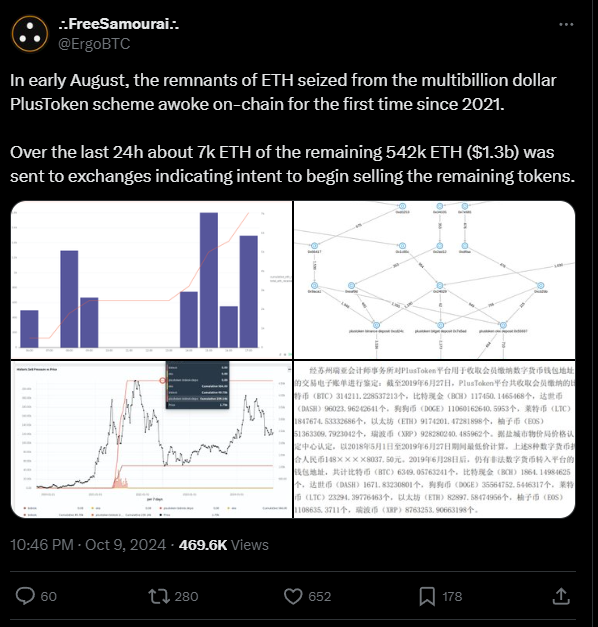

On Wednesday, a user on X pointed out that the Chinese government moved the remaining seized ETH from the PlusToken Ponzi scheme for the first time in three years.

The wallets holding these tokens have been inactive since 2021.

The initial transfer occurred in early August when various wallets linked to these seized assets sent 2,800 ETH, valued at approximately $6.5 million, to a single wallet. This raised alarms about a possible sell-off.

The most recent activity involved transferring around 15,700 ETH between several wallets to obscure tracking.

Out of this amount, over 7,000 ETH, worth about $16.7 million, was sent to exchange deposit addresses and likely sold shortly thereafter. Following the collapse of the PlusToken scheme, authorities seized around $4.2 billion in crypto assets, including 840,000 ETH valued at $215 million at that time.

Most of these assets remained untouched until 2021 when a portion was sold through a now-defunct exchange.

Ethereum’s market stability

The movements of these funds have put Ethereum investors on edge.

Analysts have noted that if the Chinese government continues to sell off its remaining 542,000 ETH, valued at over $1.3 billion, it could lead to strong downward pressure on Ethereum’s price.

In past times, such as when authorities liquidated Bitcoin in 2020, the market experienced considerable disruption, as the prices tumbled.

Ethereum Foundation, the part of the problem?

The current situation is further complicated by sales from the Ethereum Foundation itself. On-chain data shows that this week, wallets linked to the foundation moved about $3.21 million worth of ETH.

One address transferred 1,250 ETH to Bitstamp while another sold 100 ETH for DAI. This activity has contributed to bearish sentiment among investors.

Crypto analyst Ali Martinez commented on Ethereum’s performance, noting that each time it breaks above certain resistance levels, it often leads to strong bullish trends.

Each time #Ethereum breaks above the TD setup resistance trendline 🔴, a strong bull run follows. But when $ETH breaks below the TD setup support trendline 🟢, we've seen an average 53% correction.

The key support now is $2,250—losing it could trigger a significant price drop. pic.twitter.com/PljkRda78S

— Ali (@ali_charts) October 10, 2024

Conversely, when it falls below key support levels, bigger corrections can occur. The next critical support level appears to be around $2,250, losing this could trigger a substantial drop in price.