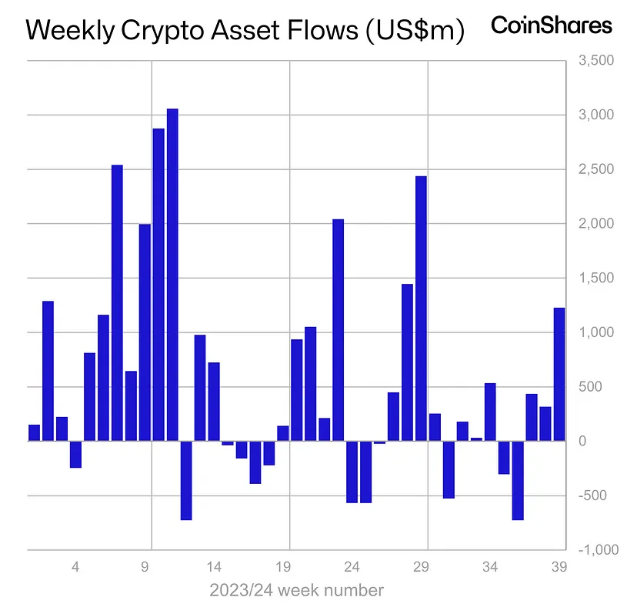

Ethereum has broken its five-week losing streak, bringing in $87 million in inflows as part of a larger trend that saw digital assets attract $1.2 billion overall.

Positive changes in digital asset investments

Coinshares’ new report’s numbers are good. The $87 million inflow into Ethereum-based products is the first notable increase since early August, as digital asset investment products have seen inflows for three weeks in a row, totaling $1.2 billion.

This rise is likely fueled by expectations of a more relaxed monetary policy in the United States, which has created positive momentum in prices.

As a result, total assets under management also grew by 6.2% over the past week.

Worth to mention that trading volumes didn’t show the same growth and actually dipped by 3.1% compared to the previous week.

Bitcoin led the way with $1 billion in weekly inflows, which also helped bring in $8.8 million into short-BTC investment products. In contrast, Solana experienced outflows of $4.8 million during this period.

Mixed sentiment among alts

CoinShares pointed out that investor sentiment was mixed when it came to altcoins.

Litecoin and XRP saw inflows of $2 million and $0.8 million respectively over the past week, but Chainlink and Cardano recorded smaller inflows of $0.4 million and $0.1 million respectively, while BNB faced outflows of $1.2 million.

US lead, as always

Looking at regional trends, the US attracted the majority of inflows at $1.2 billion, followed by Switzerland with $84 million — the highest amount since mid-2022.

Canada and Australia also saw minor inflows of $1 million and $0.6 million respectively.

On the other hand, Germany and Brazil reported outflows of $21 million and $3 million, while Sweden and Hong Kong experienced outflows of $2.5 million and $1 million

Now many think if this positive trend continues and Ethereum maintains its upward momentum, it could lead to more growth in investor confidence across the crypto market, thus, higher prices. We’re here for it!