The recent approval of spot Ethereum ETFs in the US has triggered a significant movement of ETH away from centralized crypto exchanges.

This decline in exchange reserves suggests a potential supply squeeze for Ethereum, as fewer coins are readily available for immediate sale.

Lowest Ethereum exchange reserves in years

Data from CryptoQuant reveals that over $3 billion worth of Ethereum, or roughly 797,000 ETH, has been withdrawn from exchanges since May 23rd.

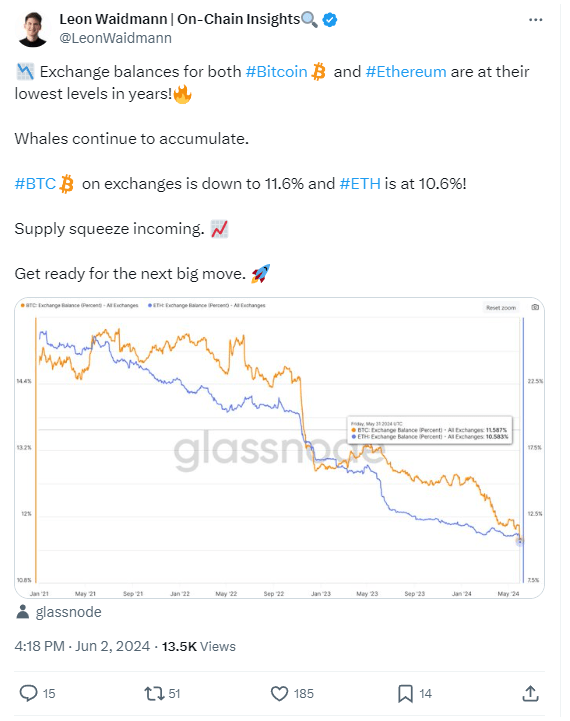

Further analysis by BTC-ECHO analyst Leon Waidmann, using data from Glassnode, highlights that the current percentage of circulating Ethereum supply held on exchanges is at its lowest point in years, sitting at just 10.6%.

This decrease in ready-for-sale Ethereum on exchanges could contribute to increased demand and as many thinks, drive up the price.

Ethereum ETFs on fire

The incoming launch of Ethereum ETFs has garnered huge attention, with speculation of their arrival as early as late June by Bloomberg ETF analyst Eric Balchunas.

Some analysts predict that the introduction of Ethereum ETFs could mirror the impact of spot Bitcoin ETFs launched in January this year, leading to a surge in demand for Ethereum that could skyrocket its price beyond its all-time high of $4,870.

Ethereum vs. Bitcoin

Compared to Bitcoin, Ethereum might benefit even more from this potential demand pressure due to its lower selling pressure.

As DeFi analyst Michael Nadeau explains that Bitcoin miners need to sell BTC time to time, to cover operational costs, particularly the electricity bills, a factor not present with Ethereum validators. Validators don’t need to sell.

Grayscale’s Ethereum Trust, the big dump?

However, concerns exist regarding the influence of Grayscale’s Ethereum Trust, the ETHE, a massive $11 billion fund, on Ethereum’s price movements, because if ETHE follows the pattern set by Grayscale Bitcoin Trust earlier this year, there could be significant outflows impacting Ethereum’s price negatively.

Ethereum now is trading at $3,781, down 0.82% in the last 24 hours and 23% from its all-time high.

More altcoin ETFs on the horizont? Not so fast!

Bloomberg ETF analyst James Seyffart suggests that political considerations, rather than purely financial ones, might have influenced the approval of spot Ethereum ETFs.

He believes the current political climate, including actions by the Biden administration and responses from the crypto community, played a central role in the decision.

Seyffart also cautions that approvals for other crypto ETFs, like Solana, are unlikely without significant changes in regulations.

He emphasizes the need for a regulated market to monitor these assets for fraud and manipulation.

Have you read it yet? US Navy introduces PARANOID blockchain security technology

Disclosure:This article does not contain investment advice or recommendations. Every investment and trading move involves risk, and readers should conduct their own research when making a decision.

Kriptoworld.com accepts no liability for any errors in the articles or for any financial loss resulting from incorrect information.