Ethereum ETFs could gather up to $10 billion in assets under management within their first year, according to Katalin Tischhauser, Head of Investment Research at Sygnum Bank.

Ethereum isn’t as big like Bitcoin, and it shows

Tischhauser based her projections on anticipated inflows for spot Bitcoin ETFs, predicting that Bitcoin ETFs could attract $30 billion to $50 billion in the first year, with Ethereum following suit, but Ethereum’s lower name recognition likely will result in slower adoption compared to Bitcoin.

She estimates that Ethereum’s relative inflows will be in the range of 15-35% of Bitcoin’s, leading to a forecast of $5 to $10 billion in AUM for Ether ETFs in their first year.

Ether ETFs got another leading narrative

The researcher shared that traditional investors, who might not be equipped to handle direct crypto investments, could benefit significantly from these ETFs, as these are just like the traditional, well known assets.

These regulated products make Ether more accessible to investors interested in straightforward investment exposure.

Unlike Bitcoin, which is often viewed as a store of value, Ethereum is recognized as the leading smart contract platform with various applications and use cases.

Tischhauser thinks that Ethereum’s value, driven by revenues and cash flows the two sacred indicator in the investment sector, might be more relatable to traditional institutional investors than the concept of digital gold.

Ether ETFs moving markets? Hold on.

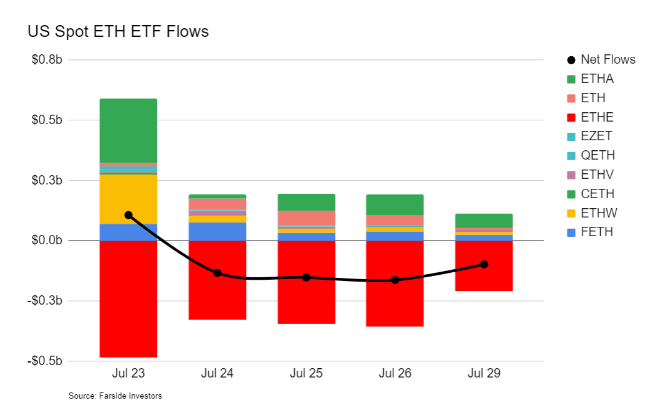

Despite the launch of Ether ETFs, Ethereum’s price hasn’t surged too big. We can say price action is pretty disappointing.

Tischhauser believes this is because the market hasn’t anticipated much upside due to expected modest inflows.

But she suggests that if net flows turn positive and accelerate, it could strongly drive up the price of Ether, and if Ethereum inflows are proportionally similar to those for Bitcoin ETFs, ETH prices could reach $6,000.