Santiment just shared their insights into the profitability of investors in the three biggest memecoins, Dogecoin, Shiba Inu, and Pepe.

The analysis focuses on the Market Value to Realized Value, the MVRV indicator, which shows the percentage of profit or loss that investors currently hold.

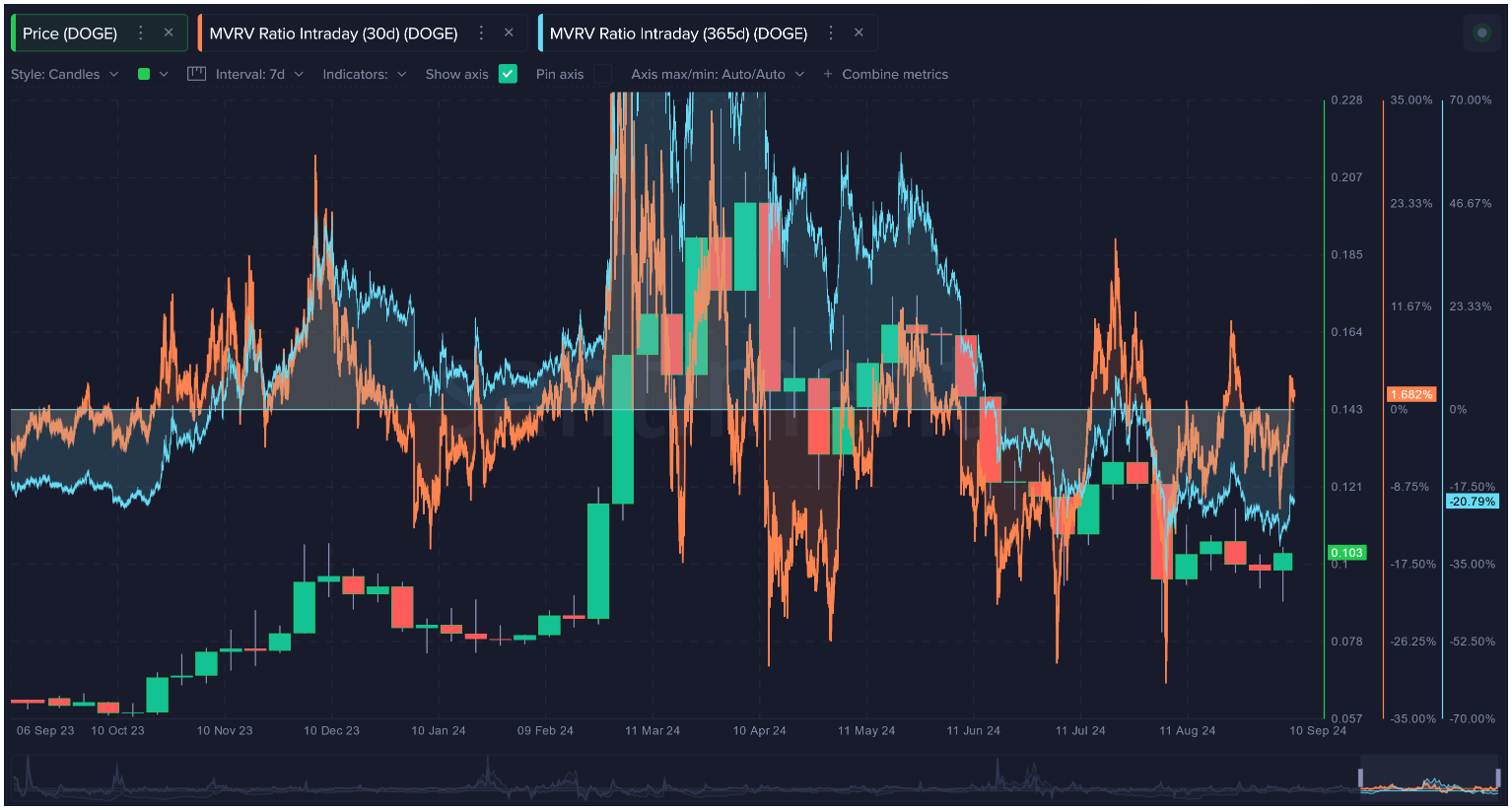

Dogecoin, the oldest memecoin

When the MVRV Ratio Intraday is above 0%, it could meanss that the overall market is in a state of profit.

For Dogecoin, the 30-day investors are only slightly in the green, with a value of 1.7%. Unfortunately, the investors who bought during the past year are in the red, with their holdings being almost 21% underwater.

Santiment told that there is an argument for a price rebound to bring this long-term deficit back to break-even.

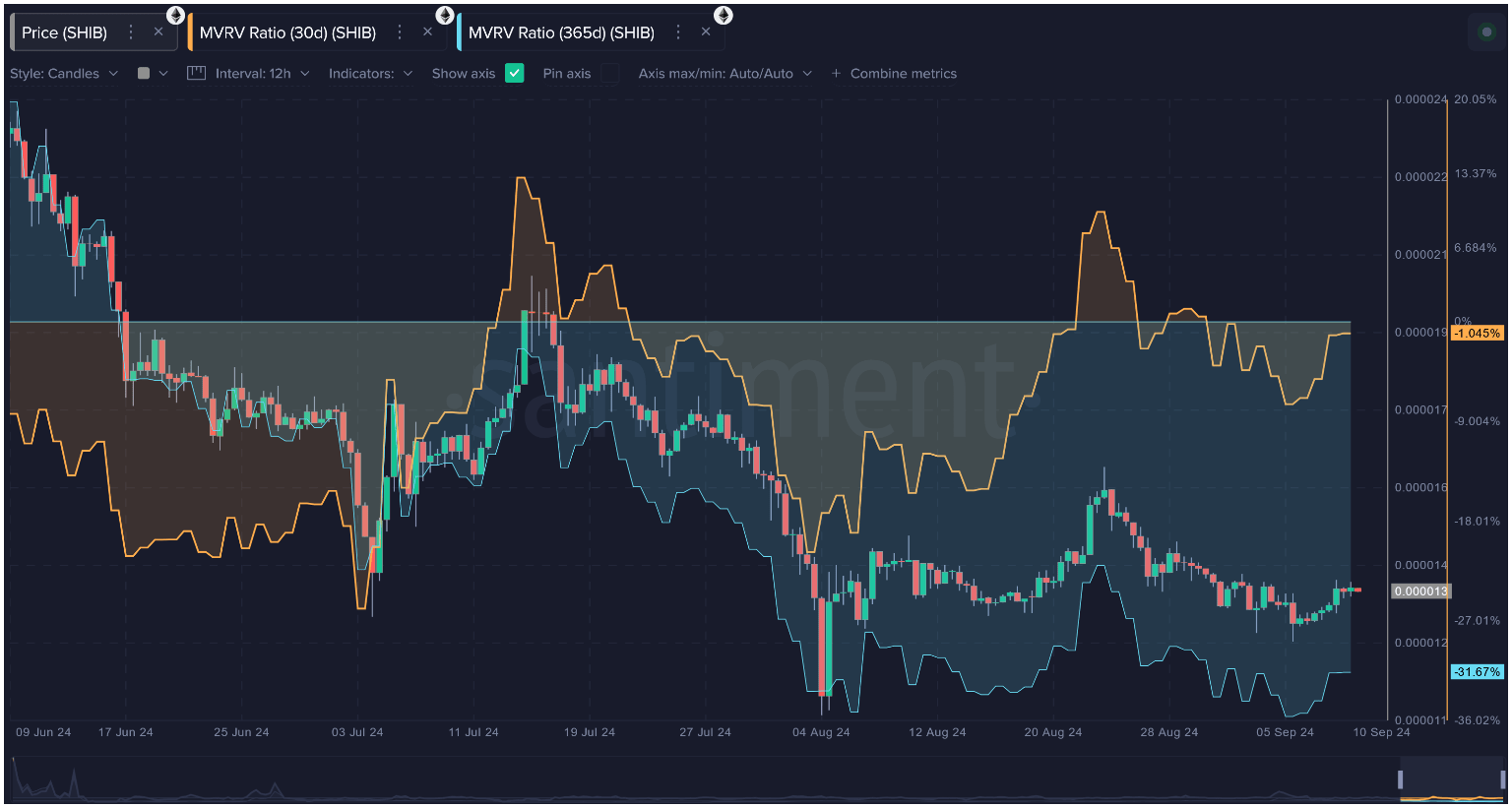

Shiba Inu’s investor profitability aren’t that good either

Shiba Inu has been performing worse than Dogecoin in these metrics, with both classes of investors are in a state of loss.

The 30-day SHIB investors are holding their tokens at -1%, while the 365-day buyers are more than 31% below their buying price. Not tragic, but not comfy at all.

Blessed are the frog frens

Pepe’s situation is the opposite of SHIB and DOGE, with long-term holders being rewarded for their patience.

The monthly investors are down around 0.8% for PEPE, while the yearly ones are enjoying gains of almost 24%.

This could means that there is still a bit of profit that patient traders may need to wait to see evaporate before a clear buy signal emerges.

Some say that the varying profitability levels among these memecoins reflect their different market dynamics and investor sentiments, but in reality, we’re talking about memecoins, with pretty similar market dynamics and investor sentiments.

It’s likely about community hype, having fun, and speculation. Nothing wrong with that, but worth to keep in mind.