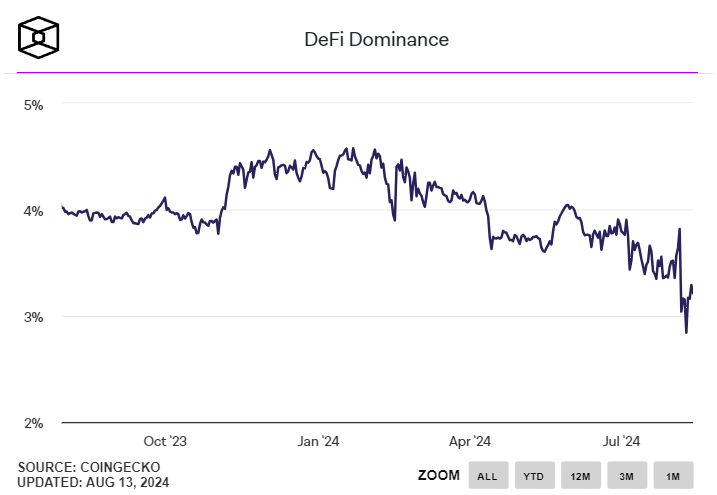

The decentralized finance sector has seen its market dominance shrink to its lowest level in three years.

The index dropped from 3.82% on Monday to 2.84% by Friday last week, and this is the lowest point since early January 2021.

Maybe it’s not the future of finance

Since peaking at around 4.8% in September 2022, DeFi’s market dominance has been on a clear downtrend, a decline, with only short recoveries.

By the beginning of the year, it had dipped to 4.47%, and the trend didn’t stop.

The broader crypto market has seen sectors like memecoins and institutional interest in Bitcoin and Ethereum grow, but DeFi tokens have largely been overlooked.

Experts think there are several factors what are contributed to the weakening interest in DeFi tokens, like the ongoing hype with memecoins, what has diverted both attention and capital from DeFi projects.

Investors are attracted to the potential for fast and huge profits that memecoins offer, no matter how high is their risk profile.

Decentralized finance, but works like centralized finance

Next to this, many DeFi tokens have high fully diluted valuations, aka future inflation, and incoming venture capital unlocks in many DeFi projects has also been a source of concern.

These unlocks often lead to selling pressure and are viewed by retail investors as giving an unfair advantage to early private investors.

Bitcoin is the king, and others rarely can follow the pace

The broader DeFi market has undoubtedly struggled, but there have been some exceptions.

MakerDAO’s MKR token has seen periods of pretty good performance due to specific catalysts and narratives.

But keep in mind that even MKR and other top DeFi tokens have generally underperformed against Bitcoin this year.

The DeFi sector faces hard challenges as it tries to regain both investor interest and market share.

As memecoins and institutional-grade assets continue to dominate the market, experts warn that DeFi projects will need to address the concerns surrounding token inflation and private unlocks to being able to gain more attention and new users in the future.