Amplify launched two Amplify ETFs tied to stablecoin infrastructure and tokenization infrastructure. The funds began trading on NYSE Arca on Tuesday.

Hyperliquid Smacks Down Insider Trading Fiasco

Strap in for the latest DeFi drama about Hyperliquid, that perpetual futures DEX that’s been riding the HYPE rollercoaster like a gonzo gambler in a Vegas fever dream.

Solana Split Signal: Bearish Flag Break Targets $82 as Analyst Eyes $160–$180 After $90–$100 Sweep

Solana continued to weaken on the daily chart on Dec. 23, with price breaking below a clearly defined bearish flag pattern, according to TradingView data. SOL traded near $124 at the time of the snapshot, extending a decline that began after repeated failures below the 50 day exponential moving average near $142. The broader structure shows lower highs since November, while selling pressure has stayed consistent during each recovery attempt.

A bearish flag is a continuation pattern that forms after a sharp drop, followed by a short period of sideways or slightly upward consolidation. This pause usually reflects temporary relief rather than renewed demand. In Solana’s case, price moved lower in early November, then consolidated inside a rising channel marked by two parallel trendlines. Volume contracted during this consolidation, which aligned with typical bearish flag behavior.

The chart now shows Solana already breaking below the lower boundary of the flag. This breakdown signals that sellers have regained control and that the prior downtrend is resuming. Price also remains below the 50 day EMA, which continues to slope downward and act as dynamic resistance. Each attempt to reclaim that level failed, reinforcing the bearish bias.

Based on the height of the flagpole and the breakdown level, the pattern projects a further downside move of roughly 33 percent from the current price. That projection points toward the $82 region, which aligns with a marked horizontal support zone on the chart. This area previously acted as a base during earlier consolidation phases, making it a key downside level to monitor.

Momentum indicators support the bearish structure. The daily RSI sits below 40 and remains unable to sustain moves above its signal line. This behavior reflects weak demand and limited upside momentum. Unless Solana reclaims the broken flag structure and the 50 day EMA, the technical setup continues to favor further downside toward the projected target.

Solana Tests Weekly Support as Analyst Flags $90–$100 “Sweep” Risk Before Rally

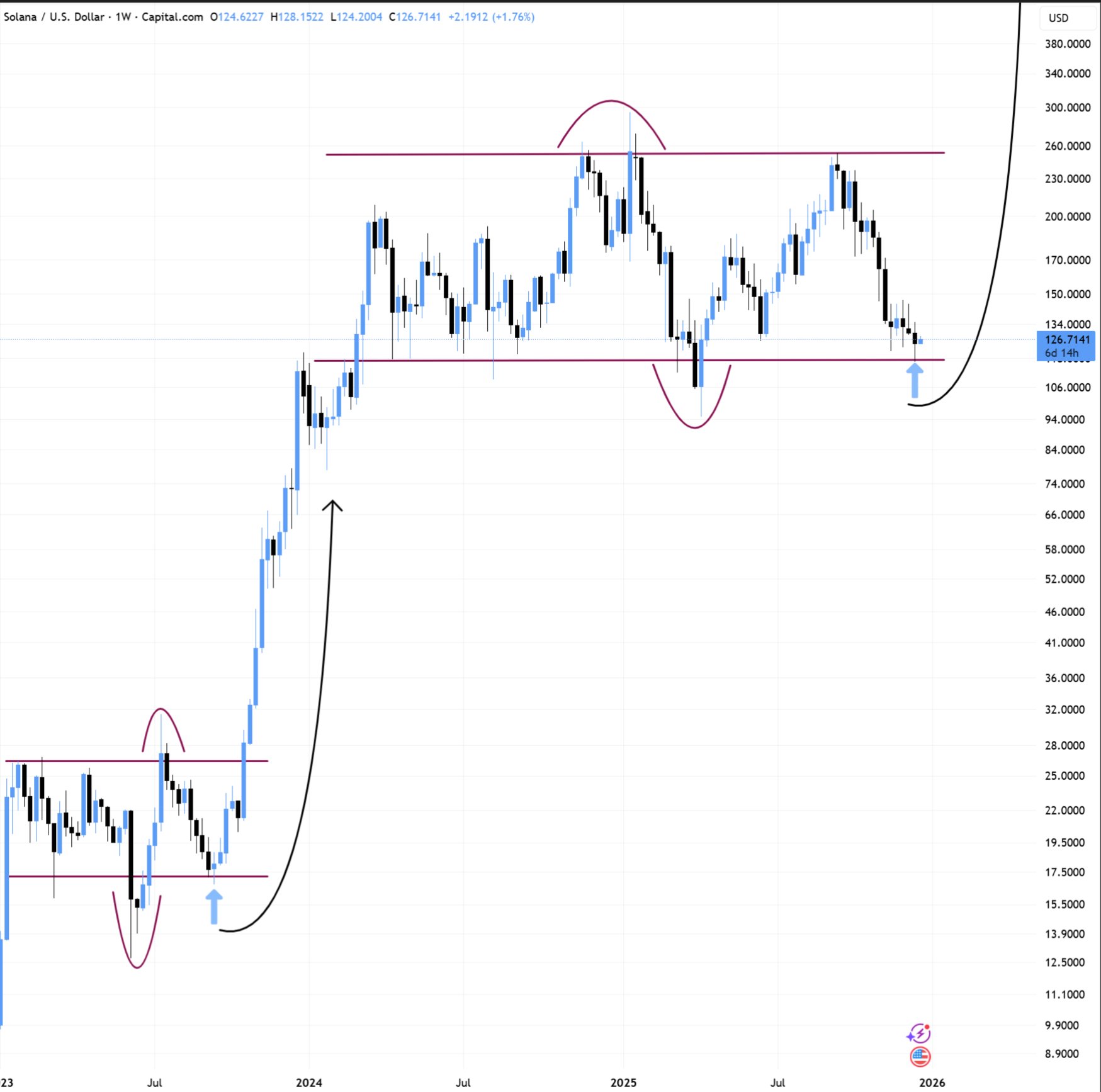

Solana held near $126 on the weekly chart this week, stabilizing around a long running support zone after a sharp pullback from late 2025 highs, according to TradingView data shared by X user BitBull. The chart shows SOL repeatedly reacting around the same horizontal band near the current price area, while a higher resistance line sits far above near the mid $200s, marking the prior peak region.

BitBull said SOL “is looking good here,” but added that price could briefly dip below the support zone before moving higher. In market terms, that move is often described as a deviation or liquidity sweep, where price slips under a widely watched level, triggers stops, and then rebounds back into the range. The chart annotation highlights that risk by pointing to the $90–$100 area as a potential downside zone before any recovery attempt.

The analyst said any drop into $90–$100 would be a “buying” area and argued SOL is “due for a rally now.” BitBull also projected a move toward $160–$180 in the first quarter of 2026 before another correction, framing the current zone as a base for a rebound if support continues to hold.

Disclosure:This article does not contain investment advice or recommendations. Every investment and trading move involves risk, and readers should conduct their own research when making a decision.

Kriptoworld.com accepts no liability for any errors in the articles or for any financial loss resulting from incorrect information.

Tatevik Avetisyan is an editor at Kriptoworld who covers emerging crypto trends, blockchain innovation, and altcoin developments. She is passionate about breaking down complex stories for a global audience and making digital finance more accessible.

📅 Published: December 23, 2025 • 🕓 Last updated: December 23, 2025

SEI Slides to $0.11 as Weekly Trend Stays Weak While 4 Hour Chart Signals a Bounce

As of Dec. 23, 2025, the weekly SEI USDT chart on Binance shows price trading near $0.11, extending a steady decline that began after the mid-2025 rebound failed below the 50-week exponential moving average. The latest weekly candle holds near prior consolidation lows from late 2023, placing SEI at one of its weakest historical levels since listing. However, the chart does not yet confirm a clear historical bottom, as price continues to print lower lows without a strong reversal signal.

From a structure perspective, SEI remains in a broad downtrend on the weekly timeframe. Price stays below the 50-week EMA near $0.25, which has acted as dynamic resistance throughout 2025. Each recovery attempt stalled below that level, followed by renewed selling. The recent move lower also broke a short-term descending support trend, shown by the downward purple guide, reinforcing bearish continuation rather than exhaustion. At the same time, volume has not expanded aggressively on the latest decline, which suggests steady distribution rather than panic selling.

Momentum indicators show growing downside pressure but not a confirmed capitulation. The weekly RSI sits near 32, hovering just above oversold territory. Historically, SEI’s deeper cycle lows formed when RSI moved decisively below 30 and then reversed with bullish divergence. That signal has not appeared yet. Instead, RSI continues to slope lower, while its moving average also turns down, indicating momentum still favors sellers in the near term.

In historical context, the current price zone overlaps with early accumulation ranges seen before SEI’s first major expansion phase. That overlap explains why the area may attract attention as a potential long-term demand zone. However, the chart alone does not validate it as a confirmed bottom. A historical bottom would require either a strong weekly rejection with rising volume or a clear momentum divergence. Until such signals emerge, the data shows SEI trading at cycle-low territory, not a proven cycle low.

SEI Shows Short-Term Rebound Signals on 4-Hour Chart

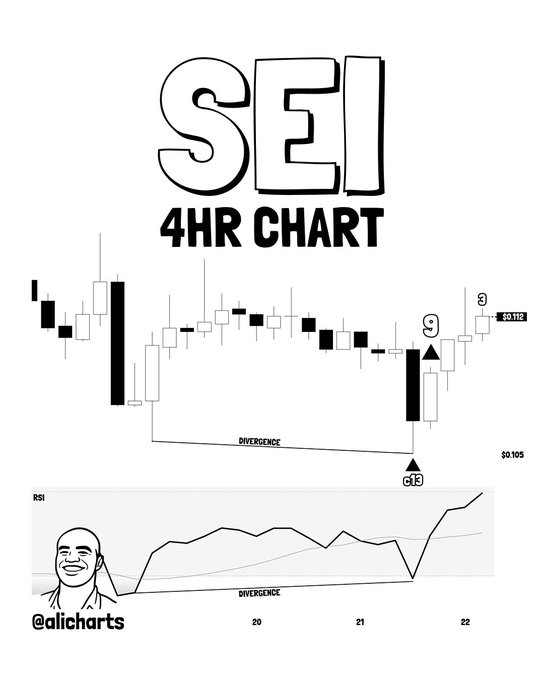

Meanwhile, as of Dec. 22–23, 2025, the SEI USDT 4-hour chart shows early technical signals pointing to a short-term rebound after a prolonged intraday decline. The chart highlights a TD Sequential buy signal, marked after a completed downside count, which typically appears when selling pressure starts to weaken. Price reacted higher immediately after the signal, suggesting short-term sellers began to step aside.

At the same time, momentum data shows a bullish RSI divergence. While price printed a lower low near the $0.105 area, the RSI formed a higher low. This divergence signals that downside momentum weakened even as price briefly pushed lower. Such setups often appear near short-term reaction lows, especially after sharp selloffs.

Price has since rebounded toward the $0.112 zone, reclaiming nearby intraday levels. The structure shows a quick recovery rather than a slow grind, which supports the idea of a technical bounce rather than continued immediate weakness. However, the move remains corrective within a broader downtrend, as higher time frames still show price below key resistance levels.

Overall, the 4-hour data points to a short-term rebound in progress, driven by momentum divergence and TD buy signals. Still, confirmation depends on follow-through above nearby resistance and sustained RSI strength, as the broader trend remains unresolved.

Disclosure:This article does not contain investment advice or recommendations. Every investment and trading move involves risk, and readers should conduct their own research when making a decision.

Kriptoworld.com accepts no liability for any errors in the articles or for any financial loss resulting from incorrect information.

Tatevik Avetisyan is an editor at Kriptoworld who covers emerging crypto trends, blockchain innovation, and altcoin developments. She is passionate about breaking down complex stories for a global audience and making digital finance more accessible.

📅 Published: December 23, 2025 • 🕓 Last updated: December 23, 2025

BlackRock Puts IBIT Bitcoin ETF Next to T bills and Big Tech

BlackRock placed its IBIT Bitcoin ETF on its homepage as one of three main 2025 themes as 2026 approaches. The firm also highlighted an ETF tied to Treasury bills and another linked to the “Magnificent 7” US tech stocks: Apple, Microsoft, Amazon, Alphabet, Meta, Nvidia, and Tesla.

The positioning linked the IBIT Bitcoin ETF to mainstream ETF categories. It also showed that BlackRock kept the Bitcoin ETF in focus during a weaker price year.

IBIT Bitcoin ETF Pulls $25 Billion Even With Negative 2025 Return

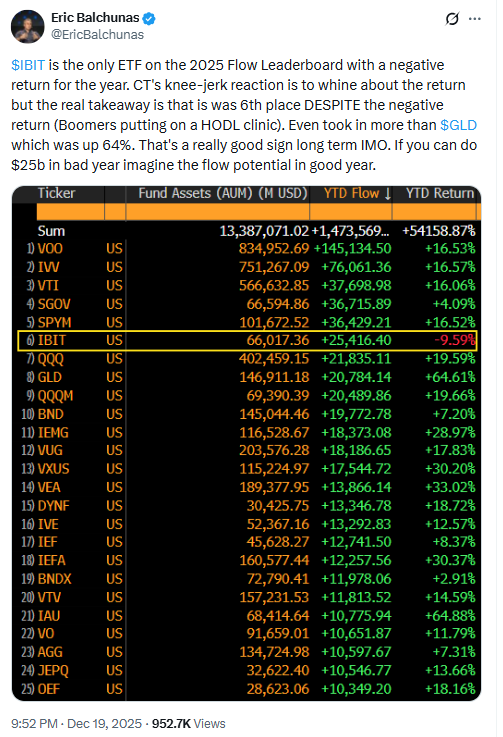

The IBIT Bitcoin ETF has attracted more than $25 billion in net inflows in 2025, according to the figures cited in the report. That ranked IBIT sixth among all ETFs by inflows as of mid December.

The same report said IBIT has delivered a negative return so far in 2025. It also noted Bitcoin fell about 30% from its October high, with BTC shown near $87,303 in the post.

Nate Geraci, president of NovaDius Wealth Management, said BlackRock’s naming of IBIT showed the firm “isn’t fazed” by Bitcoin’s pullback. He made the comment on Monday.

Farside Data Shows IBIT Bitcoin ETF at $62.5 Billion Total Inflows

The report said IBIT brought in about $37 billion in 2024. When combined with 2025 inflows, it takes total inflows since launch to $62.5 billion, based on Farside Investors data.

The IBIT Bitcoin ETF has also outpaced competing spot funds. The report said its flow tally is more than five times that of the Fidelity Wise Origin Bitcoin Fund (FBTC).

Bloomberg ETF analyst Eric Balchunas added a reaction on Friday. He said if the ETF

“can do $25 billion in a bad year, imagine the flow potential in a good year.”

A chart he shared ranked ETF inflows for 2025 as of mid December.

BlackRock Files Bitcoin Premium Income ETF Using Covered Calls on Futures

BlackRock filed to register a Bitcoin Premium Income ETF in September, according to the report. The proposed fund would sell covered call options on Bitcoin futures.

The strategy aims to collect option premiums and use them as a source of yield. The filing described the approach as part of the product design.

BlackRock ETHA Ethereum ETF Brings $9.1 Billion Inflows and Spurs Staked ETH ETF Filing

BlackRock’s ETHA Ethereum ETF has attracted more than $9.1 billion of inflows in 2025, the report said. That brought total inflows to nearly $12.7 billion.

BlackRock also filed in November to register an iShares Staked Ethereum ETF to complement ETHA, according to the report. It said BlackRock first launched ETHA without staking.

The report also linked the filing to a more crypto friendly Securities and Exchange Commission environment. It said the regulator has loosened ETF standards, which has opened room for new ETF structures.

BlackRock Keeps Bitcoin ETF and Ethereum ETF Focus While Others Push Altcoin ETFs

The report said BlackRock has not joined the altcoin ETF push seen across the market. It noted that other asset managers have launched products tied to Litecoin, Solana, and XRP in recent months.

Those references appeared alongside prices shown in the feed: LTC $76.80, SOL $124.54, and XRP $1.88. The report did not cite BlackRock filings for those tokens.

BlackRock’s updates kept attention on the IBIT Bitcoin ETF and the ETHA Ethereum ETF, while filings pointed to further expansion through strategy and staking formats.

SEO keywords used throughout: IBIT Bitcoin ETF, BlackRock Bitcoin ETF, iShares Bitcoin Trust ETF, Bitcoin ETF inflows, Farside Investors data, ETHA Ethereum ETF, iShares Staked Ethereum ETF, Bitcoin Premium Income ETF, covered calls Bitcoin futures, Treasury bills ETF, Magnificent 7 ETF.

Disclosure:This article does not contain investment advice or recommendations. Every investment and trading move involves risk, and readers should conduct their own research when making a decision.

Kriptoworld.com accepts no liability for any errors in the articles or for any financial loss resulting from incorrect information.

Tatevik Avetisyan is an editor at Kriptoworld who covers emerging crypto trends, blockchain innovation, and altcoin developments. She is passionate about breaking down complex stories for a global audience and making digital finance more accessible.

📅 Published: December 23, 2025 • 🕓 Last updated: December 23, 2025

CFTC Leadership Change Puts Michael Selig in Charge as Caroline Pham Leaves

The Commodity Futures Trading Commission confirmed a CFTC leadership change on Monday. Acting chair Caroline Pham said Monday was her last day at the agency. The commission also swore in Michael Selig as CFTC chair that same day.

The agency said President Donald Trump nominated Michael Selig on Oct. 27. It also said the Senate confirmed him on Thursday. After the swearing in, the change left Selig as the agency’s sole commissioner, according to the report.

The transition shifts responsibility for US crypto regulation and broader commodity market oversight onto one official. It also arrives as Congress considers digital asset market structure legislation, which could expand the CFTC’s role.

Michael Selig CFTC Chair Starts Term With Focus on Crypto and Market Structure

The report said Michael Selig CFTC chair will serve a term that expires in April 2029. It also noted he previously served as chief counsel of the SEC’s Crypto Task Force. That background ties the new CFTC chair to federal work on US crypto regulation.

In his statement, Selig pointed to a policy approach he described as avoiding “regulation by enforcement.” He framed that line as the agency faces new products and more retail activity in commodity markets.

“I’m grateful for the confidence President Trump has placed in me and for the opportunity to lead the CFTC at this pivotal time,”

Selig said, according to the report.

“We are at a unique moment as a wide range of novel technologies, products, and platforms are emerging, retail participation in the commodity markets is at an all time high, and Congress is poised to send digital asset market structure legislation to the President’s desk, cementing the US as the Crypto Capital of the World,” he added.

David Sacks Mentions Selig and Paul Atkins as Agencies Face US Crypto Regulation

The report said White House crypto czar David Sacks commented on the leadership shift on Monday. He described Selig and SEC chair Paul Atkins as a “dream team to define clear regulatory guidelines,” the report said.

That remark placed the CFTC leadership change next to parallel work at the Securities and Exchange Commission. It also highlighted the split roles that often shape US crypto regulation, especially when lawmakers debate market structure and agency authority.

The report connected the moment to Congress moving toward digital asset market structure legislation. It did not provide bill text, but it described the effort as heading toward the President’s desk.

The CFTC now faces questions tied to digital assets, and it also faces scrutiny around markets such as prediction markets, which Pham mentioned in her exit statement.

Caroline Pham Leaves CFTC and Moves Toward MoonPay, Report Says

Caroline Pham leaves CFTC after serving as acting chair since January, according to the report. It also said she had been the agency’s sole commissioner since August. She previously said she would depart once Congress confirmed a new leader.

On Wednesday, MoonPay confirmed earlier reporting that Caroline Pham was headed to the crypto fintech company, the report said. That confirmation placed her next move inside the private sector during a period of active debate on US crypto regulation.

In her departing statement, Pham said the CFTC had “refocused on our mandate to promote responsible innovation and fair competition,” as the agency prepares for “expanded oversight of new markets and new products like digital assets, crypto, and prediction markets,” according to the report.

“I am thrilled to welcome Michael Selig as the 16th Chairman of the CFTC,”

Pham said.

“His pragmatic, common sense approach will ensure the CFTC strikes the right balance of innovation and market integrity,”

she added.

Disclosure:This article does not contain investment advice or recommendations. Every investment and trading move involves risk, and readers should conduct their own research when making a decision.

Kriptoworld.com accepts no liability for any errors in the articles or for any financial loss resulting from incorrect information.

Tatevik Avetisyan is an editor at Kriptoworld who covers emerging crypto trends, blockchain innovation, and altcoin developments. She is passionate about breaking down complex stories for a global audience and making digital finance more accessible.

📅 Published: December 23, 2025 • 🕓 Last updated: December 23, 2025

Tether’s Wallet Gambit Sparks Speculation, AI Brains Meet Hard Money in Your Pocket?

Tether, the shadowy stablecoin overlord is ditching the backend shadows for a full-frontal assault on your smartphone.

The Bitcoin Quantum Debated: Ignoring the Doomsday Computer or Stocking the Bunker?

It’s a hot topic nowadays, but the truth is that Bitcoin’s staring down a quantum ghost that’s rattling chains louder than a saloon brawl.

Stock Futures Rally Could Ignite Seasonal Momentum in Crypto Markets

We view the recent rise in U.S. stock futures as a positive signal of renewed risk appetite, with major indices like the S&P 500 and Nasdaq leading gains amid holiday-shortened trading and growing expectations for a year-end rally.

Futures climbed modestly as investors anticipate what’s traditionally called a Santa Claus rally in equities, and historically this seasonal pattern has occasionally rippled through into risk assets such as Bitcoin and Ethereum when liquidity aligns.

These equity tailwinds are underpinned by macro sentiment around anticipated Federal Reserve rate cuts, which are widely priced into markets and supporting risk asset demand.

The prospect of easier monetary policy often lifts both stocks and crypto by expanding liquidity and reducing borrowing costs, a dynamic that has lifted Bitcoin back toward key psychological levels in recent weeks.

Against this backdrop, we expect Bitcoin and Ethereum to maintain upward momentum in the near term, aligning with seasonal trends and broader equity rebounds that have historically helped digital assets regain ground after periods of consolidation.

For the holiday period, our outlook anticipates BTC trading in the $86,000 to $93,000 range and ETH in the $2,800 to $3,200 corridor, supported by returning institutional inflows and the potential for clearer regulatory developments.

Key catalysts to watch include ETF approvals or macroeconomic surprises that can either amplify gains or introduce short-term volatility.

Risks such as geopolitical tensions or sudden liquidity shifts remain real, but overall this setup favors growth in crypto markets and reinforces the narrative of stronger integration between traditional finance and digital assets as 2025 draws to a close.

Ryan Lee, Chief Analyst at Bitget

Disclosure:This article does not contain investment advice or recommendations. Every investment and trading move involves risk, and readers should conduct their own research when making a decision.

Kriptoworld.com accepts no liability for any errors in the articles or for any financial loss resulting from incorrect information.

PEPE Breaks Downtrend Grip as 0.00000441 Becomes the Reversal Line

The PEPE USDT two week chart shows a clear technical shift after a prolonged downtrend, based on TradingView data and a post shared on X on Dec. 22.