You ever hear about a little thing called IgniteX? No? It’s new. MEXC Ventures just dropped $30 million on the table, and they ain’t playing games.

Crime Gangs Launch Crypto Tokens and Stablecoins to Launder Billions, Says UN

Organized crime groups are creating their own blockchain tools to move illicit funds, according to the UNODC crypto report released in April 2025.

RISC-V on Ethereum—A Bold Idea, But Not an Immediate Shift

Vitalik Buterin’s proposal to replace Ethereum’s EVM with RISC-V highlights the founder’s visionary push for greater efficiency and hardware compatibility.

RISC-V’s modular, open-source architecture could help process faster execution and broader tooling potential, especially as Ethereum scales.

However, such a shift would be highly complex. The EVM is deeply entrenched across Ethereum’s smart contracts, developer tools, and Layer 2s.

Transitioning would require significant coordination amongst the network participants, backward compatibility solutions, and risk careful fragmentation if not managed properly.

While the idea is still conceptual, it shows Ethereum’s still emerging stance on innovation. If this path is pursued, it could attract more low-level developers and prepare Ethereum for the next generation of high-performance applications.

Still, the cost of ecosystem disruption must be weighed against long-term benefits. For now, it’s a signal of what could be—not what’s imminent

Ryan Lee, Chief Analyst at Bitget Research

Disclosure:This article does not contain investment advice or recommendations. Every investment and trading move involves risk, and readers should conduct their own research when making a decision.

Kriptoworld.com accepts no liability for any errors in the articles or for any financial loss resulting from incorrect information.

Forty-two days in the doghouse

Dogecoin has been sitting, staying, and doing absolutely nothing for 42 days. You heard me right. For a month and a half, this coin’s been flatter than a week-old cannoli.

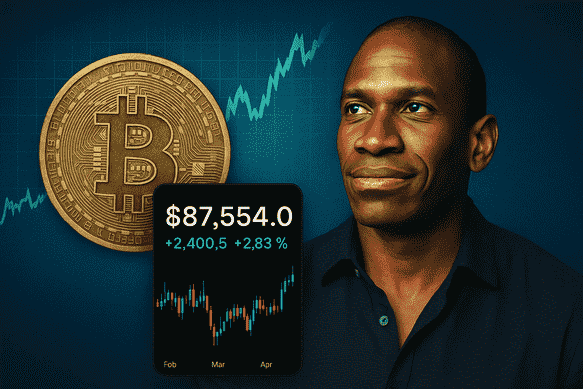

BTC Breaks Out, ETH Holds Back: Diverging Paths in the Crypto Market

Bitcoin has reclaimed bullish momentum heading into the week of April 21–27, 2025, trading between $83,000 and $90,000.

The recent breakout above $87,000 signals a trend reversal, supported by a rise in spot ETF inflows and a slowdown in miner selling following the halving.

Strong volume and technical confirmation from a descending wedge breakout suggest a potential test of the $90,000 resistance, with macro factors like a weakening dollar and rising gold correlation reinforcing BTC’s appeal as a hedge.

Ethereum, by contrast, remains range-bound between $1,520 and $1,700, showing relative weakness against Bitcoin.

Limited Layer 2 activity and a depressed ETH/BTC ratio have capped upside momentum.

Technical indicators remain neutral, with a clear breakout above $1,700 needed to shift sentiment.

While long-term fundamentals such as staking and network upgrades remain constructive, near-term price action is likely to stay muted without a fresh catalyst.

Ryan Lee, Chief Analyst at Bitget Research

Disclosure:This article does not contain investment advice or recommendations. Every investment and trading move involves risk, and readers should conduct their own research when making a decision.

Kriptoworld.com accepts no liability for any errors in the articles or for any financial loss resulting from incorrect information.

Bitcoin May Cross $100K as Treasury Buybacks Begin, Says Arthur Hayes

Arthur Hayes, co-founder of BitMEX and chief investment officer at Maelstrom, said Bitcoin may soon move past the $100,000 mark.

Schwab is going all in on crypto?

Let me tell you a not-so-average Wall Street bedtime story. Charles Schwab, the buttoned-up, old-school titan of finance is about to wade knee-deep into the crypto market.

Strategy Adds 6,556 Bitcoin for $555.8M, Lifts 2025 Total to 91,800 BTC

Michael Saylor’s Strategy acquired 6,556 Bitcoin between April 14 and April 20, spending $555.8 million at an average price of $84,785.