The crypto world is full of frustration over new IRS rules that classify DeFi protocols as brokers.

This has sparked a quick backlash, with many in the industry calling on Congress to step in and overturn these regulations.

IRS creates rules?

The U.S. Internal Revenue Service announced rules that treat various DeFi platforms facilitating digital asset transactions as brokers.

This means they’ll need to comply with Know Your Customer requirements, which could affect up to 875 DeFi brokers.

The crypto community isn’t happy about it and has taken to social media to voice their concerns, arguing that the IRS might be overreaching its authority.

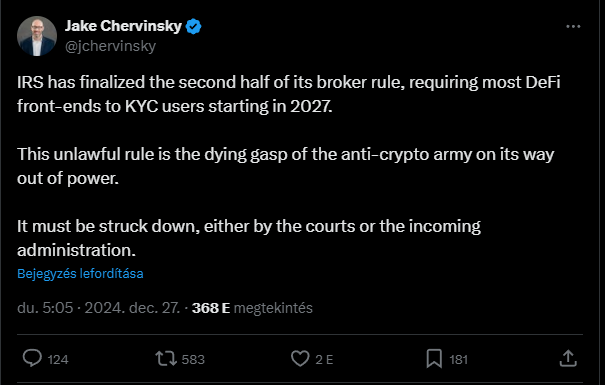

Jake Chervinsky, the chief legal officer at venture capital firm Variant, didn’t hold back.

“This unlawful rule is the dying gasp of the anti-crypto army on its way out of power. It must be struck down, either by the courts or the incoming administration.”

Alexander Grieve from Paradigm also chimed in, saying that the new pro-crypto Congress should roll back these rules through the Congressional Review Act next year.

Banhammer is coming?

The IRS’s definition of a DeFi broker includes any platform that acts as an intermediary in transactions, even if it’s just a group of people facilitating trades.

Miles Jennings, general counsel at a16z Crypto, criticized this move as an exaggerated interpretation of effectuate transactions, suggesting it could pave the way for banning DeFi altogether.

When you challenge government abuses of power, the response is even more transparent and desperate abuses.

The broker reporting rule is an obvious example — A fantastical expansion of the words “effectuate transactions” to enable the IRS to ban DeFi.

This despite courts…

— miles jennings (@milesjennings) December 27, 2024

But also, there is the question, surfacing in the social media, it is really decentralized if it can be banned?

Miles Fuller from TaxBit added that the definition captures any service provider that knows or could know if a transaction results in reportable gains from digital asset sales.

He noted that validation services and wallet software providers are specifically excluded from this classification.

Industry backlash

The Blockchain Association has labeled this rule as a final attempt to push the U.S. crypto industry offshore. Kristin Smith, CEO of the association, stated, they won’t let this happen.

“We’re prepared to take aggressive action to fight back. We also look forward to working with the new pro-crypto Congress and Administration to roll back this and other anti-innovation rules.”

According to the IRS, these new regulations could impact around 2.6 million taxpayers.