Thanks to a pro-crypto president and some friendly lawmakers in the U.S., interest in the crypto markets is back on the rise. And what rise!

Exchanges on fire

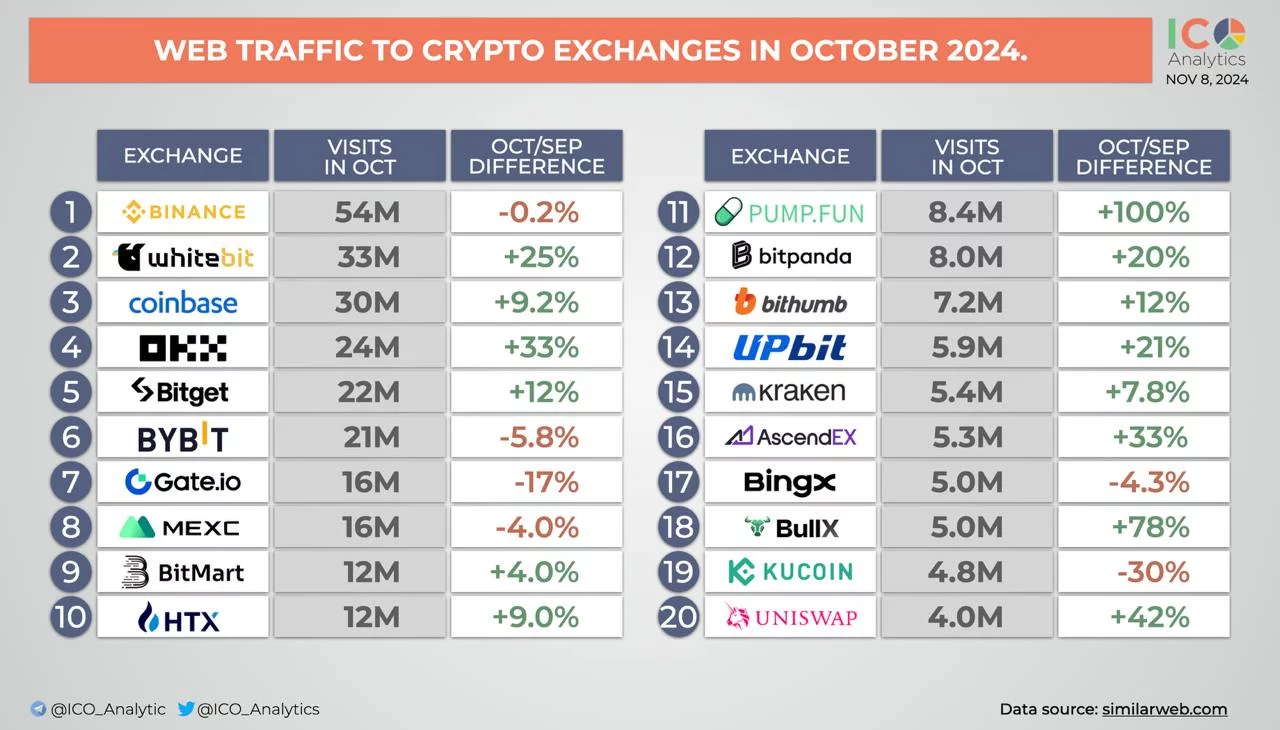

In October, cumulative traffic to 20 major crypto exchanges jumped by 8%. This spike reflects a growing enthusiasm among investors and retail traders as we gear up for the 2024 elections.

ICO Analytics shared that Pump Fun was the star of the show, boasting 100% increase in webtraffic from September to October.

BullX wasn’t far behind with a solid 78% growth, and Uniswap rounded out the top three with a respectable 42% bump.

When it comes to total visits, Binance, WhiteBit, and Coinbase were the heavyweights of the month, racking up 54 million, 33 million, and 30 million visits respectively.

Riding the Uptober wave, Moonvember next?

This growth in traffic didn’t just happen for no reason. It fueled a rally in the crypto markets that aligns perfectly with the Uptober trend, where digital asset markets usually see a boost after a summer of sideways trading.

But here’s where it gets really exciting, because while exchanges were seeing all this new traffic leading up to the November elections, the results on November 6 sparked a rally that sent Bitcoin soaring to new all-time highs.

Several indicators suggest that this rally has some legs and might just be getting started. For one, there’s an additional $1.1 billion in open interest on Bitcoin futures contracts at the Chicago Mercantile Exchange.

Plus, expectations of lower interest rates are adding fuel to the fire, along with strong inflows into Bitcoin ETFs.

On November 6, BlackRock’s IBIT Bitcoin ETF had its busiest day ever, with $4.1 billion in trading volume following the victory of pro-crypto Republican candidate Donald Trump.

Signals of continued growth

But there’s more! Recent inflows of stablecoins, often seen as a barometer for market interest, are also pointing towards further price increases.

On November 7, stablecoin exchange inflows hit $9.3 billion as Bitcoin prices kept climbing.

And it’s not just Bitcoin that’s getting attention, Ethereum is also feeling the love! Ether finally broke above the $3,000 level, and inflows into Ethereum ETFs have turned positive after months of lackluster performance.