A new report from Coinshares reveals that Ethereum’s role is built on two main pillars, the marketplaces and the stablecoins.

While the network is doing well in these areas, the future for new decentralized applications remains quite unclear.

Marketplaces and stablecoins are good use cases, but they’re enough?

The Coinshares report reveals that marketplaces and stablecoins account for just over half of Ethereum’s current use cases.

DeFi protocols and the rising stablecoin market are driving this trend, showing that Ethereum serves as a central infrastructure for many projects.

Marketplaces like decentralized exchanges and NFT platforms solidified Ethereum’s status as the go-to blockchain for tokenized assets.

Uniswap generated at least 15% of all transaction fees on Ethereum in the first half of the year.

The OpenSea NFT marketplace was also a major contributor to fees on the blockchain, although its significance greatly diminished since peaking at $572 million in the first half of 2022.

The report also mentions that over $135 billion worth of stablecoins are currently circulating on Ethereum, including top players like Tether’s USDT and USD Coin.

These digital currencies depend on Ethereum’s framework to stay linked to fiat currencies while providing liquidity to DeFi platforms, among other uses.

Sustainable growth, but for what?

There are lots of positive aspects, but the Coinshares report raises a pretty inconvenient question, as what’s next for Ethereum?

Analysts believe that newer upgrades, like the shift to Proof-of-Stake and ongoing development of Layer 2 scaling solutions put Ethereum in a good spot for future growth.

Still, it still unknown if any banger new decentralized applications might emerge.

Coinshares suggests that for Ethereum to succeed in the long run, it needs to go beyond its current use cases.

There’s potential for enterprise adoption, gaming, and innovations related to the metaverse, but real-world demand and implementation will be key.

Ethereum must attract developers who can explore new possibilities for blockchain technology in everyday life.

On the other hand, one of the most common criticism against Ethereum is exactly this, as even its developers doesn’t know what it is actually, what’s the goal, and they have to figure out new narraives time to time.

Gas for the network bandwidth

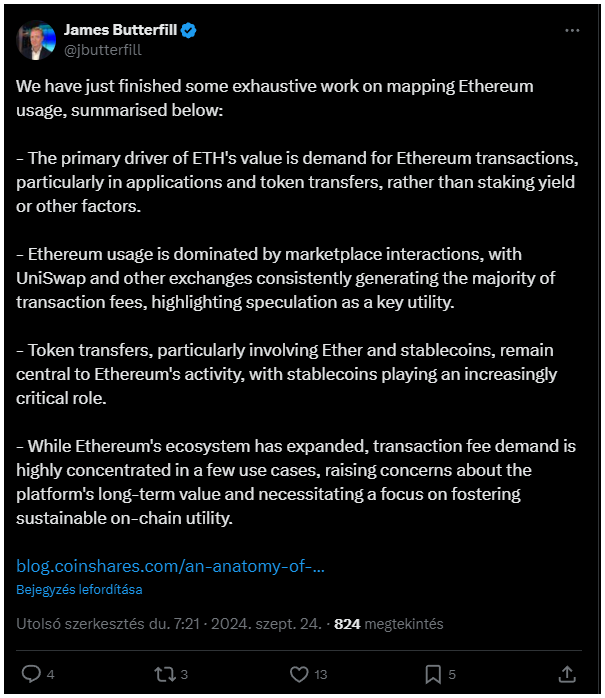

James Butterfill from Coinshares summarized that the value of ETH mostly comes from demand for Ethereum transactions, meaning how much users are willing to pay for services on the network rather than factors like staking rewards.

The report also noted that most transaction fees come from a small set of services focused mainly on speculation or simple value transfers.

Therefore, Butterfill repeated that they think creating sustainable on-chain utility is vital and necessary for securing Ethereum’s long-term future.