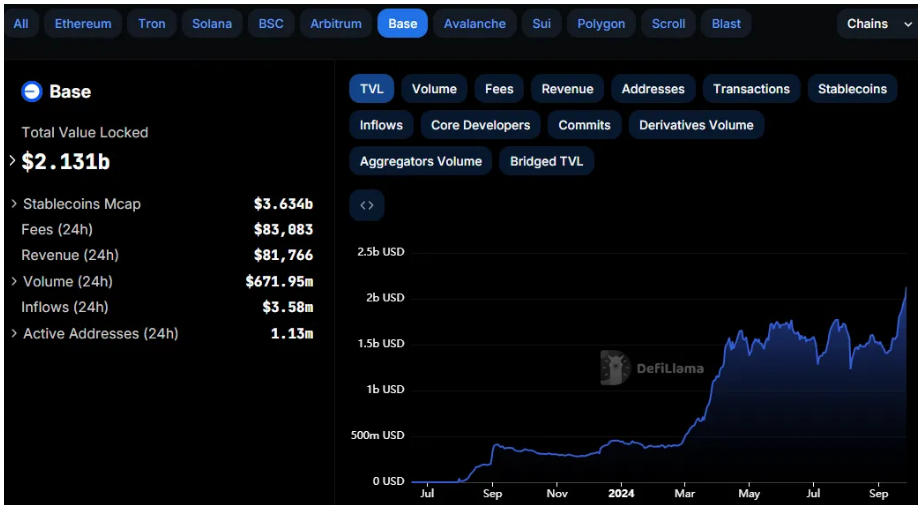

Coinbase’s low-cost Layer-2 solution just surpassed $2 billion in total value locked, reaching a cool milestone since its launch.

Base reaches $2 billion TVL milestone, why this is a big deal?

Base’s TVL has climbed past the $2 billion level, standing at $2.131 billion after seeing deposits grow by over $156 million in a single day.

The increase in TVL shows that more assets are being locked into Base’s smart contracts, and this is considered as a strong sign of the platform’s growth potential, and also user confidence.

The rise in value also signals the accelerating adoption of Base’s scaling solution, which is designed to improve the Ethereum blockchain’s efficiency in the DeFi world.

The TVL has grown by nearly 400% this year alone, increasing by $849 million since Base’s mainnet launch in July.

The progess is impressive

In this relatively short time, Base already outpaced other platforms, becoming one of the largest networks by overtaking OP Mainnet.

It’s now rapidly closing in on Arbitrum, another major Layer-2 platform, which currently holds a TVL of $2.59 billion.

The growth of Base’s TVL reflects its expanding ecosystem, fueled by rising revenues, more active users, and a spike in transaction numbers.

On last week, Base set a new record with over 4.5 million transactions, largely driven by the increasing popularity of the Basenames domain name service.

This continued activity is a clear sign of the growing investor interest, making Base a strong contender in the pretty competitive Layer-2 market.

Growth game

Now many industry experts say if this pace of growth continues, Base could even reshape the DeFi sector by providing a more accessible and scalable platform.

With a solid foundation, Base is attracting not only individual users but also institutional attention, signaling a potential long-term impact on how decentralized finance operates, or will operate in the future on Ethereum.

Maybe the biggest driver behind Base’s rise in TVL is Aerodrome, the leading DEX on the platform.

Aerodrome alone accounts for $1.018 billion of Base’s total TVL, having grown by 76% in the last month.

The exchange’s success has been propelled by its liquidity pools, particularly for popular meme oins like PEPE and WIF, which have drawn in more investors. Also the revenue sharing feature is quite popular among users.

Alongside Aerodrome, other well-known protocols like Uniswap and Aave V3 contributed to Base’s growth too.

With the potential integration of Coinbase’s Bitcoin Wrapper, cbBTC, on the horizon, Base’s ecosystem is well-positioned to attract even more capital and continue its upside trend.