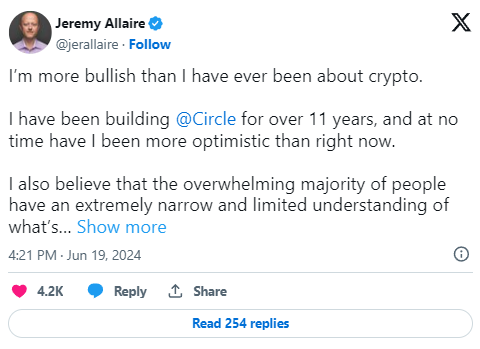

Jeremy Allaire, CEO of Circle shared his view as stablecoins will be recognized globally as electronic money by the end of 2025.

Global recognition in two years

Jeremy Allaire, head of Circle, which manages the stablecoin USD Coin, the USDC, predicted that stablecoins will achieve global recognition as legal electronic money by the end of 2025, based on the rocket-like rise of stablecoins.

Stablecoins are synthetic tokens, with a constant price by being pegged to assets like the U.S. dollar.

This sounds like a really extreme wish, but Allaire took his time, and explained the optimism about the future of cryptocurrencies and stablecoins.

He reflected on the journey of digital assets since 2009, noting how Bitcoin evolved from a weird idea to the largest cryptocurrency by 2024.

In the beginning, virtual assets were viewed as fringe and possibly illegal, but as the technology advanced, they gained widespread acceptance and now they are considered a common financial tool.

Stablecoins are reliable assets

Allaire thinks that digital assets are now an integral part of the global financial system, and many major governments have established clear regulations for issuing, using, and trading digital assets.

This growing adoption and regulatory clarity have helped stablecoins to play an important role in the economy.

Allaire believes that stablecoins could account for 10% of global economic money within this decade, as in many places there are already in use, for example in Argentine, or Nigeria.

He described stablecoins as a killer app in the crypto world, making the dollar digital, and opening the economy for more people.

The future is here

Allaire’s prediction that stablecoins will be globally recognized shows their growing importance and potential, but also raise questions too in the crypto industry.

Stablecoins are gaining popularity day by day, growing and spreading, but it’s unclear yet how they will shape the future of finance.

Despite the concerns, Allaire is no doubt optimist, and many agree with his views, but the industry is changing fast, and no one knows what will happen tomorrow, let alone almost two years from now.