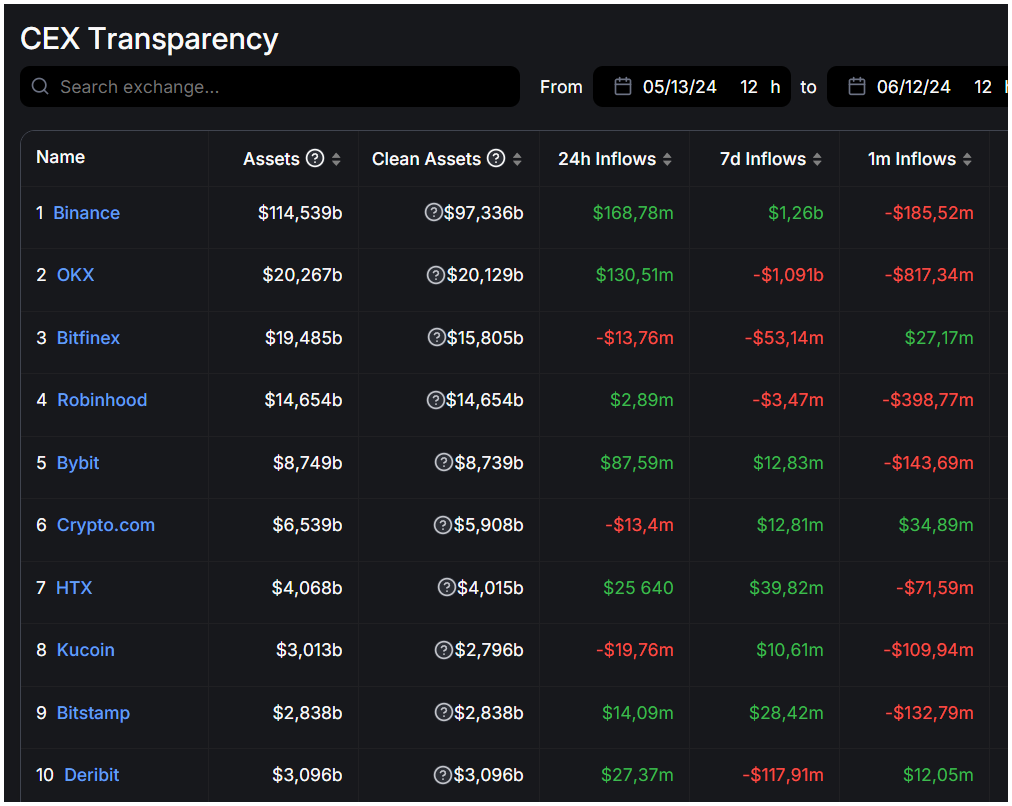

In the last 30 days, many centralized exchange platforms have seen significant net withdrawals. Among the top ten centralized exchanges only Bitfinex recorded net inflows.

Withdrawal frenzy

Major cryptocurrencies have slowed in their upward momentum, as Bitcoin’s price fell by 0.56% in the last 24 hours and by 5.53% in the past week, according to Coinmarketcap.

Based on DefiLlama’s data, the outflows from centralized exchanges ranged from $13.8 million on Crypto.com to $636.52 million on OKX.

From May 12th to June 11th, OKX saw the highest outflows with $636.52 million. Following OKX, Robinhood experienced $430.27 million in outflows.

Bybit had the third-largest outflow at $244.12 million, while Kucoin and HTX also saw significant withdrawals of $146.08 million and $139.77 million, respectively. Bitstamp recorded lower outflows compared to these, with $106.27 million.

Binance, Crypto.com, and Derbit saw minor outflows, with Derbit at $38.85 million, Binance at $23.98 million, and Crypto.com at $13.8 million.

Optimism coming back, but slowly

Interestingly, Bitfinex was the only exchange with net inflows, recording $208.51 million over the past month.

In the last seven days, some centralized exchanges have regained positive inflows, with Binance leading.

Binance recorded over $1 billion in inflows, totaling $1.011 billion. HTX, Bitstamp, and Kucoin also saw positive inflows of $47.89 million, $8.02 million, and $2.03 million, respectively.

Not your keys, not your Bitcoin

OKX experienced the highest outflows over the same seven-day period, with $909.75 million, partly due to security concerns after the news about the hacked accounts.

Other platforms like Robinhood and Crypto.com also faced outflows exceeding $100 million.

Bitfinex, Bybit, and Derbit had negative inflows, but these were under $100 million each.

Given DefiLlama’s 30-day analysis, it seems many crypto investors have been withdrawing from centralized exchanges.

Expert thinks this trend might be driven by the market’s fear and greed index, which influences traders looking to maximize profits during bullish periods, so they’re rather wait, instead of selling. Or maybe they ’re just don’t trust in exchanges anymore.