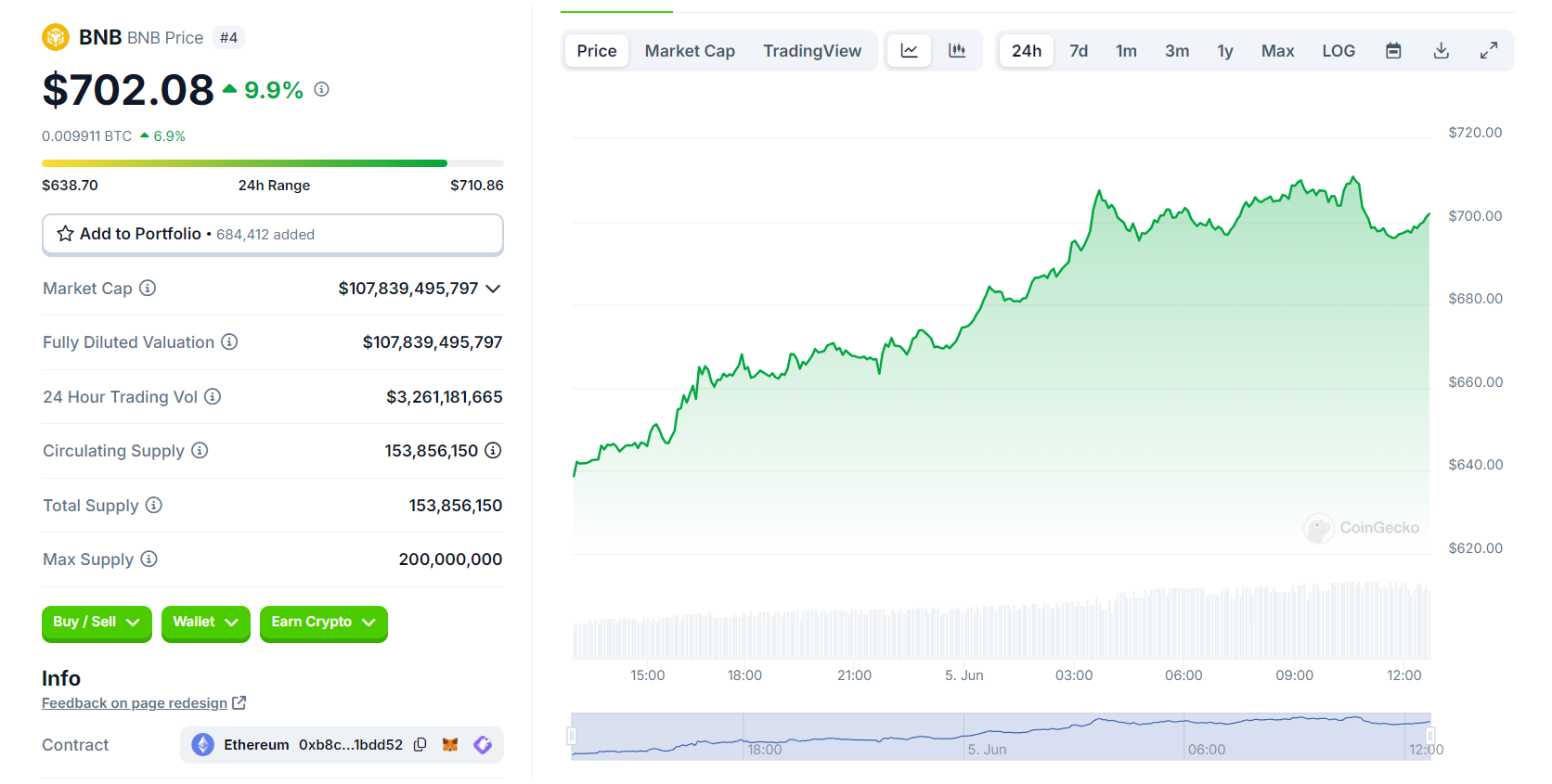

Binance Coin (BNB) has surged past $700 for the first time in its history, marking a significant milestone. Traders and investors are happy, Starbucks are not so.

To the Moon!

The native token of the world’s largest cryptocurrency exchange, Binance Coin, the BNB has experienced a giant surge, breaking the $700 mark and reaching a new all-time high.

After a period of relative quiet during the 2024 bull run, BNB has emerged as an ultimate winner, its market capitalization has also soared, surpassing $100 billion and eclipsing companies such as UBS, Dell, and even Starbucks.

Binance had hard times in the past months and years all around the world, as the exchange has faced legal issues in multiple jurisdictions, with the most recent involving Nigerian authorities, where company executives were detained, complicating efforts to secure their release.

The most significant setback for Binance occurred late last year when the exchange agreed to a $4.3 billion settlement with the U.S. Department of Justice over anti-money laundering rule violations, although it didn’t admit guilt.

Following this, Binance’s founder and then-CEO, Changpeng Zhao, better known as CZ in the crypto community, resigned and was subsequently sentenced to several months in a U.S. prison.

Look at me, I am the meme now!

These regulatory challenges kept Binance Coin from gaining momentum as Bitcoin and Ethereum did, after Bitcoin reached new heights in March, and Ethereum saw a significant boost when the U.S. Securities and Exchange Commission approved spot Ethereum ETFs.

The recent bull market has been dominated by meme coins, drawing attention away from BNB.

But in the past 24 hours, BNB’s fortunes have changed dramatically. The cryptocurrency surged nearly $100, climbing from $625 to a new peak of $715 earlier today.

Of course, since then it has slightly retraced, BNB remains above $700, with its market cap still approaching $110 billion.

Happy ending?

This surge has placed BNB ahead of major traditional companies like UBS, the State Bank of India, Dell, Hitachi, Starbucks, and Airbnb in terms of market capitalization.

The huge growth highlights BNB’s potential as it continues to navigate a complex regulatory landscape, with visible success.

One can speculate that BNB’s rise could signal increased investor confidence in Binance’s long-term viability despite its legal issues, because if the cryptocurrency maintains its current trajectory, it could potentially reshape the perceptions of digital assets in the financial world.

Have you read it yet? Ethereum exchange withdrawals signal incoming supply squeeze?

Disclosure:This article does not contain investment advice or recommendations. Every investment and trading move involves risk, and readers should conduct their own research when making a decision.

Kriptoworld.com accepts no liability for any errors in the articles or for any financial loss resulting from incorrect information.