BlackRock’s USD Institutional Digital Liquidity Fund, aka BUIDL, achieved a $500 million market cap, becoming the first tokenized treasury fund to reach this mark, ever.

Much crazier that the fund reached this in less than four month after its launch. That’s what we call popularity.

Other kind of ATH

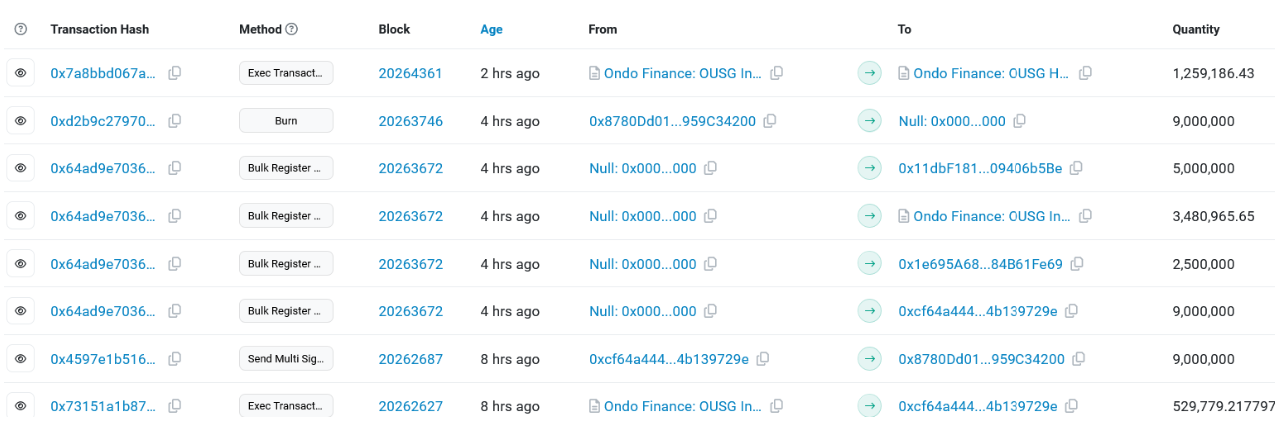

BUIDL now holds $502.8 million in tokenized Treasuries, as shown on Etherscan.

Analysts think this huge growth was partly due to Ondo Finance, a real-world asset tokenization firm, purchasing more BUIDL to back its OUSG token.

In late April, BUIDL surpassed the Franklin OnChain U.S. Government Money Fund, called BENJI, to become the largest tokenized treasury fund in the world, and it maintaining its top position since then.

Other kind of stablecoin

The price of BUIDL is pegged 1:1 to the U.S. dollar, providing daily dividends to investors through a partnership with Securitize.

Ondo’s OUSG is the largest holder of BUIDL, with $173.7 million, and Mountain Protocol also holds BUIDL to support its stablecoin, USDM.

The total value of tokenized treasury funds on the blockchain is now $1.67 billion, with Ethereum leading at over 75%, followed by Stellar at 23.9%.

Other kind of market

BlackRock CEO Larry Fink highlighted the efficiency what blockchain tokenization can bring to capital markets.

Another well-known industry player, the Boston Consulting Group estimates this market could grow to $16 trillion by 2030.

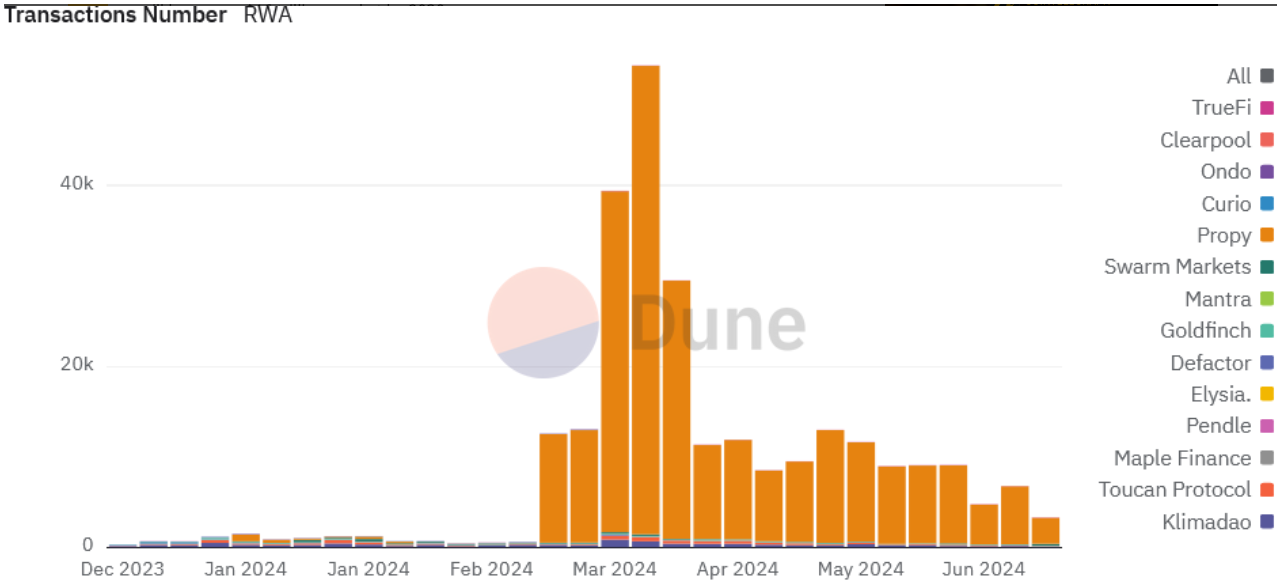

That’s 20x in six years, we would love to see it! Besides U.S. Treasuries, other assets like stocks and real estate can also be tokenized, and in April 2024, the number of these kind of activity, the real-world asset transactions already peaked, but of course there was a decline since then.

Other firms involved in tokenizing real-world assets include WisdomTree, Ondo Finance, Backed Finance, Matrixdock, Maple Finance, and Swarm.