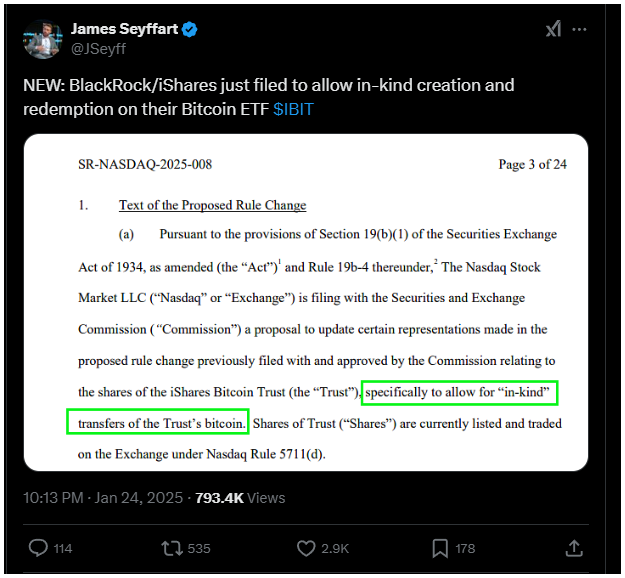

Nasdaq has just thrown its hat in the ring with a proposal to the U.S. Securities and Exchange Commission for BlackRock’s IBIT, and the new system could let institutional investors swap their ETF shares directly for Bitcoin instead of cash.

Dollar bad, Bitcoin good?

Right now, when investors want to cash out their Bitcoin ETFs, they get cash generated from selling Bitcoin.

But with this proposed in-kind system, institutions can simply trade, or swap their ETF shares for actual Bitcoin.

This change cuts out the middleman and makes the whole process smoother and cheaper, plus, investors won’t have to worry about extra taxes that come from selling Bitcoin.

While this change mainly targets big players in the market, retail investors might also reap some rewards through more efficient ETF operations.

Do investors really need an in-kind redemption?

So, why is this shift happening now? Last year the SEC finally gave a thumbs-up to spot Bitcoin ETFs but kept things simple by sticking with cash redemptions to dodge any regulatory headaches.

Surprisingly, as the ETF market has exploded and Bitcoin has become a household name, it’s clear that some kind of an upgrade is necessary, so the new system is designed to meet the changing needs of this booming market.

Much simple paperwork, bigger popularity?

If the SEC gives this proposal the green light, we could see a surge in institutional interest in Bitcoin ETFs.

This influx might even help stabilize Bitcoin prices, now wouldn’t that be something?

This move signals a growing acceptance of cryptocurreincies in mainstream finance, and honestly, it’s not just BlackRock making moves in the sector.

Grayscale has recently filed for a Solana ETF, hinting at even more digital asset adoption on the horizon.