BlackRock has purchased more than $680 million in Bitcoin over the past two days, and the IBIT ETF, one of the most successful in its category, sees an impressive rise in price.

BlackRock’s shopping spree

BlackRock has been acquiring large amounts of Bitcoin, with the first major purchase occurred on October 15, when the firm bought over $294 million worth of Bitcoin.

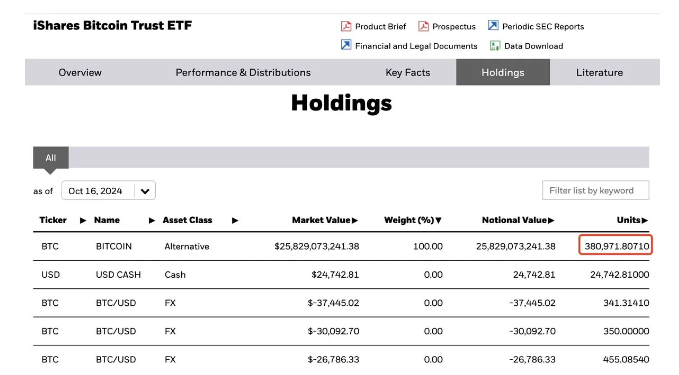

The following day, they made an even larger purchase, totaling more than $390 million.

BlackRock’s strong interest in Bitcoin isn’t surprising given the remarkable success of its IBIT Bitcoin ETF.

Eric Balchunas lately noted that IBIT is one of the best-performing ETFs of the decade, boasting over $25 billion in assets under management in ten months.

While the Bitcoin ETF market has been thriving this week, IBIT clearly stands out as the leader.

The new favorite

Several leaders at BlackRock have spoken pretty positively about Bitcoin this October.

Jay Jacobs, BlackRock’s US Head of Thematics and Active ETFs, predicted that the market for Bitcoin could reach $30 trillion in the coming years.

Larry Fink, the CEO of BlackRock, referred to Bitcoin as an independent, standalone asset class during an earnings call and told that it will play an important role in the company’s future growth strategies.

“We will continue to pioneer new products to make investing easier and more affordable.”

Building a Bitcoin treasury

BlackRock is building a substantial reserve of Bitcoin that rivals that of Binance. Since IBIT is a spot ETF, BlackRock must hold an equivalent amount of BTC to support its product offerings.

On Thursday, IBIT saw an inflow of $309 million, which was the highest among all spot Bitcoin ETFs.

According to data from SoSoValue, IBIT has recorded a total of $1.07 billion in inflows just this week.

Many industry participants shared the view that as BlackRock continues to invest heavily in Bitcoin, it could influence both the crypto market and institutional adoption of digital assets itself.